The Bitcoin recent price volatility, including a crash below $50,000 last month, has significantly slowed down the momentum of the bull run many analysts are anticipating. Despite the price lull, a certain crypto analyst believes that the Bitcoin bull run is still on track, predicting a sharp rise to over $100,000 once current price corrections stabilize.

Bitcoin Bull Run Still Going Strong

Popular crypto analyst, CryptoCon sees Bitcoin’s recent price drop as a minor setback, suggesting that the cryptocurrency’s highly anticipated bull run remains unfazed. The analyst took to X (formerly Twitter) on August 28 to make a bullish forecast for Bitcoin, based on its current price behavior based on historical trend patterns.

Related Reading

CryptoCon indicated that recent market events or news involving Bitcoin’s price decline and market volatility may be distracting for many investors, causing them to lose sight of the big picture. The analyst shared a detailed Bitcoin price chart depicting all the halving cycles from 2013, each clearly displaying a similar bullish pattern.

The analyst Identified a recurring pattern in Bitcoin’s price movements before and after each halving cycle, highlighting an initial period of decline followed by an intense bullish momentum. CryptoCon disclosed that in August 2012, Bitcoin’s price witnessed a significant bearish dip before climbing to new highs in 2013.

This trend was evident in the subsequent halving cycles, with August 2016, and 2020 marked by extended periods of “boring” price action before a dramatic increase to new peaks in 2017, and 2021, respectively. CryptoCon has described this distinctive bullish year as the “Red Year.”

The analyst describes 2024 as a “Blue Year” characterized by stable or unexciting price action. He indicated that this period is likely a build up or preparation phase before a “Red Year” where Bitcoin’s price hits a new all time high.

Drawing from his analysis of Bitcoin’s historical halving cycles, CryptoCon has notably raised his conservative estimate for the Bitcoin cycle top, adjusting the range from $90,000 – $130,000 to $110,000 – $160,000.

Other Analysts Share Similar Sentiment

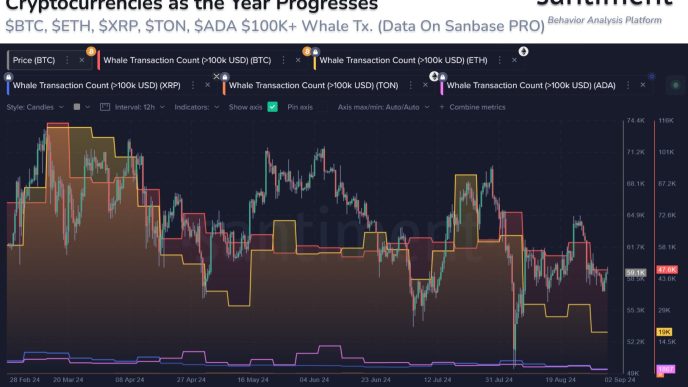

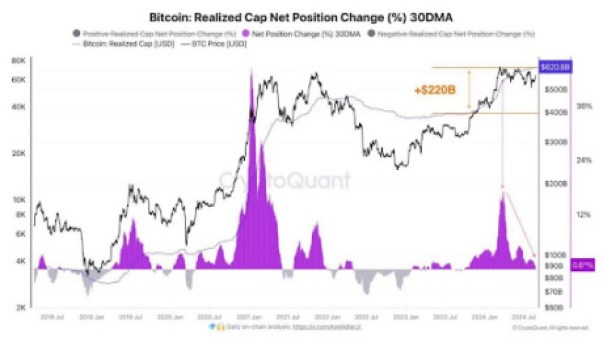

Another crypto analyst identified as ‘Kyledoops’ on X shares a similar bullish sentiment for Bitcoin’s future price outlook. According to Kyledoops, Bitcoin’s net capital inflow is slowing down significantly, indicating a delicate situation where investors’ gains and losses are nearly balanced.

Related Reading

He revealed that historically, periods of decreased capital inflow, like what Bitcoin is experiencing currently, have often been followed by significant price fluctuations and volatility spikes. However, this lull also hints that huge price swings could be just around the corner for Bitcoin.

As of writing, the price of Bitcoin is trading at $58,051, reflecting a steep 9.07% decline over the past seven days, according to CoinMarketCap. Despite persistent bearish trends, the pioneer cryptocurrency remains intent on reaching and stabilizing above the $60,000 price mark.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-100000-in-the-cards/

2024-09-02 23:00:01