According to the latest on-chain data, the Bitcoin Network Value to Transactions (NVT) Golden Cross has fallen into a crucial region. What could this mean for the price of the premier cryptocurrency?

What Does The Falling NVT Golden Cross Mean For Price?

In a recent Quicktake post on the CryptoQuant platform, an analyst with the pseudonym Burakkesmeci revealed that the price of Bitcoin might have reached a “local bottom.” This exciting prognosis is based on the latest movement by the “NVT Golden Cross” metric.

For context, the “Network Value to Transactions” ratio is an on-chain indicator that estimates the difference between the Bitcoin market capitalization and transaction volume. Typically, a high NVT value signals that an asset’s price is high compared to the network’s transaction volume, suggesting that the coin is overvalued.

Conversely, when the value of the NVT metric is low, it implies that the coin’s market value is small relative to the transaction volume. Usually, this indicates that the asset is undervalued and its price could still have room for upside movement.

Now, the Golden Cross indicator is a modified iteration of the NVT ratio, and it helps to mark gradual buy and sell zones in short-term trends. According to Burakkesmeci explained that when the NVT GC exceeds 2.2 (the red zone), it means that the price in a short-term trend is overheating (and the formation of a potential local top).

On the other hand, the NVT Golden Cross dipping below -1.6 suggests that the price decline is wearing out, signaling a potential bottom. Burakkesmeci noted that these local tops and bottoms are regions rather than just precise levels.

As shown in the chart above, the NVT Golden Cross has crossed beneath -1.6 and is currently around -3.3, suggesting that the Bitcoin price is at a local bottom. According to the CryptoQuant analyst, this could represent a “gradual buying opportunity” for investors looking to get into the market.

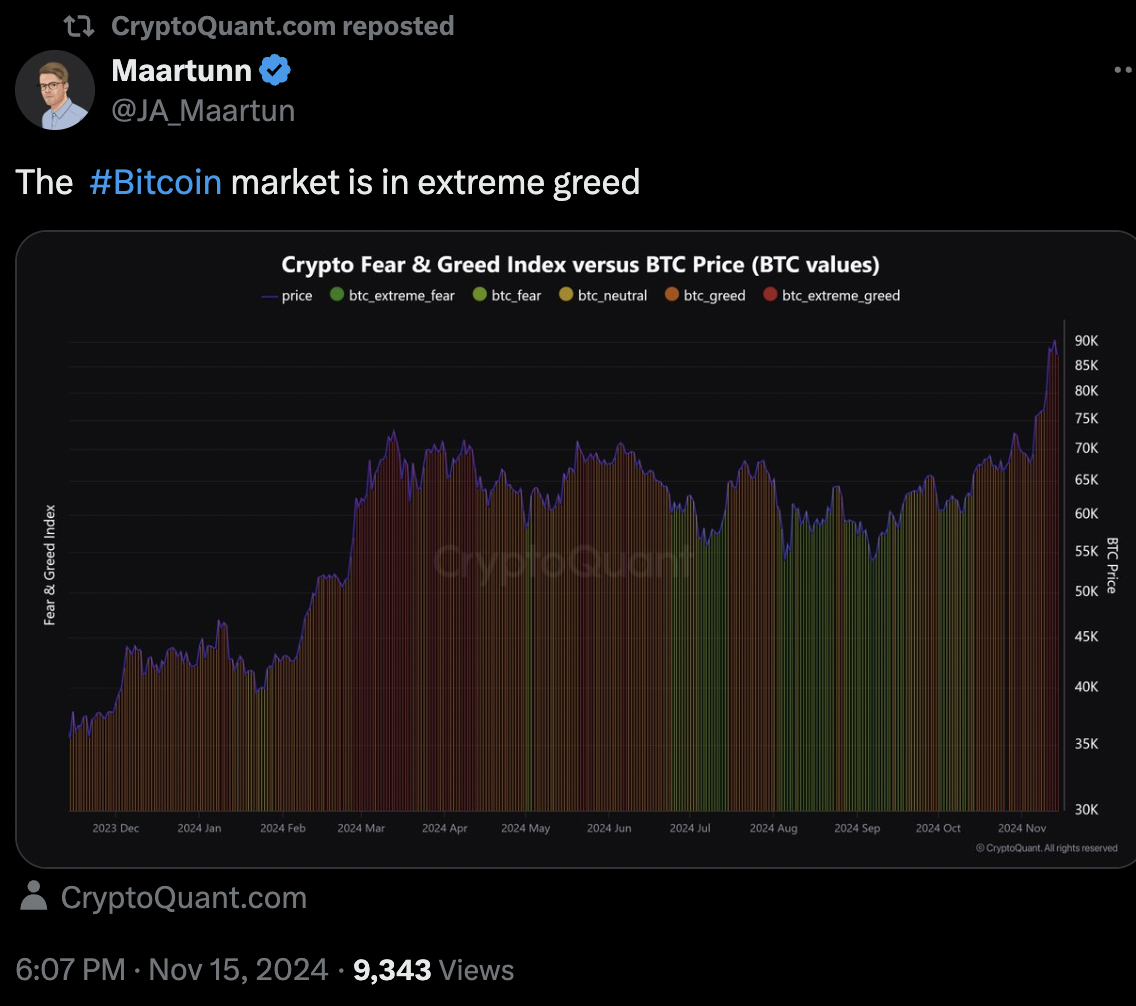

Bitcoin Market In Extreme Greed

Investors will want to proceed with caution especially as the Bitcoin market seems to be overheating in the long term. According to another CryptoQuant analyst, the Fear & Greed Index has flagged extreme greed for the premier cryptocurrency.

Typically, when the Fear & Greed Index moves toward one end, there is a potential for market reversal depending on the sentiment. In this case, where the market is in extreme greed, the Bitcoin price may be about to witness a correction.

As of this writing, the price of BTC sits just beneath $91,000, reflecting a 3% increase in the past day. According to CoinGecko data, the market leader is up by an impressive 19% in the last seven days.

Source link

Opeyemi Sule

https://www.newsbtc.com/news/bitcoin/bitcoin-nvt-golden-cross-signals-local-bottom-whats-next/

2024-11-16 15:00:03