Crypto analyst Ali Martinez has revealed the bearish sentiment among Binance’s top traders towards Bitcoin. This development suggests that the flagship crypto might soon experience significant downward pressure.

Binance Top Traders Are Shorting BTC

Martinez revealed in an X (formerly Twitter) post that 51.41% of the top traders on Binance are shorting Bitcoin. This indicates that these traders expect the flagship crypto to experience a price decline despite its recent recovery above $60,000. Indeed, BTC started this week with a price correction, dropping to $58,000.

Related Reading

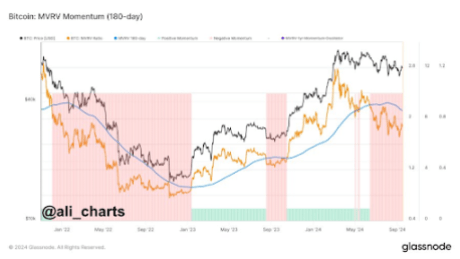

This bearish outlook for Bitcoin suggests that the rise to $60,000 was a relief bounce rather than a bullish reversal. In a recent analysis, Martinez also revealed that the flagship crypto was still in a downtrend. He alluded to the Bitcoin market value to realized value (MVRV) momentum, which he claimed shows that the flagship crypto has been in a downtrend since breaking below $66,750 in June. He added that the trend hasn’t shifted yet.

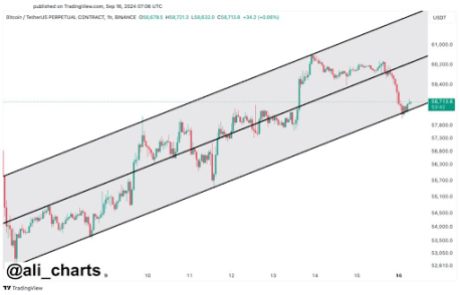

With Bitcoin still in a downtrend, the crypto risks suffering further declines. Martinez highlighted the $58,100 price level as crucial, noting that a break below could lead to a drop towards $55,000. On the other hand, he stated that Bitcoin could rebound to the mid or upper levels at $60,200 or $62,000 if it holds the lower boundary of the parallel channel.

Meanwhile, crypto analyst Jelle recently highlighted $65,000 as the price level Bitcoin must reclaim to enjoy a bullish reversal. However, reaching that price level is difficult for now, especially with uncertainty around the imminent rate cuts and the US presidential elections. Bitcoin bulls look to be waiting to see how the market reacts to the Fed’s interest rate decision that will be announced on September 18.

It is also worth mentioning that September is historically a bearish month for Bitcoin. This isn’t expected to be different as investors look to October as the month they will return to the market.

Bitcoin Could Still Drop To As Low As $15,000

Renowned economist Peter Schiff has warned that Bitcoin could still drop to as low as $15,000. He highlighted what he believes to be a triple top on Bitcoin’s chart. The expert added that the chart is worse if the flagship crypto is priced in gold. At the minimum, the economist expects BTC to drop to the upward trend line at about $42,000, but he doubts it will hold that support line.

Related Reading

As such, he predicts that Bitcoin will retest the longer-term support between $15,000 and $20,000. While it remains to be seen whether that happens, Schiff is known to be a Bitcoin bear and has consistently advocated for Gold over the flagship crypto.

At the time of writing, Bitcoin is trading at around $58,200, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/binance-traders-short-bitcoin/

2024-09-17 11:00:59