As Bitcoin continues its prolonged consolidation phase, Ki Young Ju, Founder and CEO of CryptoQuant, has warned that if no Bitcoin (BTC) bull market emerges within the next two weeks, this year will mark the longest sideways movement in a halving year in the cryptocurrency’s history.

His comment comes 285 days into 2024, a year that has seen Bitcoin remain range-bound for an extended period despite earlier bullish expectations.

Ki Young Ju’s analysis reflects growing concerns within the crypto community about Bitcoin’s performance following its latest halving event. Typically, halving years are associated with significant price surges as supply decreases, but 2024 has bucked the trend, leaving market participants in anticipation.

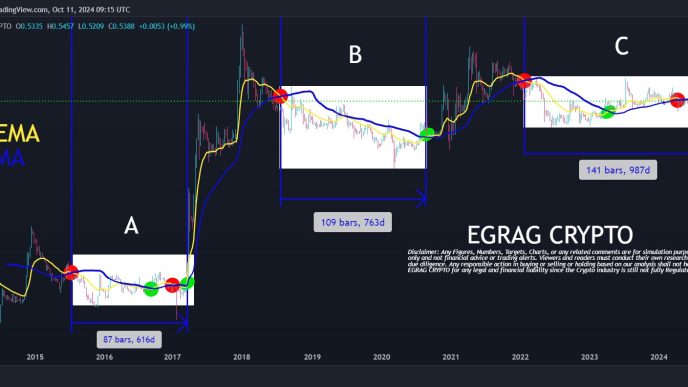

Ju also shared a chart illustrating Bitcoin’s historically consistent bull runs in prior halving years, highlighting how the current price action deviates from the established cycle. The chart shows that while Bitcoin briefly rallied in early 2024, it has struggled to maintain upward momentum and has traded largely sideways since reaching its pre-halving peak in March.

Meanwhile, Illia Otychenko, Lead Analyst at CEX.IO told Decrypt that Bitcoin experienced an extended post-halving consolidation phase in this cycle and differs significantly from previous ones.

Notably, Bitcoin reached a new all-time high before the halving in March 2024, a rare occurrence that caused several on-chain indicators to deviate from traditional patterns.

Otychenko pointed out that by July 2024, 62% of the 13 key on-chain indicators tracked by Capricole Investments had entered bearish territory. He also noted that indicators like the long-term holder market inflation rate and the dormancy Z-score mirrored historical market peaks, suggesting that this cycle may not follow the typical path seen in previous years.

“This doesn’t necessarily invalidate the established Cycle Theory,” Otychenko said. “But it does suggest that the components of this cycle, such as altcoin seasons or bull runs, might have different timelines than we’re used to seeing.”

As of Friday afternoon European trading time, Bitcoin remains flat, trading at $61,180, while Ethereum has edged up by 0.5% to $2,415, according to CoinGecko data. This stability follows a brief dip in Bitcoin’s price to near $60,000 levels on Thursday, prompted by a series of mixed economic signals.

Data on Thursday showed that headline CPI inflation fell from 2.5% in August to 2.4% in September 2024, slightly missing the consensus forecast of 2.3%. The unexpected inflation reading led to a temporary market correction.

Compounding market uncertainty, the latest jobless claims report indicated the largest weekly increase since July 2023, signaling potential weakness in the labor market. This contrasts with the strong September employment figures, complicating the outlook for future interest rate decisions.

Moreover, ETF flows have added to the market dynamics, with Bitcoin spot ETFs seeing a net outflow of $121 million, while Ethereum spot ETFs recorded a modest net inflow of $3.06 million, according to data from SoSo Value.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Murtuza Merchant

https://decrypt.co/285793/bitcoin-trading-sideways-whats-different

2024-10-11 14:09:51