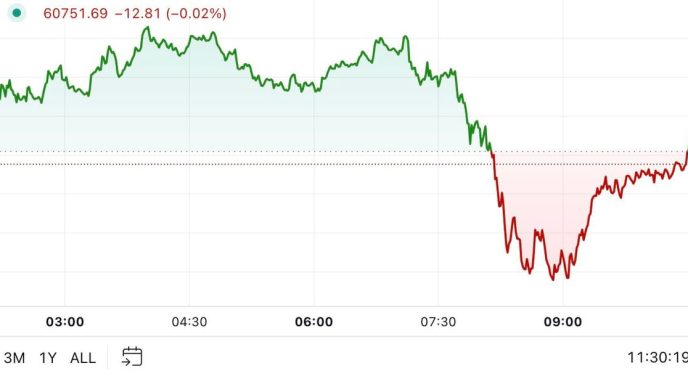

Bitcoin slipped to just over $60,000 Thursday morning, following a second day of outflows from U.S. spot Bitcoin ETFs.

At time of publication, Bitcoin’s price has climbed back to around $61,000, trading flat on the day and down 4.5% on the week, per data from CoinGecko.

In a note shared with Decrypt, Standard Chartered argued that while Bitcoin does not represent a safe-haven asset amid current geopolitical tensions, a dip under $60,000 “should be bought into.”

Following the crypto market’s plunge alongside stocks this week following Iran’s offensive against Israel, Geoff Kendrick, Global Head of Digital Assets Research at Standard Chartered, argued that Bitcoin should not be viewed as a hedge against geopolitical risks. Instead, he said, it should be seen as a hedge against TradFi issues such as bank collapses, de-dollarisation and U.S. Treasury sustainability issues.

While Kendrick noted that, “Risk concerns related to the Middle East seem destined to push BTC below 60k before the weekend,” the analyst identified a potential upside, pointing to increased activity in Bitcoin options markets and a “circularity” effect involving U.S. presidential odds as factors that could support prices.

“There has been a large fresh position in BTC options in the last couple of days,” Kendrick said, noting that, “The amount of open interest for the 27 Dec expiry at 80k on Derebit jumped by 1300 BTC over the last 2 days. Positions like the 80k call options highlighted here and the circularity vis-à-vis Trump probabilities suggests the dip should be bought into.”

Meanwhile, on October 2, the market saw net outflows from Bitcoin spot ETFs totaling $91.7 million, with Grayscale’s (GBTC) losing $27.3 million and (ARKB) seeing outflows of $60.2 million. Fidelity’s FBTC, however, managed a net inflow of $21 million, according to data from SoSo Value.

Ethereum spot ETFs reported net inflows of $14.4 million, with BlackRock’s (ETHA) receiving $18 million.

Alex Kuptsikevich, senior market analyst at FxPro, attributed Bitcoin’s current stagnation to the broader risk-off environment in global markets. He pointed to the “ongoing wave of dollar gains and declines in risk assets” resulting from the Middle Eastern conflict, alongside profit-taking ahead of the U.S. jobs report.

“Bitcoin found support on the decline towards the 50-day moving average and the $60,000 area. Over the next two days, swings within the $60-63.6K area could be misleading market noise as the market awaits new information,” he told Decrypt.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Murtuza Merchant

https://decrypt.co/284489/bitcoin-dip-under-60000-should-be-bought-into-standard-chartered

2024-10-03 11:03:49