The Bitcoin price is well on its way to reaching the $100,000 price mark, with multiple projections saying it could do so by this weekend. Notably, the Bitcoin price reached an intraday high of $99,486 in the past 24 hours, putting it by about only 0.5% from reaching $100,000.

As the entire industry continues to await the Bitcoin price break above $100,000, crypto analyst Tony “The Bull” Severino has highlighted an interesting outlook for what to expect from here.

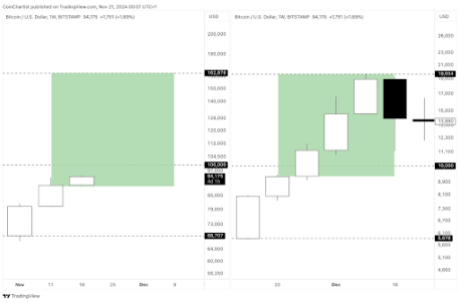

Bitcoin Price Mirrors 2017 Pattern

Crypto analyst Tony Severino drew parallels of Bitcoin’s recent price movements to its 2017 surge. The Bitcoin price first broke before the round figure mark of $10,000 in the last week of November 2017. Now seven years later, it is exhibiting similar price movements as it looks to break above the next round figure mark of $100,000.

Related Reading

Bitcoin’s break above the $10,000 level was a pivotal moment in its price history, as it marked a break above a key psychological threshold. Severino pointed out that after reaching this psychological milestone, the Bitcoin price nearly doubled in value within two weeks.

Severino used the outcome of this move to draw parallels with the current performance of the Bitcoin price. This time, however, the stakes are higher, with Bitcoin now about to break above the $100,000 mark. Particularly, this is a figure that carries even greater psychological significance in the outlook of the Bitcoin price than the $10,000 mark.

Could Breaching $100,000 Cause Another Excitement?

Severino’s analysis centers around the idea that breaking $100,000 could cause another sharp Bitcoin price increase, much like what happened after it crossed $10,000 in 2017. He noted that the Bitcoin price could see gains of up to 100% from its current price, but the pace of the rally may happen extremely fast.

Related Reading

This rapid ascent could mark the final leg of this bull run that will create a peak followed by a significant correction, much like how the 2017 bull cycle played out. “The top is near,” Severino cautioned. However, he doesn’t believe Bitcoin’s peak is just two weeks away; he suggested it could be as close to around two months.

It is important to note that the Bitcoin ecosystem has changed massively since it first broke above $10,000 in 2017. At that time, the rally was driven largely by retail investors and Bitcoin whales who got in relatively early. The current landscape includes a growing institutional interest in Bitcoin, especially through Spot Bitcoin ETFs. This institutional interest has been key to the steady growth of the Bitcoin price throughout this year, and current market dynamics point to such continued growth.

At the time of writing, Bitcoin is trading at $99,032, up by 2% in the past 24 hours.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-price-mirrors-2017-100000/

2024-11-22 21:30:36