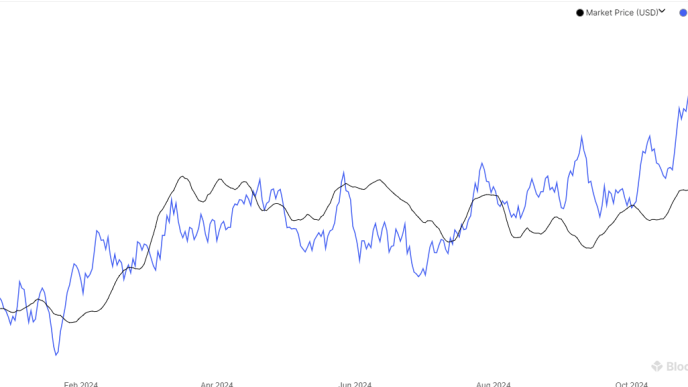

The Bitcoin price recently closed above the median in a bull channel, providing a bullish outlook for the flagship crypto. In line with this, crypto analyst Tony Severino provided insights into what could come next for Bitcoin.

What Next For Price After Close Above Bull Channel

In an X post, Tony Severino mentioned that the Bitcoin price is now retesting the median in the bull channel, with an evening star pattern forming on the chart, which hints at a potential reversal. He noted that Bitcoin is fighting to stay above the $96,000 range, which could invalidate this sell signal.

Related Reading

However, if Bitcoin closes below this median range, Tony Severino warns that the price could record a significant downtrend to the $90,000 range. If this median range holds, the crypto analyst expects Bitcoin to break into the upper channel above the $100,000 level.

Tony Severino revealed that the target for this uptrend channel is $267,000. However, he doesn’t think the Bitcoin price will reach that level in this bull run. Instead, the crypto analyst predicts that Bitcoin could peak between $160,000 and $190,000, although Severino is more confident about the former being the market top.

The crypto analyst added that the golden ratio is in the $160,000 range, which makes this target more feasible. He also raised the possibility of the Bitcoin price eventually rallying to $169,000 as it peaks in this range. Amid this analysis, it is worth mentioning that Bitcoin is currently at risk of dropping to this $90,000, having failed to hold the median at the $96,000 range.

The $94,000 Range Is Another Level To Watch

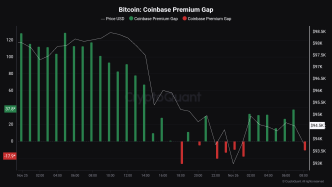

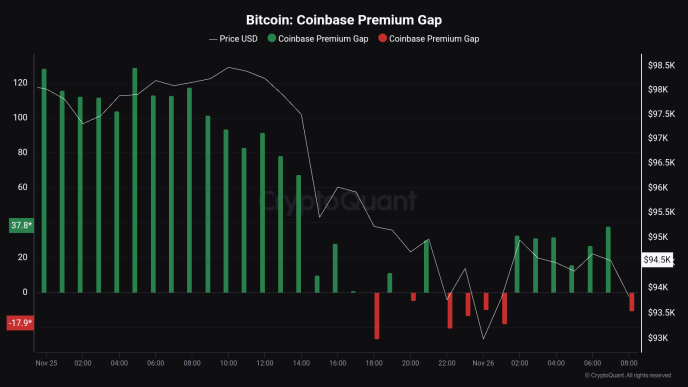

Crypto analyst CrediBULL Crypto recently suggested that the $94,000 range is another level to watch for the Bitcoin price. According to him, this is the key level that matters. He claimed that BTC is bullish on all timeframes as long as the flagship crypto stays above this level. However, if Bitcoin loses this level, it could lead to a significant downtrend.

Related Reading

CrediBULL Crypto stated that a break below $94,000 will indicate a momentum shift and a potential larger correction that could cause Bitcoin price to drop to the low $80,000 range. The positive is that investors still look heavily bullish on Bitcoin’s trajectory despite a potential price correction on the horizon.

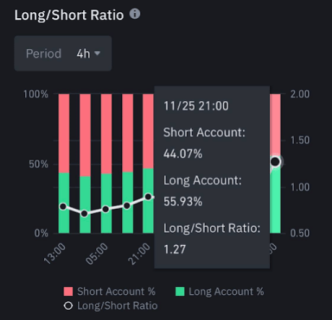

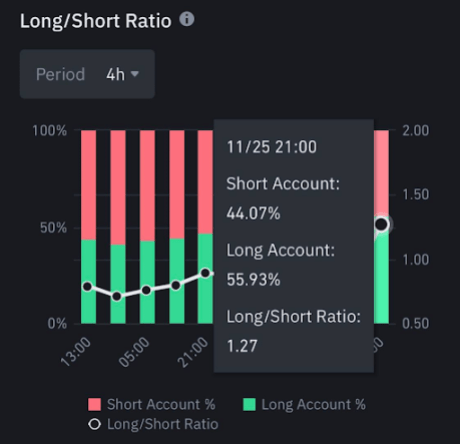

In an X post, crypto analyst Ali Martinez mentioned that investors are buying the dip. This came as he revealed that the percentage of all traders with long Bitcoin positions has increased from 45.36% to 55.93%.

At the time of writing, the Bitcoin price is trading at around $94,800, down over 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-price-bull-channel/

2024-11-26 16:30:40