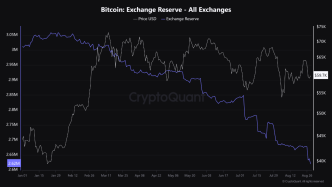

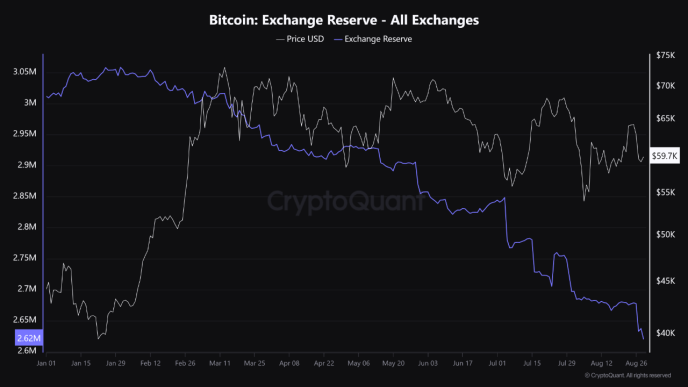

Bitcoin (BTC), after briefly reclaiming the $61,000 price mark yesterday has now fallen below it continuing its bearishness as of today. Amid this negative price action, the asset’s hash price, a key metric reflecting miners’ profitability, has reached historically low levels.

According to a recent analysis by Woominkyu, a CryptoQuant analyst, this significant drop in hash price might signal a prime buying opportunity for investors.

Understanding The Hash Price And Its Relation To Buying Opportunity

Woominkyu revealed in his analysis that the hash price, which measures the relationship between Bitcoin’s price and the revenue miners generate per unit of computational power, has shown a consistent pattern. When this metric falls to lower levels, it often coincides with Bitcoin’s price bottoming out.

Woominkyu’s further shared a chart highlighting that the blue-shaded sections on the chart represent periods where the hash price dipped, corresponding to times when Bitcoin’s price was at or near its lowest points.

The historical data suggests that these periods have been followed by significant price recoveries. Woominkyu believes that the current low hash price could indicate that Bitcoin is near a bottom, presenting a potential buying opportunity for long-term investors.

Lowest Bitcoin Hash Price Indicating the Buy Opportunity

“The highlighted sections in the chart indicate periods where the Hash Price dropped to lower levels, corresponding to times when #Bitcoin prices were also at or near their lowest points.” – By @Woo_Minkyu

Link

… pic.twitter.com/ZPf0cSTnNN

— CryptoQuant.com (@cryptoquant_com) August 30, 2024

Another Analyst Points To Re-Accumulation Bitcoin Phase

Echoing Woominkyu’s sentiment, another renowned crypto analyst known as Moustache shared insights on the Puell Multiple, a metric used to assess Bitcoin’s market cycles.

The Puell Multiple, which compares the daily issuance of Bitcoin to its historical average, is currently at a level that Moustache believes offers the second-best “re-accumulation” opportunity since 2022.

In a post uploaded on X earlier today, Moustache emphasized that Bitcoin’s current market position is comparable to previous significant periods in 2012, 2016, and 2020.

These were times when the market was primed for substantial upward movements following a phase of consolidation.

#Bitcoin – The Puell Multiple

I call it here: This is your second best chance after 2022 to re-accumulate before the next wave starts.$BTC is where it was in 2012, 2016 and 2020.

Even if it doesn’t feel like it, I think we’ve some incredibly exciting months ahead of us. pic.twitter.com/lpVXQOXvtC

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof) August 30, 2024

Moustache suggested that despite the current sentiment, the next few months could bring “incredibly exciting” developments for Bitcoin.

Featured image created with DALL-E, Chart from TradingView

Source link

Samuel Edyme

https://www.newsbtc.com/bitcoin-news/analysts-say-now-is-the-time-to-re-accumulate-bitcoin-heres-why/

2024-08-30 21:30:02