The price of Bitcoin fell to around $92,000, Friday afternoon, December 20 after the US Federal Reserve’s rate cut triggered a sharp selloff in the crypto market. However, the premier cryptocurrency seems to be recovering nicely, having returned above the $97,000 level on the same day.

While investors would be hoping to see the Bitcoin price reclaim its current all-time high of $108,135 again, a prominent crypto analyst has put forward an audacious target for the market leader. Below is the rationale behind the new bullish target for the Bitcoin price.

Can Bitcoin Price Repeat This 86% Rally?

In a new post on the X platform, NewsBTC head of research Tony “The Bull” Severino shared an interesting prognosis for the price of Bitcoin. According to the CMT-certified crypto analyst, the flagship cryptocurrency looks primed to reach as high as $178,000.

Related Reading

This bullish projection is based on the Bitcoin price movement in relation to the Bollinger Bands. The Bollinger Bands is an indicator that features three lines; a simple moving average (the middle band) and an upper and lower band. This technical analysis tool helps to assess the volatility of financial markets.

According to Severino, the price of BTC on the daily timeframe has retested the monthly upper Bollinger Band. From a historical perspective, this action has marked the start of significant price rallies in the past.

Most recently, a similar retest occurred in late January 2024 and was followed by an 86% price rally to the former all-time high of $73,737. Severino noted that if history repeats itself the Bitcoin price could also see an identical 86% rally from its current price point to reach a new record high of $178,000.

As of this writing, the price of Bitcoin stands at around $97,265, reflecting a 0.8% increase in the past 24 hours. Nevertheless, the premier cryptocurrency is still in a 4% decline on the weekly timeframe.

Here’s What Needs To Happen First

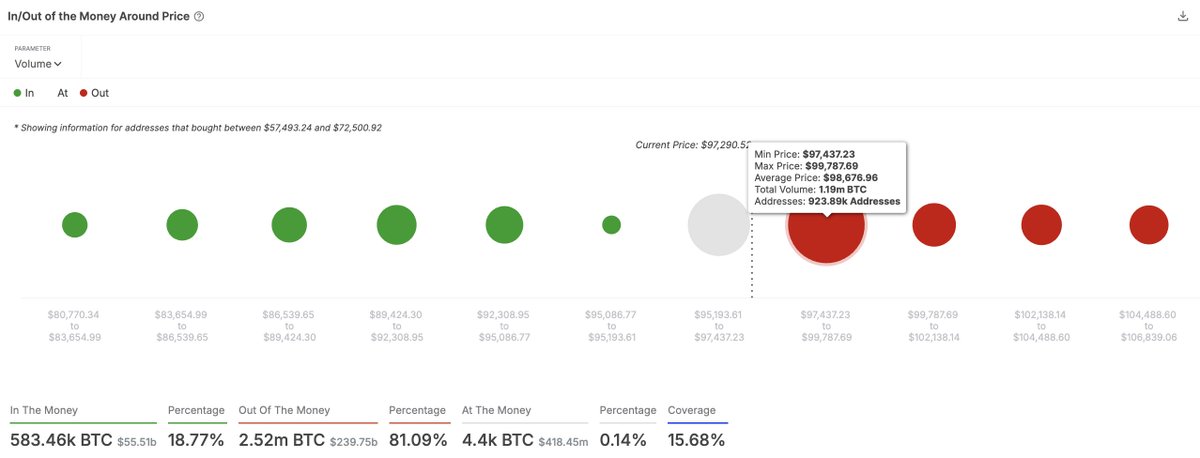

Indeed, the $178,000 target might not be all that outrageous for the Bitcoin price, especially given its performance in recent months. However, the latest on-chain data shows that the market leader needs to overcome a major resistance around $97,500 and $99,800.

Related Reading

According to crypto pundit Ali Martinez on X, over 924,000 addresses bought over 1.19 million BTC within the aforementioned price bracket. This becomes a resistance as buyers within the price range might look to sell their assets to break even after being in loss; this puts downward pressure on prices.

Martinez, however, noted that if the price of BTC manages to successfully breach this level, investors might see the premier cryptocurrency return to its all-time high price and perhaps forge a new one.

Featured image created by DALL-E, chart from TradingView

Source link

Opeyemi Sule

https://www.newsbtc.com/news/bitcoin/bitcoin-price-could-rally-to-178000-if-history-repeats-heres-why/

2024-12-21 12:30:01