Bitcoin (BTC) four-year compound annual growth rate (CAGR) has declined to 14.5%, the lowest rate on record. However, despite the slump, the premier cryptocurrency has given better returns than gold and stocks.

Bitcoin CAGR Drops To Lowest Rate Ever

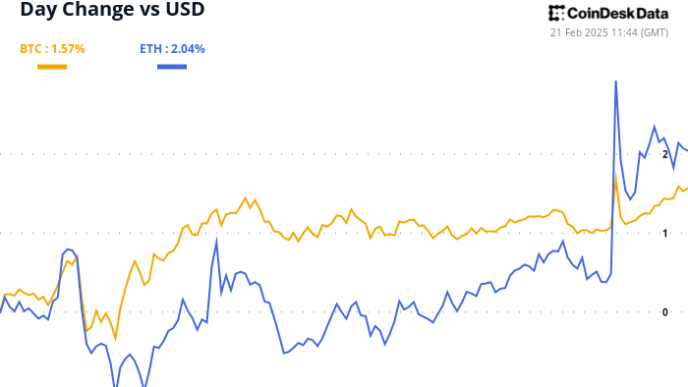

Over the past year, BTC has experienced significant price action, setting multiple all-time highs (ATHs) despite the US Federal Reserve’s (Fed) hawkish stance, which included raising interest rates to curb inflation. Data from CoinGecko shows that BTC has surged 88% over the past year.

Related Reading

Despite its strong performance in 2024, BTC’s four-year CAGR has now fallen to an all-time low of 14.5%. Market analyst Mark Harvey shared the following chart on X illustrating the cryptocurrency’s declining four-year CAGR.

For the uninitiated, the four-year CAGR represents the average annual growth rate of an asset over four years, accounting for compounding effects. It helps assess long-term performance by smoothing out short-term fluctuations.

Harvey, however, remains optimistic that BTC’s CAGR will not stay at this low level for long. Responding to a comment on his post, he agreed that the cryptocurrency could soon see an explosive upward move.

While BTC’s 14.5% four-year CAGR is its lowest on record, it still surpasses the returns of gold and stocks. According to data from Checkonchain, the four-year CAGR for gold, silver, the S&P 500, Nasdaq, and the US dollar has ranged between 4% and 13%.

That said, BTC’s four-year CAGR pales in comparison to some of the other large-cap cryptocurrencies. For instance, Solana (SOL) offered a CAGR of 118%, while XRP gave 49%. Only Ethereum (ETH) was ranked below BTC with a CAGR of just about 8%.

Is BTC On Track To Replace Gold?

At the time of writing, BTC commands a total market cap of slightly more than $1.9 trillion, while gold’s market cap is almost 10 times greater, around $19 trillion. While there is still a lot of room to grow for BTC, experts opine that it won’t be long before the ‘digital gold’ starts chipping away at gold’s dominance.

Related Reading

In a recent client note, analysts at trading firm Bernstein predicted that BTC is on track to replace gold in as little as 10 years. The note stated that BTC is slated to assume gold’s role as a reliable safe-haven asset.

As Bitcoin adoption grows, an increasing number of financial experts are envisioning a future where the cryptocurrency rivals gold. Recently, Matthew Sigel, Head of Digital Assets Research at VanEck, emphasized BTC’s potential to become a global monetary standard.

Most recently, veteran trader Peter Brandt highlighted BTC’s increasing strength against gold. At press time, BTC trades at $97,804, up 1.7% in the past 24 hours.

Featured image from Unsplash, Charts from X and TradingView.com

Source link

Ash Tiwari

https://www.newsbtc.com/bitcoin-news/bitcoin-4-year-cagr-drops-to-14-45-but-still-outshines-gold-stocks-details/

2025-02-21 11:00:29