Up to 60% of top US hedge funds now hold Bitcoin ETFs, a sharp increase since May. This shift highlights rising institutional adoption as more traditional investors are drawn to crypto.

The January decision by the US Securities and Exchange Commission (SEC) to approve Bitcoin (BTC) ETFs marked a crucial moment, providing institutional investors with direct access to the crypto market.

Hedge Funds Flocking to Bitcoin ETFs

Sam Baker, a research analyst at BTC-focused firm River, notes that 60% of the largest US hedge funds now hold Bitcoin ETFs. None of these funds sold during Q2, with many continuing to increase their holdings.

Citadel Investments, Millennium Management, Mariner Investment, and Fortress Investment are among the firms that added more shares in Q2. Additionally, 13 out of the 25 top registered investment advisors (RIAs) in the US now have Bitcoin exposure through ETFs.

Moreover, some, such as Cambridge Associates, Hightower Advisors, Moneta Group, and Cresset Asset Management, are slowly increasing their allocations.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

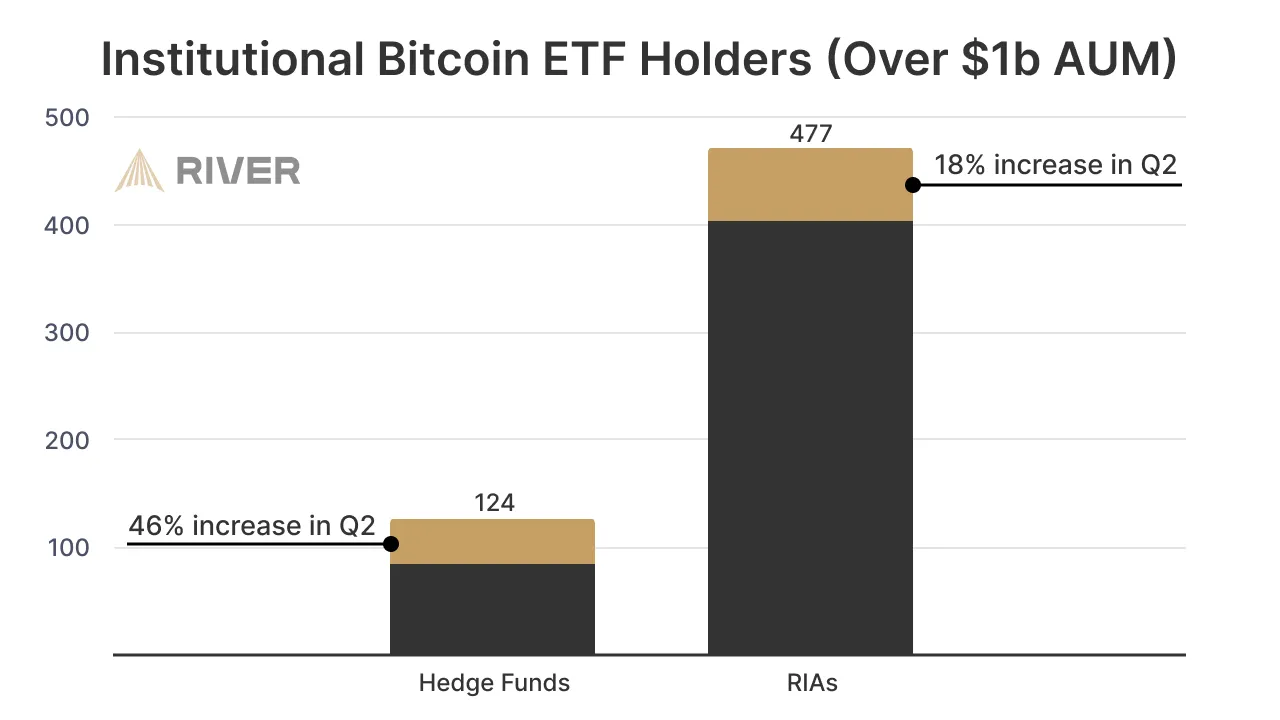

Further, large institutions with over $1 billion in assets under management (AUM) have continued to increase their Bitcoin exposure. In Q2 alone, the number of registered investment advisors (RIAs) with a Bitcoin allocation grew by 18%.

Meanwhile, the number of hedge funds holding Bitcoin increased by 46%, reflecting the growing confidence in Bitcoin among major financial players.

For hedge funds, the surge to 60% marks a notable increase, up 8% since May. As reported by BeInCrypto, around 52% of hedge funds had invested in Bitcoin ETFs as of May, allocating an average of 2.1% of their portfolios to BTC. This points to rising institutional enthusiasm for Bitcoin.

Indeed, institutions have capitalized on the recent market correction, buying the dip and showing sustained interest. According to capital compounder HODL15Capital, BTC ETF flows have been net positive in eight of the last ten days.

Amid this growing interest, BlackRock’s Bitcoin holdings are approaching 350,000 BTC, ranking just behind pseudonymous Bitcoin creator Satoshi Nakamoto and Binance. Similarly, other issuers like Bitwise, Ark Investments, and Valkyrie Investments are actively exploring expansion opportunities.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Despite the role of ETFs in adding legitimacy to crypto, some argue that these financial instruments sidestep Satoshi’s vision. The concern is that as institutional stakes grow, power shifts back into the hands of large entities, contradicting crypto’s decentralized ethos. This could lead to Bitcoin and other cryptocurrencies trading more like traditional stocks under Wall Street’s influence, diluting the core principles of decentralization.

“I still wish Bitcoin never got an ETF. It moves slower than most stocks and has lost its appeal to trade. We replaced exciting volatility with boring stability, just what the suits and institutions wanted,” said one user on X.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/top-us-hedge-funds-own-bitcoin-etfs/

2024-08-21 07:27:46