Bitcoin’s price has yet to reach a new all-time high amid the recent bullish run, as the sellers are defending their last line of resistance.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, the asset has recently rallied above the $64K level and the 200-day moving average, located around the same area. This uptrend has significantly boosted the probability of Bitcoin creating a new all-time high soon.

Yet, the sellers have defended the $69K resistance level well, as the price is getting rejected to the downside. A retest of the 200-day moving average is possible if a significant pullback occurs.

The 4-Hour Chart

The 4-hour chart indicates a clear bearish signal based on price action and momentum analysis. The market has recently created a rising wedge at the key $69K resistance zone. Yet, the RSI has displayed a clear bearish divergence with the recent price highs.

This has led to a breakdown of the pattern, which is a classic bearish reversal signal. The RSI also shows values below 50%, which shows that momentum is bearish in the 4-hour timeframe. Yet, there’s still a high probability that this move is just a temporary correction, as the overall market structure remains bullish.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

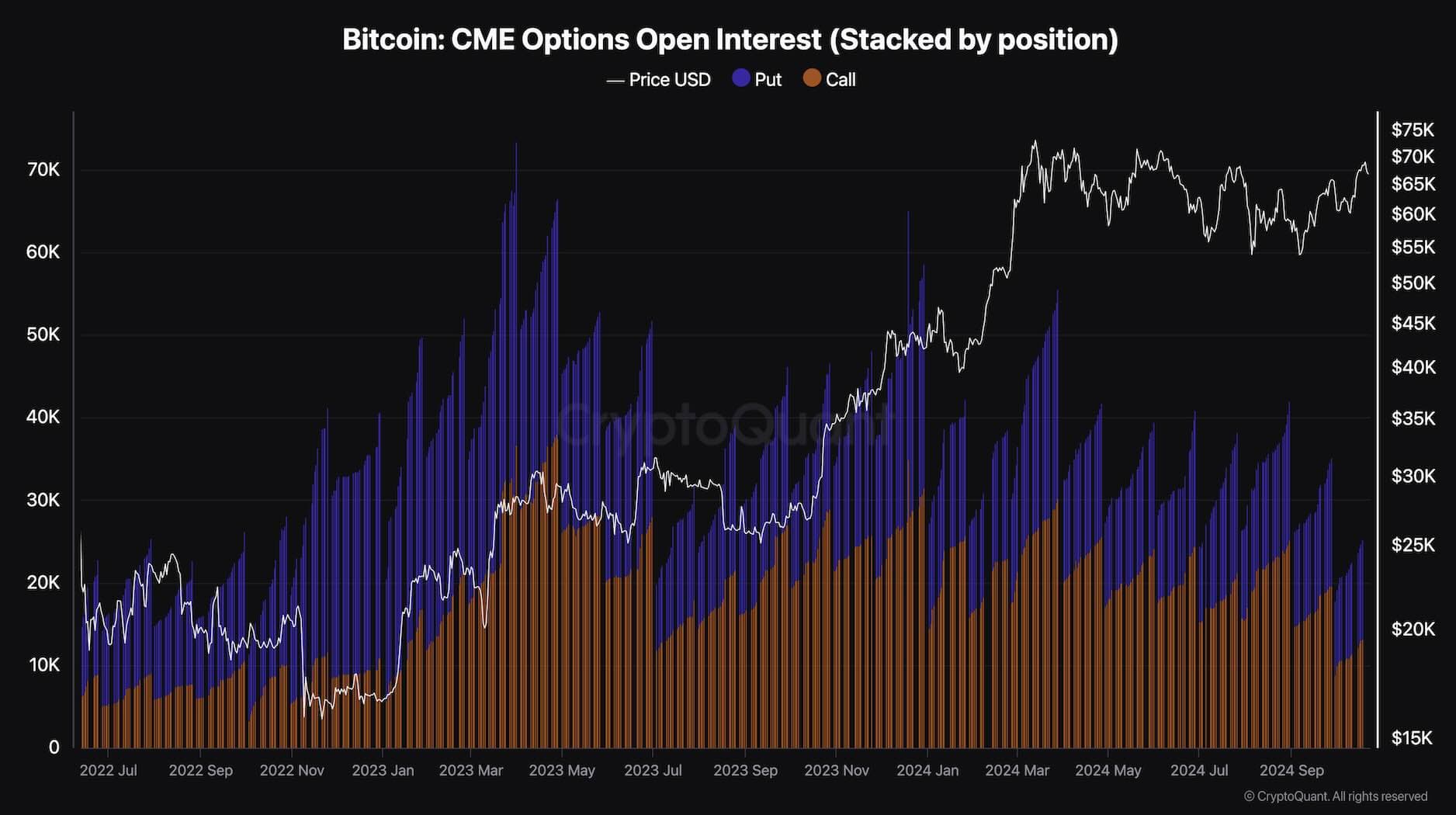

Bitcoin CME Options Open Interest (Stacked)

Amid Bitcoin’s recent price rise, investors are becoming increasingly optimistic that a new record high and long-term rally will soon occur. Yet, there is a slight chance that this optimism might lead to the market’s downfall.

This chart demonstrates the Bitcoin CME Options Open Interest (Stacked), which measures the number of open options positions, both calls and puts. Evidently, there’s a notable decrease in aggregate options open interest (OI) compared to the levels seen earlier in the bull market and near the market bottom, where both calls and puts were more heavily stacked.

This reduction in OI suggests that investors are experiencing less uncertainty about Bitcoin’s price movements, leading them to take on more directional positions with less need for hedging through options. At the same time, the increasing open interest in CME futures indicates that investors are becoming more confident in the trend, willing to take more leveraged positions and assume more significant risks. Needless to say, leverage is a two-edged sword.

The post Bitcoin Price Analysis: What Are BTC’s Chances for New ATH After the Rejection at $69K? appeared first on CryptoPotato.

Source link

CryptoVizArt

https://cryptopotato.com/bitcoin-price-analysis-what-are-btcs-chances-for-new-ath-after-the-rejection-at-69k/

2024-10-22 10:34:09