Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

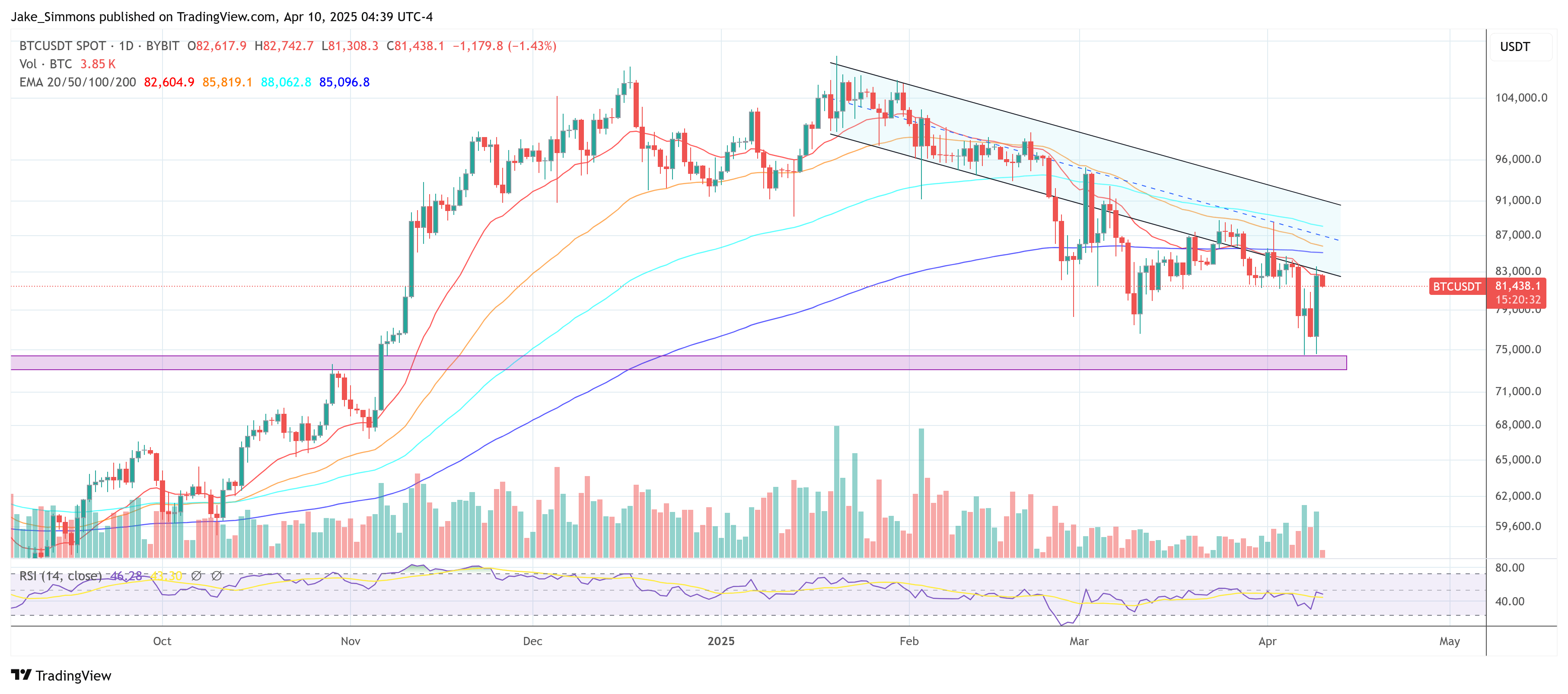

On Wednesday, Bitcoin surged more than 8% to reach a high of $83,588 following President Donald Trump’s announcement of a 90-day pause on new reciprocal tariffs for over 75 countries, excluding China. Investors and market analysts viewed the move as a signal of relief, reflecting hopes that the rapid escalation of tariffs would abate, at least temporarily. Yet President Trump simultaneously hiked the tariff rate on China to 125%, indicating that the trade battle between the world’s two largest economies remains far from settled.

Trump’s decision to pause most of his newly announced tariffs was tied to concern over disruptive shifts in the bond market. Yields on 10-year Treasury notes, which had soared to a seven-week high, remained elevated after the tariff pause was revealed. Despite the temporary relief for many countries, the immediate tariff hike on China highlighted the ongoing stalemate, suggesting persistent uncertainty for global markets. Some analysts see the surge of risk assets, including Bitcoin, as partly driven by changing expectations around future negotiations.

Potential China Deal Not Priced In For Bitcoin

Amid this backdrop, Joe McCann, founder, CEO, CIO, and solo managing GP of the crypto fund Asymmetric, voiced his perspective on X, observing that the market was originally pricing in tariffs for China, EU and the entire world, but is now only pricing China.

Related Reading

He indicated that a deal with Beijing remains unpriced, so if a breakthrough emerges, the market “explodes” higher. “Market was priced for China, EU and everyone else getting tariffed. Market now pricing only China. Market not pricing a China deal,” McCann remarks.

He also notes that “the explosion on the long end is risk parity pods blowing up,” referencing abrupt market movements in long-duration bonds. McCann sees the current environment as reminiscent of the market bottom during the COVID period, with funds starting to re-gross positions and short-sellers covering. He highlights the possibility that if the yuan strengthens against the dollar, it would likely mean China is prepared to negotiate, implying that equity and crypto markets may be trading too low.

“But today, long only funds re-grossed and shorts covered.Trump has signaled max pain for China and is willing to negotiate. Market can only re-price higher. If the Yuan rallies against the Dollar tonight, that is likely a sign China wants to negotiate, which means the market is mispriced (too low). UST 30Y auction tomorrow should see further indirect bids – same story as today,” McCann writes.

“Not Out Of The Woods Yet”

Jeff Park, Head of Alpha Strategies at Bitwise, cautioned that the environment remains fragile, noting on X that weakened yuan dynamics, a still-robust 10-year yield above 4%, and ongoing credit concerns at spreads beyond 400 basis points persist as potential headwinds. According to him, “[this] will be an unpopular opinion […] we are out the woods yet […] the net outcome is still negative for risk assets,” especially if the Federal Reserve does not cut rates as previously anticipated.

Related Reading

He cited this lack of monetary support as a factor that amplifies volatility. “If anything its actually more concerning how little liquidity is in the market to experience casino swings like this,” he writes via X.

X user Adam Yoder agrees that “bonds still went up today, gold went up,” suggesting there are still enough safe-haven flows to keep traditional investors wary of riskier assets. Park concurred, suggesting “this is actually kind of a horrible move” and expressing confusion over what the White House hopes to achieve with a partial pause that leaves China alone to bear the brunt.

Meanwhile, in a swift reversal of its earlier call, Goldman Sachs withdrew a recently announced recession baseline after the 90-day pause was confirmed. Its revised outlook, published by Jan Hatzius, maintains that total tariffs—both the existing 10% and anticipated sector-specific rates of 25%—will still be implemented, but that the market has been spared an immediate global escalation.

Goldman now returns to its previous non-recession baseline forecast of 0.5% Q4/Q4 GDP growth in 2025, a 45% recession probability, and three successive 25-basis-point “insurance” cuts by the Federal Reserve in June, July, and September. According to the statement, “we continue to expect additional sector-specific tariffs” and an overall rate that could approach the 15 percentage-point increase Goldman had initially anticipated.

All Eyes On Today’s CPI Release

Notably, today, the US Consumer Price Index (CPI) data for March 2025 is scheduled to be released by the US Bureau of Labor Statistics (BLS) at 8:30 ET – a big report for the market which could be crucial for BTC’s next move.

The CPI for February 2025 showed a year-over-year (YoY) increase of 2.8% (not seasonally adjusted), with a month-over-month (MoM) rise of 0.2% (seasonally adjusted). Core CPI, excluding food and energy, was up 3.1% YoY. This marked a slight cooling from January’s 3.0% YoY headline rate, suggesting a gradual disinflation trend.

Expectations for the March CPI are to potentially drop to around 2.5% YoY, with some analysts suggesting it could even fall to 2.6% or lower if trends in housing costs, rents, and energy prices continue to ease. Core CPI is anticipated to hover around 3.0% to 3.1% YoY, reflecting persistent pressure from services and shelter costs.

At press time, BTC traded at $81,438.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/bitcoin-news/is-the-bitcoin-bottom-in-trumps-tariff-pause/

2025-04-10 12:30:12