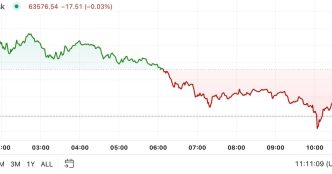

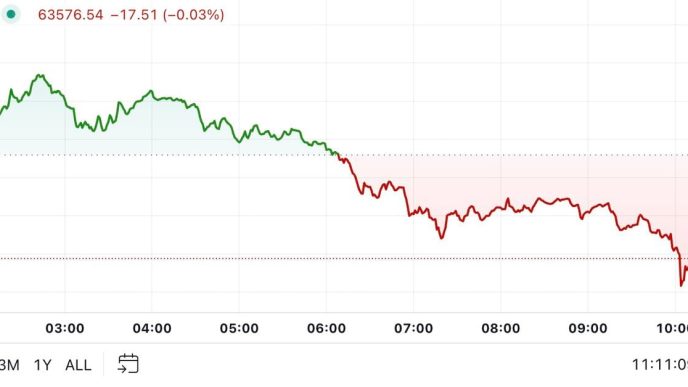

Bitcoin (BTC) continues to wrestle with the $64,000 threshold on Wednesday, trading up 0.3% at $63,850, while market experts point to increasingly bullish sentiment and potential catalysts for further growth.

Despite the cryptocurrency’s short-term struggle to break decisively above this level, analysts have noted several positive indicators that could fuel Bitcoin’s next leg up.

Ethereum, meanwhile, is down 1%, trading at $2,625, according to data from CoinGecko.

U.S. spot Bitcoin ETFs continue to show strength, marking their fourth consecutive day of net inflows. On September 24, these ETFs saw a total net inflow of $136 million, with BlackRock’s iShares Bitcoin Trust (IBIT) leading the pack with $98.8 million in deposits. Ethereum spot ETFs also performed well, with a total net inflow of $62.5 million, primarily driven by BlackRock’s ETHA at $59.2 million, according to data from SoSo Value.

In a note sent to Decrypt, Geoffrey Kendrick, Global Head of Digital Assets Research at Standard Chartered, said last week’s FOMC decision and the steepening of the U.S. Treasury yield curve have supported Bitcoin, referencing the yield curve spread now at +21 basis points.

The yield curve spread at +21 basis points means the 10-year U.S. Treasury bond yields 0.21% more than the 2-year bond, he wrote. A steeper curve signals optimism about future economic growth, which can support higher Bitcoin prices.

“This rapid pace of accumulation suggests more than just higher prices—there’s a belief that broader market conditions are favoring Bitcoin, especially after VP Harris’ comments encouraging the crypto industry,” Kendrick said.

According to AltIndex, sentiment around Bitcoin has surged to 83 on a scale of 0 to 100, marking a significant shift in market optimism. After weeks of neutral sentiment, the positive outlook has given rise to speculation that Bitcoin could soon break through its current resistance.

“Google search trends for Bitcoin are starting to climb, hinting at growing interest in the cryptocurrency. This uptick in searches could be an early sign of a new bull cycle,” the noted.

Speaking with Decrypt, Avinash Shekhar, Co-founder and CEO of Pi42, a crypto derivatives firm in India, said Bitcoin needs market momentum to break through the $65,000 barrier. He added that while Ethereum is also showing bullish trajectories, traders and investors fear a chance of a bearish dip to $2,500.

“China’s announcement of rate cuts also fueling bullish momentum in the crypto market,” he said, cautioning that bullish market indicate the possibility of more gains, but obstacles include resistance levels and a slowing market.

“Investors are optimistic for market growth targeting $65,000 for BTC, $2,700 for ETH, and $650 for BNB. This bullish trend and growth can attract new investors or traders,” he added.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Murtuza Merchant

https://decrypt.co/251133/bitcoin-price-market-hesitation-standard-chartered

2024-09-25 10:25:02