Bitcoin breached the highly anticipated $100,000 price level on Wednesday, reaching the vaunted milestone more than 15 years after its mysterious creator, Satoshi Nakamoto, launched the original crypto.

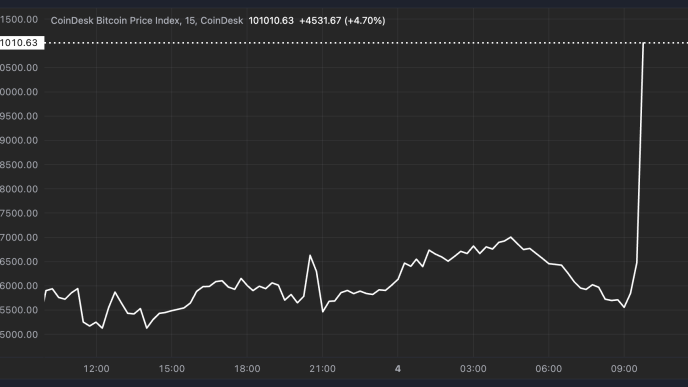

Bitcoin hit the long-anticipated target above $101,000 just after 9:45 pm ET, according to Coinbase data. At the start of the year, the coin was trading for a little over $44,000. It has since risen over 120%, repeatedly breaking its high price record throughout November but falling just short of the $100,000 mark until now.

The largest crypto by market cap has come a long way since its creator, or creators mined the genesis block in January 2009.

Bitcoin has its roots in cypherpunk philosophy, designed as a decentralized currency that can be freely transacted and traded without a centralized authority and on an immutable ledger that cannot easily be altered or taken offline.

Over the years, the coin has gone from a near-worthless curio and something primarily used to purchase drugs online to one of the most valuable assets in the world—and an attractive investment for prestigious asset managers looking to hedge against inflation. Now, with Bitcoin exchange-traded funds (ETFs) flourishing this year, even Wall Street is on board.

In the past decade alone, Bitcoin has appreciated by more than 14,250%.

A bullish year

The recent surge in the asset comes amid a flurry of favorable tailwinds for the crypto industry this year.

Investor interest and inflows surged this year following the January approval of U.S.-listed spot Bitcoin exchange-traded funds (ETFs).

The Securities and Exchange Commission, Wall Street’s primary regulator, gave the green light to those funds in January following years of rejections.

Those previously prohibited from engaging with the industry over custody and security concerns can now invest as easily in it as gold, foreign currencies, or the S&P 500.

Traditional financial titans such as Goldman Sachs and Paul Tudor Jones’ Tudor Investment Corporation have bought exposure to the asset via the ETFs.

President-elect Donald Trump’s shock win on November 5 helped spur a rally aptly dubbed the “Trump Trade” by market participants.

The former Republican president—who served a four-year term between 2017 and 2021—has been a vocal industry advocate during his campaign, promising to promote and retain U.S.-based crypto mining efforts while establishing a Bitcoin reserve.

Now, with Trump’s return to the White House imminent, investors are feeling bullish that the space will be allowed to grow under his watch.

Gary Gensler, the SEC’s current Chair, who President Joe Biden nominated, has cracked down on the digital asset space, hitting exchanges and other crypto firms with lawsuits.

With his announced upcoming departure, industry observers are hopeful for a return to a less hostile era under a new agency head. Earlier Wednesday, Trump nominated former SEC commissioner Paul Atkins for the top job, pending Senate confirmation.

Industry observers think a Republican boss of the financial watchdog will be far more friendly to the space and are now anticipating a “golden” era for digital assets.

Edited by Sebastian Sinclair and Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Mathew Di Salvo

https://decrypt.co/292828/bitcoin-hits-100000-15-years-satoshi

2024-12-05 02:45:11