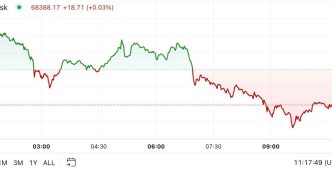

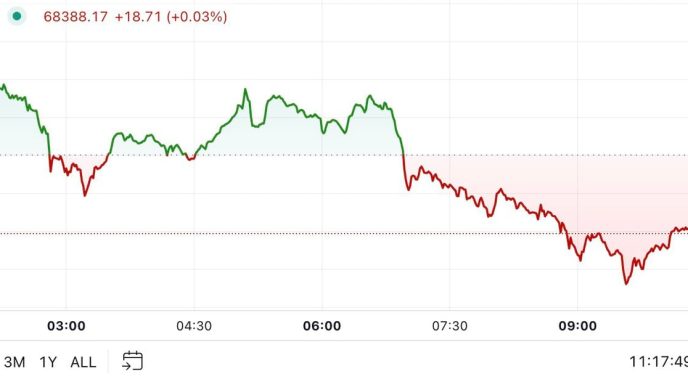

As the 2024 U.S. presidential election approaches, the Bitcoin price is still exhibiting upward momentum Monday morning during European trading hours. In fact, BTC briefly touched a high of $69,227 earlier today.

The apex cryptocurrency is currently trading at $68,270, down 0.2% over the last 24 hours, according to data from CoinGecko. Meanwhile, Ethereum (ETH) has also seen positive movement, trading at $2,713, up 2.5% during the same period.

Experts are attributing the market’s bullish sentiment to the upcoming elections, with Bitcoin edging closer to the critical $70,000 mark.

Speaking with Decrypt, Avinash Shekhar, Co-founder and CEO of Pi42, believes Bitcoin is approaching a critical resistance level of $70,000, driven by multiple factors including Kamala Harris’s support for crypto and Trump’s strong odds of reelection.

“Bitcoin is currently trading at $68,700, fueled by Kamala Harris’s support for crypto, Trump’s 60% odds of reelection, low interest rates, and diminished fears of World War III,” Shekhar said.

He added that bulls are targeting $72,000 in the near term, while bears are looking to defend against a drop below $66,500.

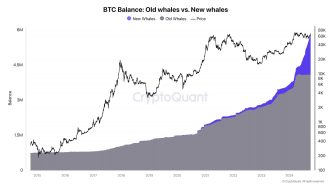

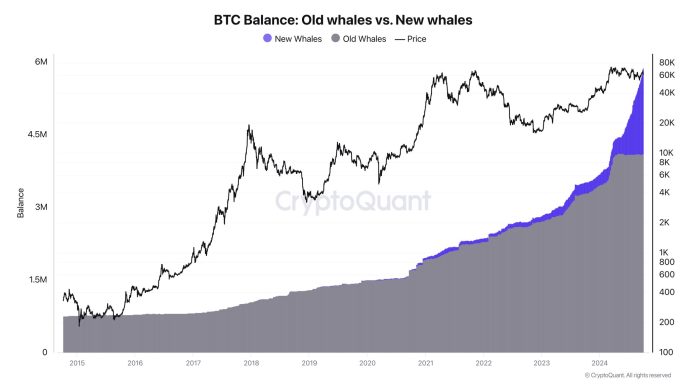

Interestingly, Bitcoin’s open interest (OI) has surged to new highs, signaling increased participation and interest from crypto derivatives traders. The total OI stands at $40.57 billion, with 593 thousand BTC locked in open contracts, reflecting a high level of market activity, according to data from CoinGlass.

The renewed enthusiasm among traders comes as the U.S. presidential election is set to take place on November 5 and former president Donald Trump is currently leading with 61.4% odds, compared to Vice President Kamala Harris’s 38.6% on betting platform Polymarket. Trump’s potential reelection has been viewed positively by market participants, as his administration has shown favorable attitudes toward cryptocurrencies.

In a report shared with Decrypt, Bernstein stated that the rising Trump odds are being interpreted as bullish for Bitcoin, with market players increasingly leaning toward a “risk-on” approach

“Bitcoin is attempting a break out of the $70K resistance (one more time) and like other risk-on markets, is interpreting rising Trump odds as bullish for crypto,” the analysts stated.

Moreover, Kamala Harris’s clear policy statements in support of cryptocurrency have also contributed to the overall bullish sentiment, reducing fears of a negative regulatory environment regardless of the election outcome.

Retail sentiment has also shifted to a “risk-on” stance. Trading platform Robinhood (HOOD) has seen a 10% growth in active traders quarter-on-quarter, with crypto trading revenues up 160% year-on-year. This aligns with the broader market’s positive outlook, which expects the Federal Reserve to cut interest rates further, making risk assets like Bitcoin more attractive.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Murtuza Merchant

https://decrypt.co/287370/bitcoin-price-bulls-targeting-72000

2024-10-21 11:39:00