Bitcoin’s price has recently experienced a notable decline, crashing below $90,000 after slipping through critical support levels. The drop came as BTC struggled to maintain momentum, straying farther from the $100,000 mark.

The ongoing downtrend may be influenced by the behavior of short-term holders (STHs), who appear to be changing their stance as the market shifts.

Bitcoin Investors Fear Losses

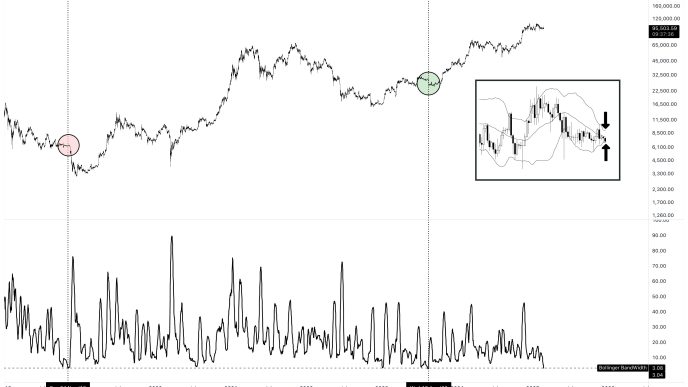

The short-term holder (STH) Spent Output Profit Ratio (SOPR) indicator is struggling to reclaim the bullish threshold of 1.0. While staying above this level suggests that STHs are profitable and willing to hold, the indicator’s failure to do so may signal an increase in sell pressure. If the SOPR remains below 1.0, more STHs are likely to sell, potentially leading to further losses for Bitcoin investors.

The current situation is concerning, as STHs are known for their quick trading behavior. When they start to sell in large volumes, Bitcoin’s price can drop quickly. The inability of the SOPR to stay above the critical threshold indicates that bearish sentiment may increase, which could bring Bitcoin’s price below $90,000, prolonging the market downturn.

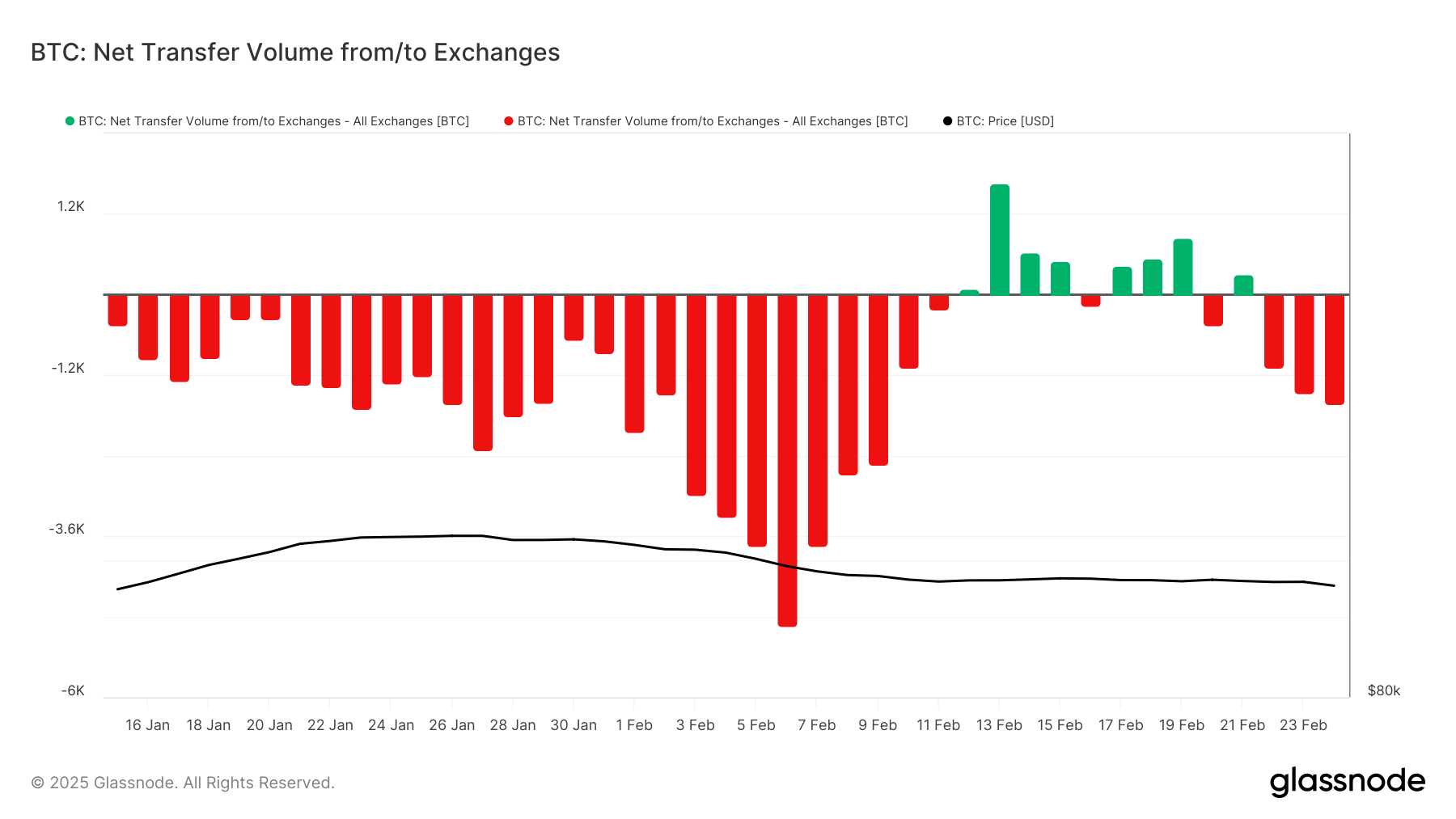

Despite the heavy crash Bitcoin has endured in the past 24 hours, exchange netflows show that there hasn’t been a significant amount of BTC leaving exchanges. Over the past 24 hours, exchanges saw only 157 BTC worth $14 million in outflows. This minor outflow is not aligned with the expected fear-driven sell-off that would typically occur after such a drastic drop.

The relative lack of large withdrawals suggests that short-term holders (STHs) may be hesitating to sell despite the recent downturn. This could indicate that many investors are holding on, waiting for a potential reversal. Without a massive wave of sell-offs, Bitcoin may find a path to recovery as market conditions improve.

BTC Price Continues To Fall

Bitcoin’s price currently stands at $88,449, the lowest it has been since November 2024, after experiencing a nearly 8% drop in the last 24 hours. The crash caused Bitcoin to lose its downtrend line support, which had been intact for over a month. If Bitcoin’s price can maintain above its next major support at $87,041, it could stage a bounce back.

Bitcoin’s price is expected to test the support level at $87,041 before attempting a recovery. If the support holds, it would give Bitcoin the opportunity to breach the next resistance at $89,800, eventually continuing its journey toward $92,005. These potential moves could signal a reversal and trigger a positive trend.

However, if Bitcoin loses the $87,041 support level, the sell-off could intensify, and Bitcoin might fall to $85,000. Such a drop would invalidate the current bullish recovery outlook, resulting in a prolonged downtrend and further losses for investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoins-price-crash-continues-amid-market-downturn/

2025-02-25 08:03:40