In a nuanced shift in cryptocurrency markets, Bitcoin (BTC) appears to be entering a stabilization phase with indicators suggesting traders are moving into an accumulation period.

Analysts are noting the tepidly good news despite price fluctuations that have seen the leading cryptocurrency trading at $66,300, down 0.7%, but maintaining a 7% gain over the past two weeks.

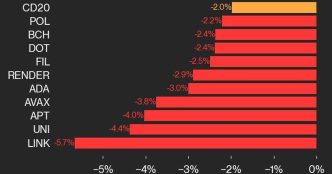

Ethereum, meanwhile, is down 2% at $2,570, though it too has seen a rise of 5.5% over the last two weeks, according to data from CoinGecko.

Market analysts point to several key factors supporting this stabilization thesis. The $1.7 billion reduction in Circle’s USDC has been more than offset by significant liquidity indicators, including substantial stablecoin inflows totaling $38 billion this year—notably surpassing the $21 billion that has flowed into Bitcoin Spot ETFs.

According to 10x Research, the market is absorbing a number of factors before potentially resuming an upward trajectory. “Instead of turning overly pessimistic, we believe the market needs time to digest the higher bond yields before Bitcoin can resume its upward movement,” said 10x Research in a note to Decrypt.

They emphasized that while funding rates for Bitcoin and Ethereum have risen to 10%, spot prices have lagged, and retail participation remains subdued. “We’d like to see multiple indicators aligning to confirm bullish momentum, but this isn’t a significant concern. The market likely just needs a few days to absorb these factors.”

Adding to this, total stablecoin inflows have been a key driver of liquidity this year. “With $36 billion in stablecoin inflows since the Bitcoin Spot ETF launch, liquidity remains robust,” noted 10x Research, highlighting that these inflows continue to provide upward pressure on Bitcoin’s price.

Valentin Fournier, an analyst at BRN, also pointed to institutional activity as a key indicator.

“After a streak of seven consecutive days of ETF inflows totaling over $2 billion, Bitcoin’s ETF inflows have taken a temporary pause,” Fournier explained. “While this indicates a minor dip in institutional demand, we’re still seeing accumulation at the current price level, which suggests a potential uptrend once the market consolidates.”

Fournier also noted that while Bitcoin has retreated to $67,000 after being rejected at the $70,000 resistance level, this softer rejection suggests traders are accumulating in preparation for a bullish breakout. “The upcoming U.S. presidential election, potential interest rate cuts, and global stimulus efforts could drive cryptocurrencies to new highs in the weeks ahead,” he added.

However, Alex Kuptsikevich, senior market analyst at FxPro, urged caution as Bitcoin hovers near a key support level. “Bitcoin is close to a local support level at $66,800. A break below this support could open the way for a deeper correction toward $65,500,” Kuptsikevich said.

Despite the recent pullback, he emphasized Bitcoin’s dominance in the market, noting that BTC’s share of cryptocurrency market capitalization has risen to 57.3%, the highest since April 2021.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Murtuza Merchant

https://decrypt.co/287869/bitcoin-price-stabilize-accumulation-period

2024-10-23 13:02:39