Bitcoin may be heading for a challenging September, according to a new report, which points to seasonal trends, exhaustion signals, and macroeconomic factors as indicators of potential weakness for the world’s largest cryptocurrency in the coming month.

“We are entering a seasonally weak period in September for risk assets broadly. A correction usually impacts the most volatile assets the hardest, albeit temporarily,” technical analysis firm Fairlead Strategies said in its weekly report.

The analysis identifies several technical indicators suggesting Bitcoin (BTC) might face downward pressure. One key factor is the appearance of short-term exhaustion signals.

“There are now minor signs of upside exhaustion per the DeMARK Indicators, and once the daily stochastics turn below 80%, it would increase risk that support (~$56,500) is retested,” the report notes.

The DeMARK Indicator is a proprietary tool used to identify potential market reversals, while stochastics measure momentum by comparing closing prices to price ranges over time. Adding to the bearish outlook, Fairlead expects anemic mid-term momentum for Bitcoin.

“Intermediate-term momentum is weak, and a monthly counter-trend signal from the DeMARK Indicators supports another two months of corrective price action,” the report explains.

This suggests the potential for continued downward or sideways movement in Bitcoin’s price beyond just September. The firm also points to broader market conditions that could impact Bitcoin’s performance. Notably, the report mentions potential strength in the U.S. dollar as a headwind.

“The Dollar Index, which tends to hold a slight negative correlation with Bitcoin, looks primed for a near-term rebound,” the analysis states. Typically, a stronger dollar correlates with weaker Bitcoin prices.

Despite these short-term concerns, Fairlead Strategies maintains a long-term bullish stance on Bitcoin. The report identifies key price levels to watch, including “trendline resistance near $70,000.” As of this writing, Bitcoin is trading at $62,145, down just over 2% in the last day.

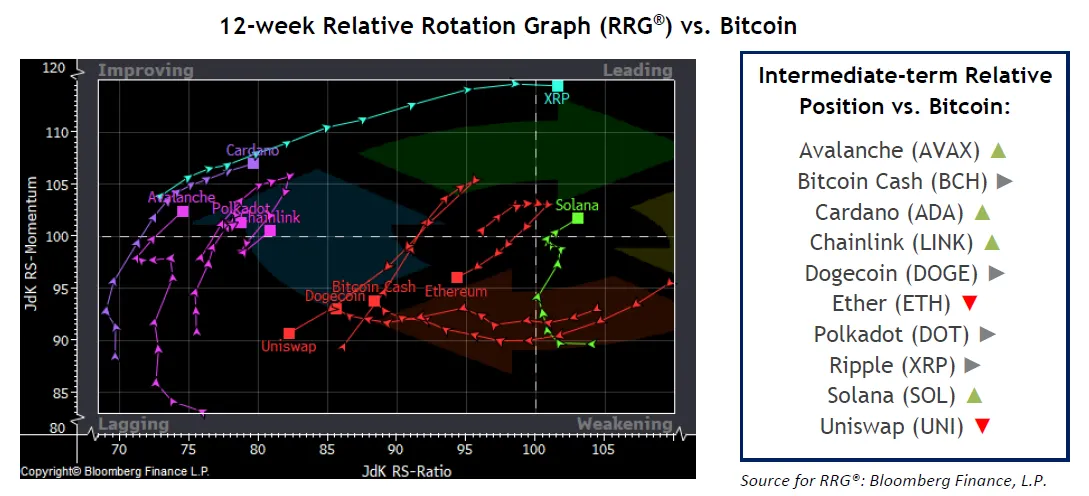

The report also looks at how other popular cryptocurrencies are performing compared to Bitcoin.

A 12 week-chart called the Relative Rotation Graph (RRG) shows improvement for Avalanche (AVAX), Chainlink (LINK), and Solana (SOL). This means that over the past few months, these three cryptocurrencies have been gaining strength and might perform better than Bitcoin in the near future.

However, not all cryptocurrencies are showing positive signs, with the report noting that Ethereum (ETH) and Uniswap (UNI) “remain least favorably positioned, pointing down and to the left.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Murtuza Merchant

https://decrypt.co/246584/bitcoin-price-poised-weak-september-analysts

2024-08-27 14:33:22