Bitcoin, after experiencing a blood bath last Month, several analysts have re-analyzed its price action to see what this new month of September might hold for the Bitcoin Market.

Amongst them, a renowned crypto analyst known as Mags on X has recently shared an insightful perspective on Bitcoin’s current market behavior in one of his latest posts.

Is Bitcoin Primed For A September Rally?

Mags pointed out that Bitcoin has been in a long consolidation phase since March and is now entering its seventh month.

He drew a parallel to a similar pattern observed last year, where Bitcoin also began its consolidation in March, only to start recovering by September.

According to Mags, over the following seven months, Bitcoin experienced a 195% increase in price. So far, this historical pattern has raised whether September will again serve as a pivotal month for Bitcoin.

#Bitcoin – september is a bearish month ?

We all know Bitcoin has been stuck in a long consolidation phase for the past few months.

This sideways PA began in March and is still ongoing. But what if I told you we saw a similar pattern last year?

Back then, the consolidation… pic.twitter.com/8PJ8MMNEUR

— Mags (@thescalpingpro) September 2, 2024

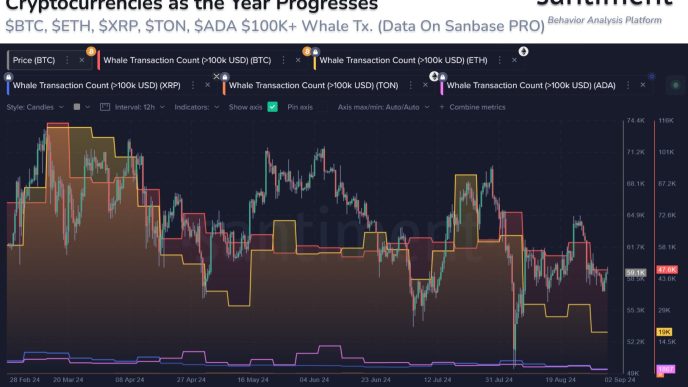

Bitcoin is showing signs of a bearish trend, having fallen below the psychological $60,000 level. Over the past week, the cryptocurrency has seen a 9.9% decline.

However, there seems to be a slight recovery in progress, with BTC currently trading at $58,411, up 0.3% in the past 24 hours.

Next Moves Expected From BTC

In response to Bitcoin’s recent price action, prominent crypto analyst Captain Faibik offered his outlook, suggesting that BTC is still moving within a bullish flag pattern. According to Faibik, there is a possibility that Bitcoin may test the $54,000 support area once again.

He emphasized the importance of bulls defending this level, as a bounce back from $54,000 could potentially lead to a rally up to $68,000 in September.

This scenario aligns with Mags’ theory that September could be a turning point for Bitcoin, mirroring last year’s price recovery.

Adding to the discussion, another well-known analyst, Willy Woo, provided insights on the supply dynamics affecting Bitcoin’s price. Woo noted that the influx of BTC from sources such as Germany’s Mt. Gox and the US Department of Justice is gradually being “absorbed” by the market.

He also observed that paper BTC bets are declining, which he interprets as a positive sign. Overall, Woo suggested that the market sentiment has shifted from bearish towards neutral, indicating that the worst sell-off may be over.

Featured image created with DALL-E, Chart

Source link

Samuel Edyme

https://www.newsbtc.com/bitcoin-news/bitcoin-eyes-68000-in-september-could-this-be-the-turning-point/

2024-09-03 06:30:15