Bitcoin (BTC) is showing signs of a potential breakout, with recent price action indicating positive momentum.

As broader market conditions cool down, BTC has remained steady, with consistent investor behavior fueling hopes of further gains. The altcoin is poised for possible growth as it continues to attract investors’ attention.

Bitcoin Has The Support Of Key Holders

The Long/Short Term Holder Supply Ratio has shown notable growth since the end of February, signaling a positive shift in investor behavior. Long-Term Holders (LTHs) are in steady accumulation, with the 30-day accumulation rate now nearing 6%. The rate of this change has also increased, averaging 7% daily since late February.

This sustained accumulation suggests that LTHs have a strong belief in Bitcoin’s future potential, which could help BTC maintain its recent growth. LTHs are often seen as a stabilizing force in the market, and their consistent accumulation could act as a foundation for the ongoing uptrend in Bitcoin’s price.

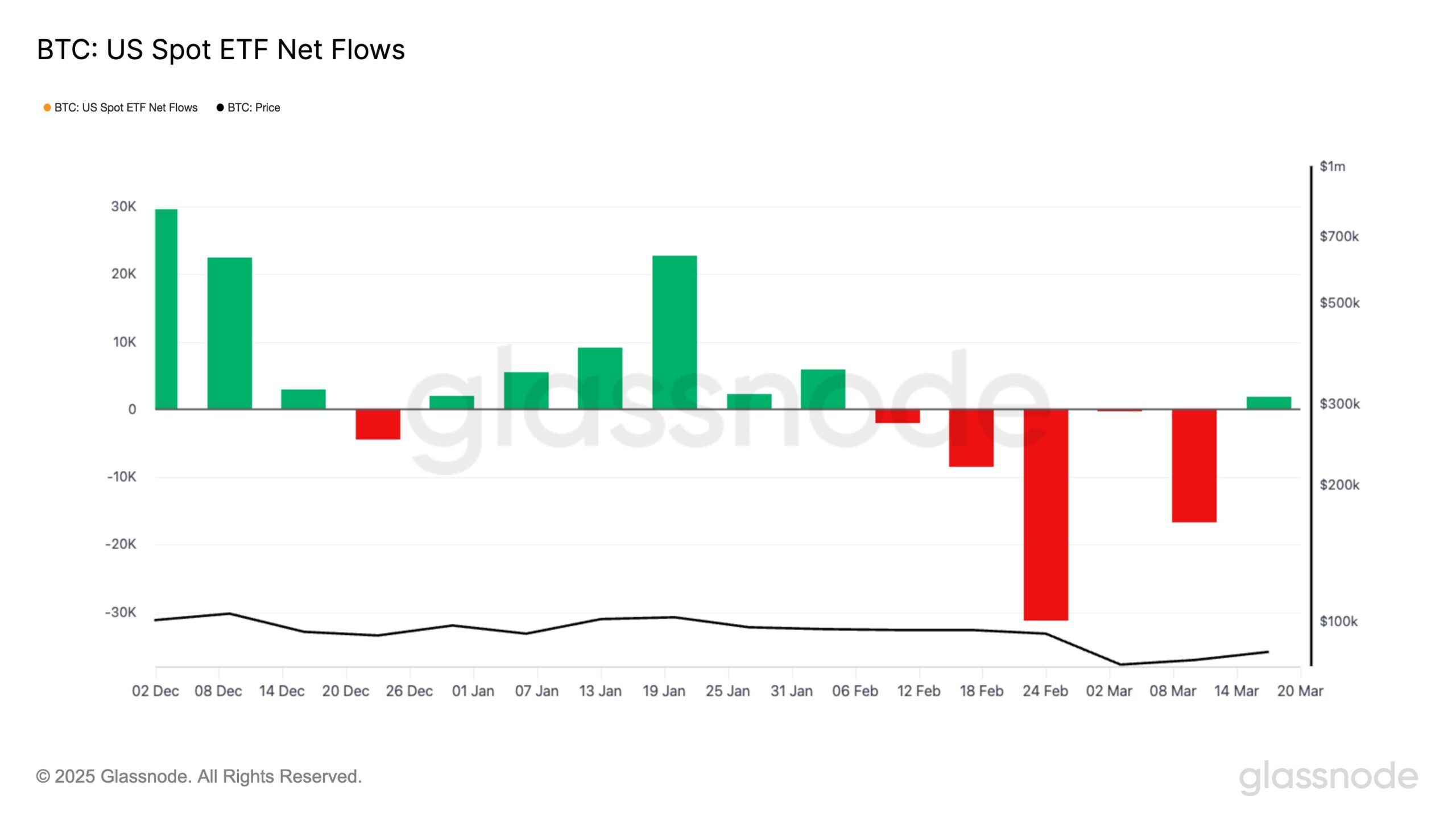

Bitcoin has also seen a positive shift in macro momentum, particularly with the recent inflows into Bitcoin Spot ETFs. Last week marked the first ETF inflows in a month, breaking a four-week streak of outflows. This change signals returning confidence among investors, particularly macrofinancial investors. The renewed interest in BTC ETFs reflects the growing demand for Bitcoin exposure in institutional portfolios.

The inflows indicate that larger investors are once again viewing Bitcoin as a valuable asset. This could be a strong signal that demand for Bitcoin is recovering, which may help propel the price further. The involvement of institutional investors could drive significant price appreciation in the coming weeks.

BTC Price Rise Is Consistent

Bitcoin is currently trading at $86,630, breaking out of a descending wedge pattern. The price is attempting to secure $86,822 as support, which will be crucial for BTC’s next move. If the support holds, Bitcoin may continue its upward trajectory towards the $89,800 resistance level.

The confirmation of the breakout will come when Bitcoin successfully flips the $89,800 resistance into support. A sustained move above this level could push the price further toward $93,625 and potentially $95,000.

However, if Bitcoin fails to breach $89,800, it could struggle to maintain its current momentum. A consolidation below this level or a drop to $85,000 would delay the recovery, shifting the market sentiment toward caution. This would halt the progress and potentially lead to a longer consolidation phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-price-breaks-bullish-pattern-as-spot-etf-inflows-rise/

2025-03-25 05:30:00