Shiba Inu (SHIB) price has been consolidating in a tight range since early August, fluctuating between $0.00001462 and $0.00001304. Despite a generally bearish market sentiment, SHIB has managed to stay above its support level, largely avoiding a major price drop.

While many meme coins are experiencing declines, Shiba Inu has maintained stability thanks to its strong correlation with Bitcoin.

Bitcoin Saves Shiba Inu

Shiba Inu’s price movement has been closely tied to Bitcoin, with a positive correlation coefficient of 0.94. This strong correlation is currently helping SHIB avoid a significant decline.

Over the past six months, SHIB has mirrored Bitcoin’s performance. The meme coin tends to decline whenever the correlation weakens, but when it strengthens, the price recovers. This trend continues to play a crucial role in preventing Shiba Inu from falling at this moment.

Read more: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

Recent market fluctuations have caused some concern among SHIB investors. However, as long as Bitcoin remains stable or bullish, it is unlikely that Shiba Inu will see a substantial drop.

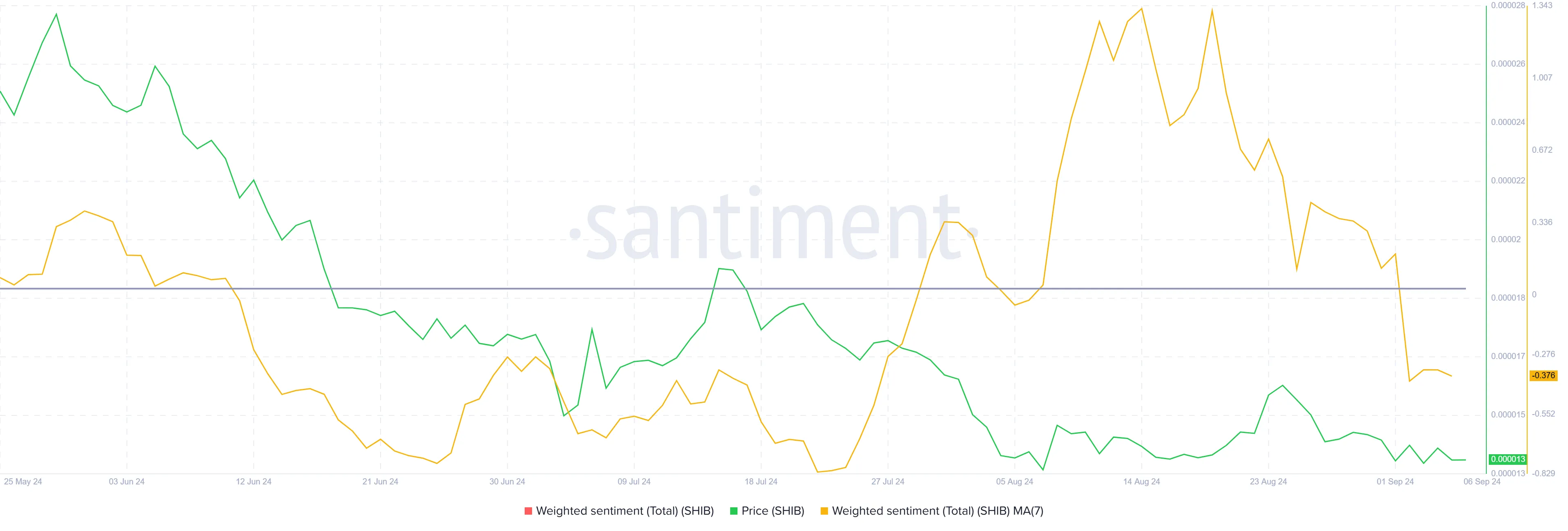

This is important since Shiba Inu’s overall macro momentum shows signs of bearishness. The weighted sentiment of SHIB holders has turned negative over the last week due to the coin’s lack of price growth. Investors are beginning to lose confidence, and this could lead to increased bearish pressure.

However, for now, the bearish sentiment among SHIB holders may not translate into a sharp price drop.

SHIB Price Prediction: Keeping It Close

Shiba Inu is currently trading at $0.00001317, just above the critical support floor of $0.00001304. Given the ongoing sideways momentum, it is likely that SHIB will continue trading within this range in the short term.

If the correlation with Bitcoin remains strong and investor sentiment turns positive, SHIB could bounce off its support level and attempt to break past $0.00001462. This resistance has been tested before, most recently in late August, when SHIB dropped by 12% in just three days after a failed breakout attempt. Still, a successful move past this level could signal recovery.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

However, should the correlation between SHIB and Bitcoin weaken, the meme coin could face a significant decline. A drop below $0.00001304 could trigger a 13% fall, sending SHIB to $0.00001141, marking its lowest price in six months and invalidating any bullish momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/shiba-inu-shib-price-is-avoiding-a-fall/

2024-09-06 10:25:31