Berachain’s native token, BERA, has had an underwhelming start, struggling to gain traction amid weak market conditions. The token’s launch followed the debut of Berachain’s Layer 1 proof-of-liquidity blockchain on Thursday.

Along with it came an airdrop of 55.75 million BERA, which peaked at a valuation of $1 billion before experiencing a sharp decline.

Berachain Is Losing Traction

The Relative Strength Index (RSI indicates that bearish momentum is currently in control, with the indicator struggling below the neutral 50.0 mark. This suggests that selling pressure outweighs buying interest, limiting any immediate recovery potential. Traders remain cautious, further contributing to BERA’s sluggish performance in the early trading phase.

Given the lack of strong bullish momentum, short-term price growth appears uncertain. If RSI remains below the neutral level, BERA could continue to face resistance in establishing a meaningful uptrend. Without a shift in market sentiment, the token may remain under pressure, extending its current consolidation phase.

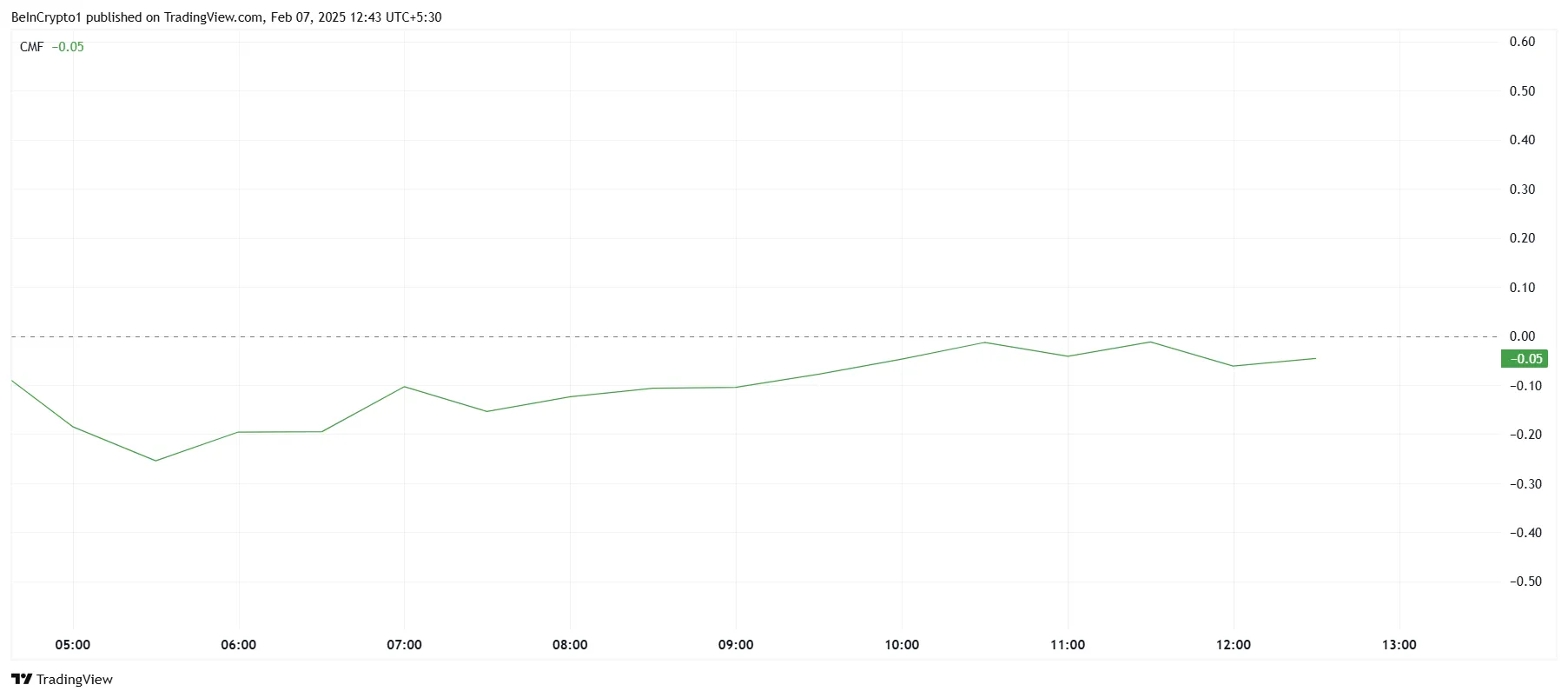

The broader market outlook for BERA remains uncertain, as reflected in the Chaikin Money Flow (CMF) indicator, which is currently below the zero line. This signals weak capital inflows into the token, suggesting investors are hesitant to commit funds. The uncertainty surrounding Berachain’s long-term viability may be a contributing factor.

Skepticism regarding newly launched projects often results in cautious trading behavior, as seen with BERA. If investor confidence does not improve, the token may struggle to attract significant inflows. Without an increase in buying pressure, the price could remain subdued, further limiting its ability to recover from the initial decline.

BERA Price Prediction: Breaking Out

BERA is currently trading at $7.61, consolidating between $8.72 and $7.07 over the past 12 hours. The limited movement within this range highlights the impact of bearish sentiment and weak investor interest. Until a breakout occurs, price action is likely to remain subdued.

The altcoin has already experienced a sharp 50% decline during its intra-day low and its current all-time low and is now down by 45% from its peak. Such a steep drop on the first day raises concerns about its immediate outlook. If selling pressure continues, BERA could extend its losses, potentially testing the $5.00 support level.

However, a potential turnaround remains possible if the altcoin can reclaim $8.72 as a support level. A successful flip of this resistance could spark renewed interest, leading to a rally toward $9.85. This move would invalidate the bearish outlook and set the stage for further recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/berachain-bera-falls-post-launch-new-lows/

2025-02-07 13:00:00