Despite Bitcoin (BTC) and Ethereum (ETH) still struggling to reclaim their all-time highs, there appears to be a distinct fact amongst both assets now, as shown in the latest data.

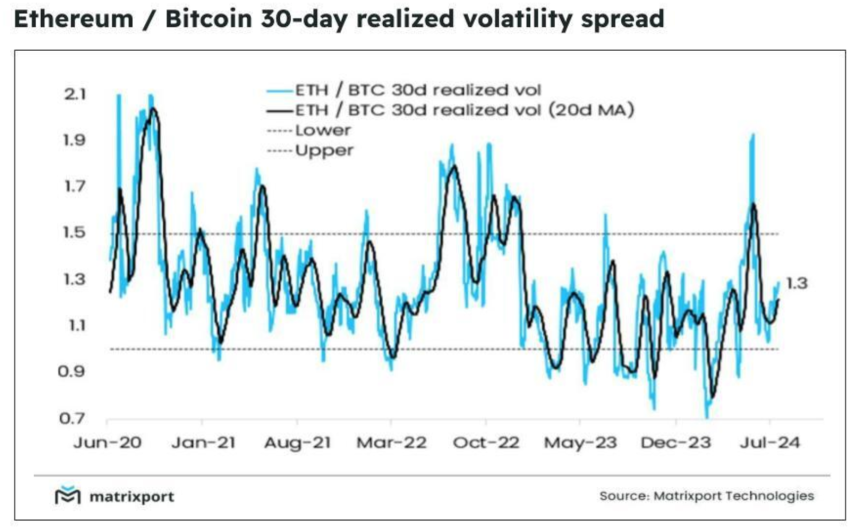

Particularly, according to Matrixport’s recent report, Ethereum is now displaying greater price fluctuations compared to Bitcoin in the past weeks.

Ethereum’s Volatile Outpacing Bitcoin’s

Volatility measures the price variations of an asset over time, with higher volatility indicating more significant price changes. According to data from Matrixport, the 30-day realized volatility spread between ETH and Bitcoin typically ranges from 1.0 to 1.5.

#Matrixport Today-Aug 13: #Ethereum’s Volatility Surpasses #Bitcoin’s#Cryptoassets #cryptomarket #BTC #ETH pic.twitter.com/QoKsuLUrAH

— Matrixport Official English (the only official X) (@Matrixport_EN) August 13, 2024

This means that Ethereum’s price movements have been up to 50% more erratic than that of Bitcoin, suggesting that Ethereum may offer a riskier market for investors.

This increased volatility is evident in the way Ethereum reacts to market stimuli. Over recent weeks, Ethereum has shown volatility levels higher than Bitcoin.

This distinction has become particularly notable since the onset of the latest bull market, with Ethereum’s price experiencing more drastic shifts.

These rapid changes can significantly impact investment strategies, as Ethereum’s larger peaks and troughs present different risk and reward scenarios compared to the relatively more stable Bitcoin. Matrixport noted in the report:

Due to Ethereum’s underperformance since the start of this bull market, this higher volatility has made it a less appealing asset. However, as long as the volatility ratio stays within this range, buying Ethereum volatility at the lower end could present an attractive opportunity.

Bitcoin And Ethereum Performance

Meanwhile, over the week, both assets appear to be almost mirroring each other in price performance, with BTC rising by 7.5% and ETH by 7.9%.

However, there has been a noticeable difference in the performance of the past 24 hours. Over this period, Bitcoin has surged by 2.8% to reclaim its $61,000 price mark. On the other hand, Ethereum has increased by only 1.2%, reclaiming its price mark above $2,700.

The technical outlook on Bitcoin shows that the asset has now validated the setup of a potential rebound to higher levels.

Bitcoin has successfully retested the Channel Bottom as support (green circle) to confirm a reclaim of the Channel overall$BTC #Crypto #Bitcoin https://t.co/CKXDAAOA9v pic.twitter.com/ZCTQtKw580

— Rekt Capital (@rektcapital) August 13, 2024

Meanwhile, the technical outlook suggests that ETH might still be stuck. Crypto analysis platform known as More Crypto Online on X noted:

Clearly, Bitcoin is leading today. Ethereum is still stuck in the range but might try an upside breakout from here.

Featured image created with DALL-E, Chart from TradingView

Source link

Samuel Edyme

https://www.newsbtc.com/news/ethereum/ethereum-volatility-surpasses-bitcoins-by-50-data-shows/

2024-08-14 10:00:33