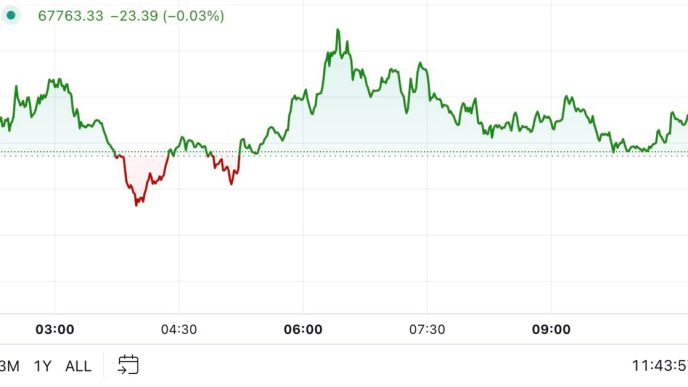

Bitcoin has climbed 11% in the past week and is within range of the highs it saw in July. But there may be trouble on the horizon for the price of Bitcoin when you zoom out to look at macroeconomic factors, said one analyst.

Yuya Hasegawa, a crypto market analyst at Bitbank in Japan, highlighted that rising U.S. bond yields are “a bit of a concern for Bitcoin looking ahead.”

Simply put, when bond yields begin to remain elevated it can make them more appealing than risky assets like Bitcoin. That can lead investors to siphon money out of risky assets, like stocks or cryptocurrency, to redeploy into U.S. bonds.

As of mid-October, the yield on 10-year U.S. Treasury notes has hovered between 4.02% and 4.08%. That’s down slightly from September, when yields climbed as high as 4.3%. But still high enough to create an alluring alternative to risky crypto assets.

And that’s not the only thing giving Hasegawa reason to worry.

“The stronger than expected retail sales and the declining jobless claims have raised a concern amongst the wider financial market that the Fed may not continue cutting rates so quickly,” he wrote in a trading note shared with Decrypt.

The possibility that the Fed doesn’t lower rates again in November isn’t an immediate threat. The Bitbank analyst says there’s still a “reasonable chance” the Federal Open Market Committee (FOMC) will enact a 25 basis points cut after its meeting in early November.

And for the most part, traders seem to agree with him. As of Friday morning during European trading hours, about 9% of traders think the Federal Reserve will leave interest rates unchanged after its next meeting, per CME. The rest, like Hasegawa, think markets are in for another 25 basis points cut.

For starters, the European Central Bank lowered its key interest rates by 25 basis points on Thursday, “based on its updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of the monetary policy transmission,” it said in a press release.

Although the ECB cautioned that economic conditions “remain restrictive,” there’s reason to believe it’ll buoy the Bitcoin price in the near term.

“This rate cut is expected to increase liquidity across markets, boosting the performance of risk assets such as Bitcoin,” wrote BRN analyst Valentin Fournier in a note shared with Decrypt.

“The combination of strong ETF inflows and macroeconomic catalysts points to an imminent breakout,” he added. “If Bitcoin avoids a rejection over the weekend, it could reach $70,000 by Monday for a final test.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Stacy Elliott

https://decrypt.co/287119/bitcoin-could-hit-turbulence-from-us-bond-yields-fed-policy-analyst

2024-10-18 11:49:19