Australia’s central bank said it intends to shift its attention from developing a consumer-facing retail CBDC to a wholesale CBDC in a speech given at a fintech conference in Melbourne.

A retail CBDC can be used by the general public, for use cases like buying groceries. A wholesale CBDC is only used for transactions between banks and other financial institutions, such as international payments.

Brad Jones, Financial System Assistant Governor at the Reserve Bank of Australia, said the bank assessed “the benefits to the economy as more promising, and the challenges less problematic, for a wholesale CBDC compared to a retail version”.

He added: “This recognizes that unlike a retail CBDC that would be issued for use among the public, a wholesale CBDC would represent more an evolution than revolution in our monetary arrangements.”

In addition, the bank committed to a 3-year applied research program on the future of digital money in Australia, dubbed Project Acacia.

This will include a new project focusing on wholesale central bank-backed digital asset and tokenized commercial bank deposits, including “understanding how new ledger arrangements and concepts like ‘programmability’ and ‘atomic settlement’ in tokenized markets” could help the Australian economy.

Tokenized deposits are traditional bank deposits, which are then converted to digital tokens on a blockchain network.

Jones highlighted potential issues with a retail CBDC including high borrowing costs, increased risk of bank runs, and complicating monetary policy. The Governor also said that if a retail central bank-backed coin was to be introduced it would also “almost certainly require legislative change”.

“We don’t have all the answers here, so look forward to engaging with industry partners who have an ability and appetite to innovate with the national interest in mind,” added Jones on the new plans.

The shifting focus comes after Australia launched a CBDC Pilot and Study for the eAUD in March 2023. The pilot included collaborations with numerous firms in the private sector including Mastercard, Australian financial services firm ANZ, and Canvas Digital, a layer-2 network built on top of Ethereum.

At the time, Assistant Governor Jones highlighted how a functional CBDC could help Australia overcome issues such as 5% average fees for overseas payments and relatively slow settlement times.

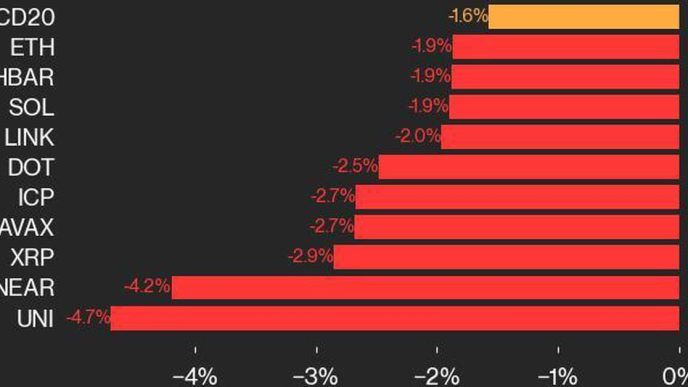

Australia’s switching focus should not come as particularly surprising. Though many Central Banks have announced work on CBDC projects—94% according to a report by BIS—the majority expect to implement wholesale rather than retail CBDCs over the next six years.

Retail CBDCs remain relatively rare at the time of writing with only the Bahamas, Jamaica and Nigeria having released these to the general public.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Will McCurdy

https://decrypt.co/250041/australia-central-bank-pivots-to-wholesale-cbdc-as-more-an-evolution-than-revolution

2024-09-18 12:57:47