Bitcoin has been trading sideways since March, and the third quarter, especially September, has traditionally been a bearish period.

With the month and quarter approaching the end, analysts are turning bullish again, predicting a long-awaited breakout for BTC and crypto markets.

On Sept. 18, analyst ‘RamenPanda’ observed that markets have spent six months going sideways, “yet the price is barely down from the previous high.”

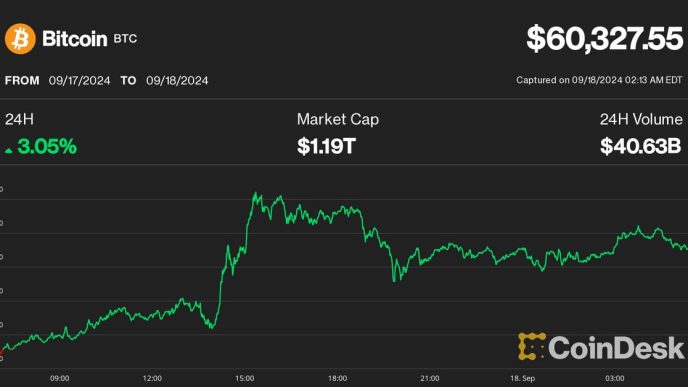

Bitcoin, which has reclaimed $60,000 again, is just 18% down from its all-time high.

The End is Nigh

The analyst added that all the time spent going sideways will end in a big rally.

“If you think we won’t have a world shocking of a rally next, you are f**king delusional. All that time spent in sideways will be compensated by upward momentum.”

Look, we spent 6 months going sideways , yet price barely down from previous high

Corrections can take place in two forms : price depth or time

Time based correction, ops, I meant capitulation, is BULLISH AS FUCK

If you think we won’t have a world shocking of a rally next,… pic.twitter.com/00RXuAzINB

— RamenPanda (@IamRamenPanda) September 17, 2024

Meanwhile, economist Alex Krüger observed that “sentiment among crypto traders has not been this low since 2022.” Meanwhile, Bitcoin is trading around the same level it was trading six months ago, he added in a post on X on Sept. 18.

On Sept. 17, Capriole Fund founder Charles Edwards said, “You made it through the worst time to be in Bitcoin,” pointing out that Q3 is usually bearish and fourth quarters are usually bullish.

Analyst ‘Income Sharks’ echoed the sentiment, predicting a large upward movement in Q4.

#Bitcoin – If Q4 isn’t exciting after the suspense that’s been building up I don’t know what to say. Price perfectly in the middle of the channel and OBV stuck perfectly in the tip of the wedge. pic.twitter.com/IOWObF1BV6

— IncomeSharks (@IncomeSharks) September 17, 2024

Bitcoin reclaimed $61,000 in late trading on Sept. 17 but has fallen back to around $60,500 during the Wednesday morning Asian trading session. The asset has pulled out of September lows, posting a 6.7% gain over the past week.

Fed Rate Cut Looming

The United States central bank is expected to cut interest rates on Wednesday, Sept. 18. However, markets remain conflicted over the magnitude of the rate cut.

Currently, the CME Fed Watch tool favors a larger cut with 65% odds on a 50 basis point cut versus 35% odds for a smaller 25 bps cut.

Analysts suggest that the larger rate cut would be better for high-risk assets such as crypto.

“The last time the Fed cut rates, Bitcoin went parabolic. If history repeats itself, the next 6-12 months are going to be insane,” commented crypto YouTuber Lark Davis in a post on X on Sept. 17.

The Fed is expected to cut interest rates tomorrow.

The last time the Fed cut rates, Bitcoin went parabolic

If history repeats itself, the next 6-12 months are going to be insane.

h/t/ @milkroaddaily pic.twitter.com/GxNtThDDwS

— Lark Davis (@TheCryptoLark) September 17, 2024

However, the Kobeissi Letter cautioned, “There has never been a more uncertain Fed meeting on record,” before adding, “Regardless of what the Fed does tomorrow, half of the market will be disappointed.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Source link

Martin Young

https://cryptopotato.com/analysts-predict-end-of-bitcoin-consolidation-as-fed-rate-cut-looms/

2024-09-18 06:12:23