Bitget Token (BGB) has been on an impressive rally, setting new all-time highs (ATHs) almost daily throughout the past month.

However, recent indicators suggest that this bullish momentum may be cooling off, potentially leading to increased selling pressure as investors reassess their positions.

Bitget Token May Face Selling

The Price DAA Divergence indicator is flashing its first sell signal in four months, raising concerns about the sustainability of BGB’s rally. This signal has emerged due to a noticeable decline in investor participation, with many opting to step back and observe how the market behaves around the new year.

This pullback in participation could dampen BGB’s ability to sustain its upward momentum. While investor caution is understandable after such significant gains, it also leaves the token more susceptible to short-term corrections, especially if broader market trends turn bearish.

BGB’s macro momentum is being influenced by its negative correlation with Bitcoin, currently standing at -0.16. This inverse relationship means BGB’s price trajectory is moving opposite to Bitcoin’s, a trend that could be concerning if BTC’s price rises further.

Historically, BGB has demonstrated strong recoveries whenever its correlation with Bitcoin improves following a low. While the negative correlation poses a short-term challenge, it also provides an opportunity for BGB to decouple and carve its path based on unique market conditions.

BGB Price Prediction: Going Back to The ATH

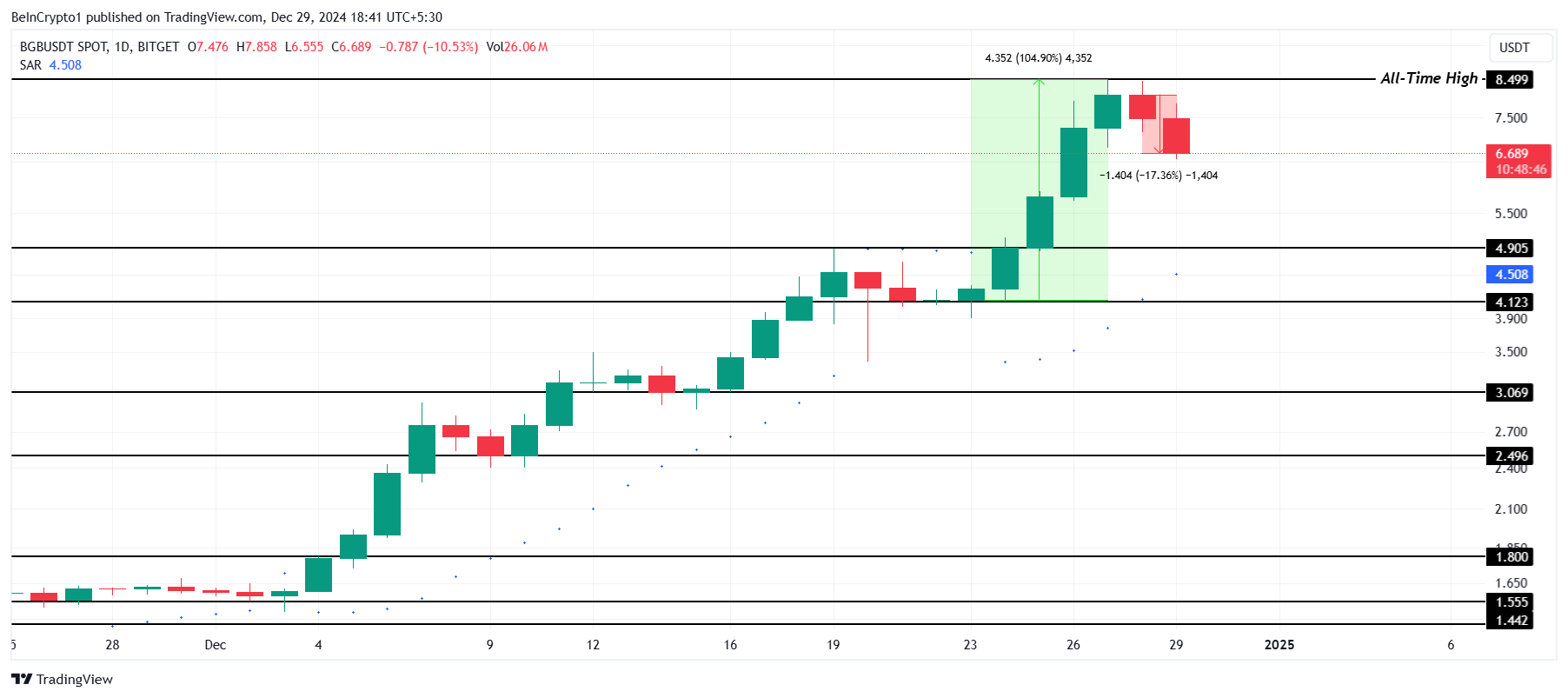

BGB’s price has dropped by 17% over the last 24 hours, following a 104% rally during the past week. This decline appears to be a natural cooldown after a period of rapid growth and may be accompanied by further corrections in the near term.

If the drawdown continues, BGB could slip to test the $4.90 support level, erasing a significant portion of its recent gains. Such a decline might trigger heavy profit-taking among investors, further pressuring the token’s price.

However, a strong recovery supported by bullish broader market cues could push BGB beyond its current ATH of $8.49. Achieving a new high would invalidate the bearish thesis and signal renewed momentum for the token, solidifying its position as a standout performer in the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitget-token-falls-after-rally/

2024-12-29 18:15:00