Bitcoin’s recent price action has been marked by a struggle to sustain the bullish momentum needed to push BTC higher.

Despite traders calling for a sharp rally to $110,000, the market appears hesitant, suggesting that a significant uptick might still be some time away.

Bitcoin Traders Are Optimistic

Traders remain optimistic about Bitcoin hitting $110,000, with data from Santiment highlighting a spike in social dominance around this target. However, historical trends suggest BTC typically rises after mentions of such price milestones begin to decline. This pattern indicates that while a rally is possible, it may take several days to materialize.

The elevated social dominance reflects the market’s eagerness for another rally, but excessive hype often precedes a period of stagnation. For Bitcoin to sustain upward momentum, market sentiment needs to stabilize, allowing organic growth rather than speculative pressure to drive the price higher.

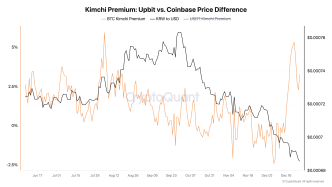

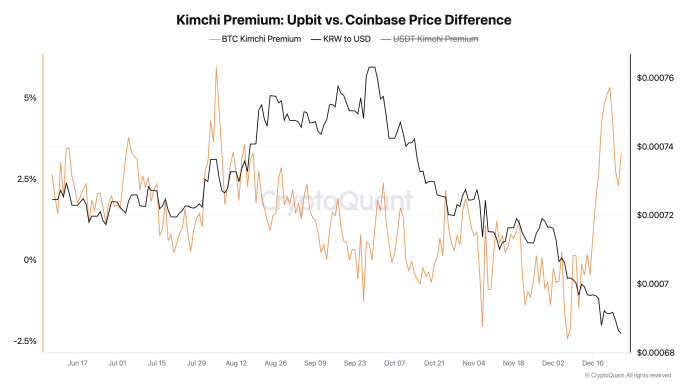

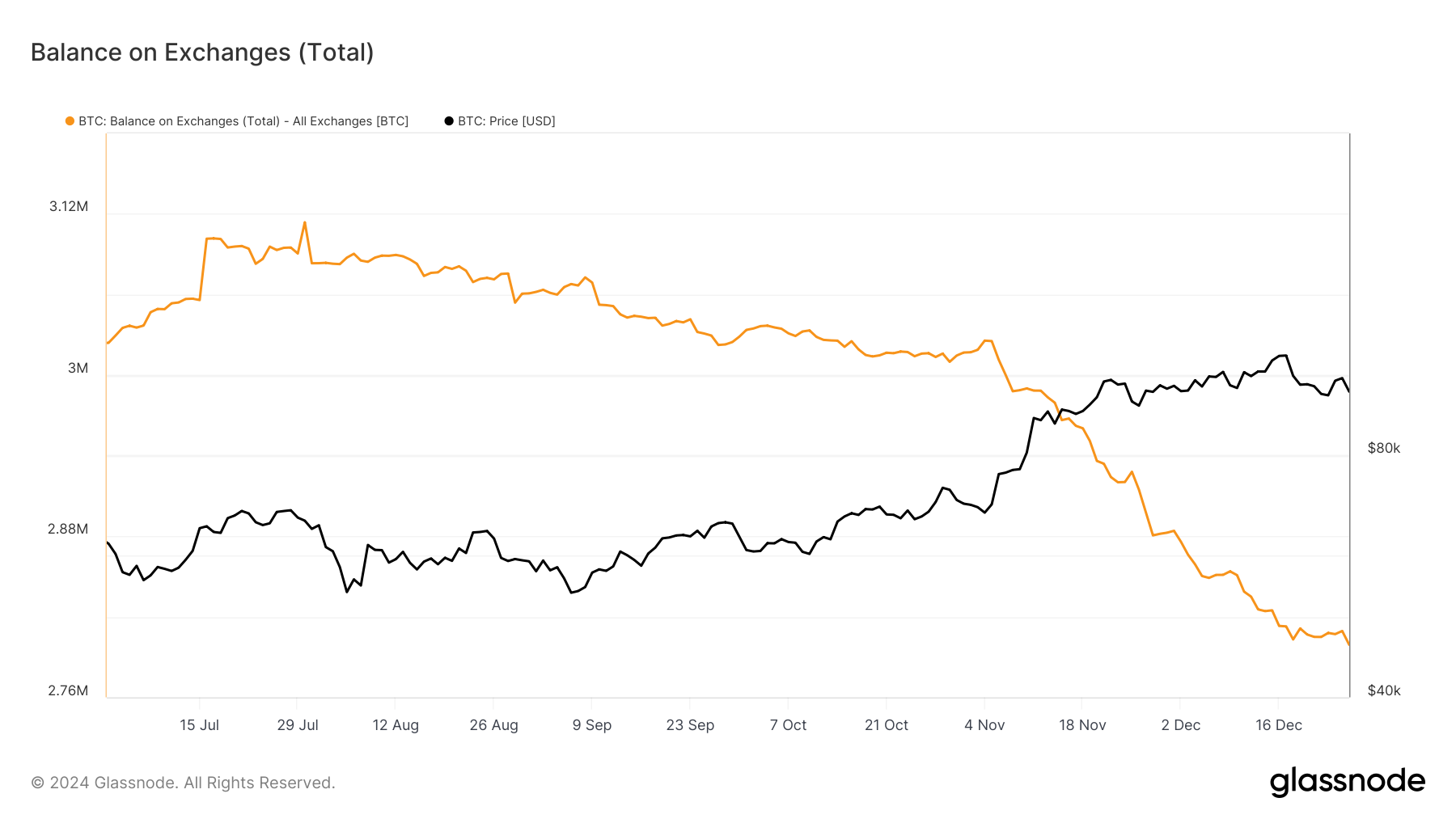

Bitcoin’s macro momentum is showing signs of hesitation. Exchange balances reveal that accumulation has slowed over the past nine days, with investors displaying skepticism about BTC’s short-term prospects. This pause in accumulation suggests uncertainty, with many participants waiting for clearer market signals.

If Bitcoin’s price begins to rise, it could reignite interest among sidelined investors, potentially resuming the accumulation trend. For now, the lack of significant buying activity is contributing to the consolidation phase, keeping BTC from breaking out of its current range.

BTC Price Prediction: Looking Forward To A Rise

Bitcoin is currently 13.5% away from the $110,000 milestone, a level that sits above its all-time high (ATH) of $108,384. While traders are optimistic, broader market signals remain mixed, creating uncertainty about whether BTC can sustain the momentum needed for a significant rally.

A rally could become likely if Bitcoin manages to flip $105,000 into a solid support level. To achieve this, BTC must escape its current consolidation phase and break above $100,000, a key psychological resistance point. Such a move would likely attract renewed buying interest.

Conversely, if investors grow impatient and choose to book profits, Bitcoin could lose its $95,668 support level. A drop below this threshold could push BTC toward $89,800, invalidating the bullish thesis and leaving the cryptocurrency vulnerable to further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-price-rise-likely-delayed/

2024-12-27 12:00:00