In the latest edition of the Capriole Investments newsletter dated August 20, 2024, Charles Edwards, founder and CEO, draws striking parallels between the current market behavior of Bitcoin and the historical performance of Gold, particularly during its 2008 rally.

Bitcoin Mirrors 2008 Gold Rush

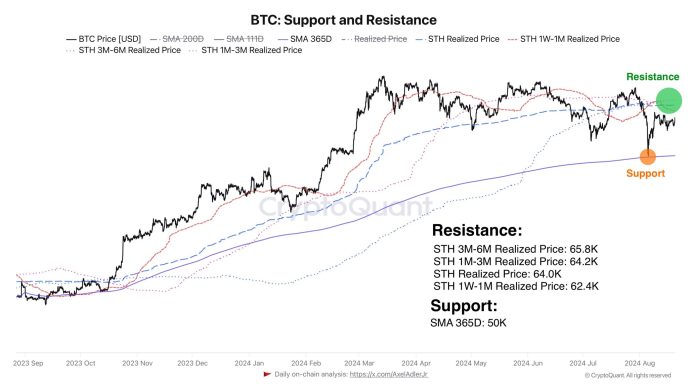

Edwards points out that Bitcoin has been consolidating around $60K, echoing the pattern Gold followed before its significant rally. “Bitcoin is under pressure, mirroring the longest period of consolidation at any ATH in its history,” Edwards notes, suggesting that this could be a precursor to a significant breakout. According to him, this pattern closely mirrors that of Gold in the late 2000s, when it consolidated for nine months around its 1980 ATH before launching a significant two-year rally in 2008.

Edwards elaborates on the technical similarities, noting, “Gold’s first significant consolidation post-ETF launch preceded a rally that saw its value climb by 180% in just over two years. Today, Bitcoin exhibits similar market behavior in the aftermath of its own ETF launches and consolidations.”

Related Reading

Edwards notes that during Gold’s consolidation phase in 2008, the asset underwent a -33% drawdown, eventually marking what many investors consider a generational bottom. Bitcoin’s recent dip to $48,000—a -33% crash—strikingly aligns with this aspect of Gold’s historical price action. “The July 2024 Bitcoin dip saw a -28% drop to $53K, and the more recent August 2024 dip mirrored Gold’s final plunge, falling a mere half a percent short,” Edwards states, highlighting the precision of these parallels.

Based on these historical parallels, Edwards predicts that Bitcoin price could be “ripping straight to $140K with no dips by around May 2025.” While he acknowledges that a single datapoint does not mean that gold’s history has to repeat for Bitcoin, he believes that it is “the most comparable asset at the most comparable time in its history.”

Related Reading

Despite the bullish signal from the historical and technical analysis, Edwards remains only cautiously optimistic. He acknowledges ongoing discrepancies in fundamental data signals and suggests a conservative stance until further bullish confirmations can be observed.

“We are still awaiting the Monthly close; the conservative position would be to await further bullish confirmations (and potentially Q4) to fully clear what is typically the most bearish period of each calendar year for Bitcoin and risk assets,” Edwards notes.

If Bitcoin can close above the monthly support, Edwards sees a “very attractive technical setup.” He concludes, “I believe this period of market consolidation is coming to a close as we exit summer, and I maintain strong conviction that the next 12 months will be the best time out of the last 3 years to be allocated to this asset class.”

At press time, BTC traded at $60,712.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/bitcoin-news/bitcoin-on-brink-of-massive-breakout-like-gold-in-2008-hedge-fund-ceo/

2024-08-20 20:00:38