Bitcoin (BTC) appears to be bouncing off its summer slumber, say analysts who believe the asset could rebound in the coming months. Recent technical indications and charts suggest that BTC could be on the cusp of a significant price move. The cryptocurrency is geared for a bounce that could take the asset far beyond $92,000, despite recent losses.

Related Reading

Short-Term Projection

Bitcoin’s immediate technical projection points to a possibly positive trend. Right now, Bitcoin is selling 39.27% below its projected price for next month, according to CoinCheckup. Still, an increase is seen in the coming week; short-term signs suggest a possible comeback.

With forecasts of a 70.68% gain, this momentum might open the path for significant price rise over the next three months. These short-term signs could point to a buying opportunity before a bigger rise starts.

Past Performance And Forecasts

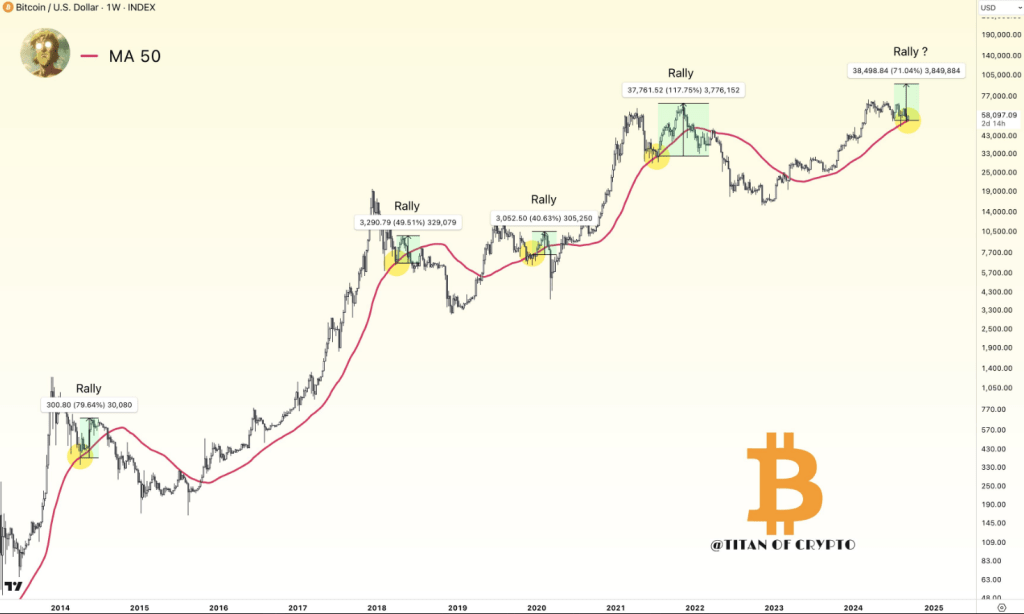

This price movement of Bitcoin coincides with trends that have been exhibited during past halving events. According to popular analyst Titan of Crypto, the current trend goes in line with most the previous trends, especially the post-halving periods that have been the source of various significant movements.

#Bitcoin Rally Imminent? 🚀

In previous cycles, when the price retested the 50-week simple moving average 🔴, it bounced at least 40%.

On average, the bounce was 71%. If #BTC rallies 71% from here, it could reach $92,000. pic.twitter.com/e3ghGxn3NS

— Titan of Crypto (@Washigorira) September 13, 2024

Titan underlined on the weekly chart a significant support level retest on September 13th, which historically has resulted in average price gains of 71%. According to his analysis based on historical data, Bitcoin might soon surpass the $92,000 mark, therefore attaining a new record for the currency.

For Bitcoin, it’s always been a challenging month because average returns come in at around -4.69%. But history would tell a different tale when the following months, especially October and November, go on to reflect considerable increases.

In October, Bitcoin has normally delivered average gains of 22.9%; in November, 46.8%.This trend supports the present projection of a possible comeback, therefore strengthening the belief that Bitcoin might bounce back rather powerfully in the next months.

Bitcoin Long-Term Outlook

In the long-run, the prospect of Bitcoin remains very promising. It will almost certainly rise upward with an estimation of 102% for the next six months and a chance to rise within the year by 166%. This would show intense market confidence in the future of the virtual currency and might even let Bitcoin continue outperforming at its current low.

Related Reading

The ability of the cryptocurrency to recover the $60,000 level lately shows a good change in market attitude, which prepares the ground for the possible price gains.

All things considered, historical patterns and present technical indications of Bitcoin point to a bright future. Although current losses and short-term difficulties create hazards, generally the pattern shows a big comeback and possible price surge.

Bitcoin is a good asset for both present and future benefits since investors who negotiate the short-term volatility could be well-positioned to profit from the expected long-term development. The chances for a strong comeback for Bitcoin seem more feasible as the market steadies and momentum gathers.

Featured image from Pexels, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/bitcoin-on-track-for-92000-bounce-in-3-months-analyst-predicts/

2024-09-16 13:30:30