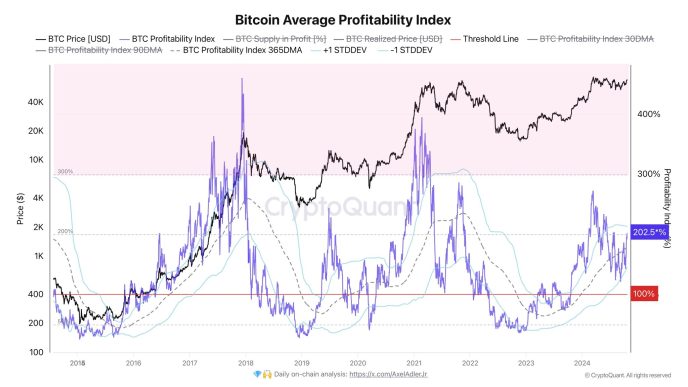

As Bitcoin experiences a gradual recovery in its price performance, a new analysis sheds light on the cryptocurrency’s broader market stance.

A CryptoQuant analyst known as “Crazzyblockk” recently shared an in-depth study on Bitcoin’s quarterly performance, focusing on key metrics like the asset’s market capitalization and realized capitalization.

According to the analyst, examining these metrics every quarter can offer valuable insights into long-term trends and potential future price movements.

Related Reading

Current Market Signals Resemble 2021 Boom

The analysis highlights how fluctuations in Bitcoin’s market cap and realized cap signal bullish and bearish trends over time. Market cap refers to the total value of all BTC in circulation, while realized cap measures the value based on the price at which each Bitcoin last moved.

Historically, when the market cap grows faster than the realized cap, it often signals the beginning of selling pressure, leading to bear markets. Conversely, when the market cap declines while the realized cap holds steady or rises, Bitcoin tends to find its price bottom, indicating potential buying opportunities.

Crazzyblockk’s analysis parallels Bitcoin’s current market situation and behavior during the 2021 boom. During that period, rapid market cap growth led to significant selling pressure, eventually correcting prices.

According to the analyst, Bitcoin is currently in a similar position. While the market cap has seen a notable increase, the realized cap continues to rise, indicating the possibility of another major price correction on the horizon.

The analyst’s study also points out that sustained growth in the realized cap, without corresponding support from the market cap, tends to trigger corrections as investors realize their profits.

This phenomenon is particularly relevant in the current market environment, where Bitcoin’s price has surged in recent months but faces challenges in maintaining its upward trajectory. Crazzyblockk warns that a correction may be inevitable if Bitcoin’s market cap cannot sustain its current levels.

Bitcoin Market Performance

Meanwhile, Bitcoin appears to be seeing a cooling-off in the positive price performance seen earlier in recent weeks. So far, the asset has increased by nearly 10% in the past 14 days, reclaiming major highs and even approaching the $70,000 price mark with a high of $69,227 seen yesterday.

Related Reading

However, the past-day performance of Bitcoin suggests a cool-off of this price increase. Over this period, Bitcoin had fallen below $67,000 with a current trading price of $66,980.

Regardless of this price correction, some analysts remain bullish. Particularly, a renowned crypto analyst known as Moustache on X has recently highlighted in a recent post that “Bitcoin has broken out of a falling channel that has been in place for over 7 months.”

The analyst added that this price action is “reminiscent” of 2020 before the rally. Commenting on the ongoing decline in BTC, the analyst said: “Are bears celebrating a retest? They will be surprised soon.

Featured image created with DALL-E, Chart from TradingView

Source link

Samuel Edyme

https://www.newsbtc.com/bitcoin-news/bitcoin-quarterly-performance-hints-at-possible-correction-heres-what-you-should-know/

2024-10-23 10:30:22