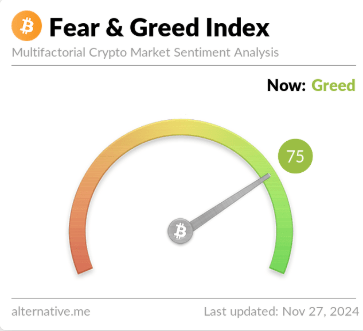

On-chain data shows the Bitcoin Fear & Greed Index has cooled down from extreme greed, a sign that may be positive for BTC’s price.

Bitcoin Fear & Greed Index Is Pointing At ‘Greed’ Again

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the average sentiment among investors in the Bitcoin and wider cryptocurrency markets.

This metric uses a scale from zero to a hundred to represent its value. All values greater than 53 imply the presence of greed among the traders, while those under 47 suggest fear in the market. The index reflects a net-neutral mentality in the region between these two cutoffs.

Related Reading

Besides these three main sentiments, the indicator can also signal two special sentiments: extreme fear and extreme greed. The former occupies the region below 25 and the latter above 75.

Now, here is what the Bitcoin Fear & Greed Index is saying regarding the current market sentiment:

As is visible above, the index has a value of 75, which means that the investors share a sentiment of greed right now. This mentality is also particularly strong, as the indicator’s value is right on the boundary of the extreme greed zone.

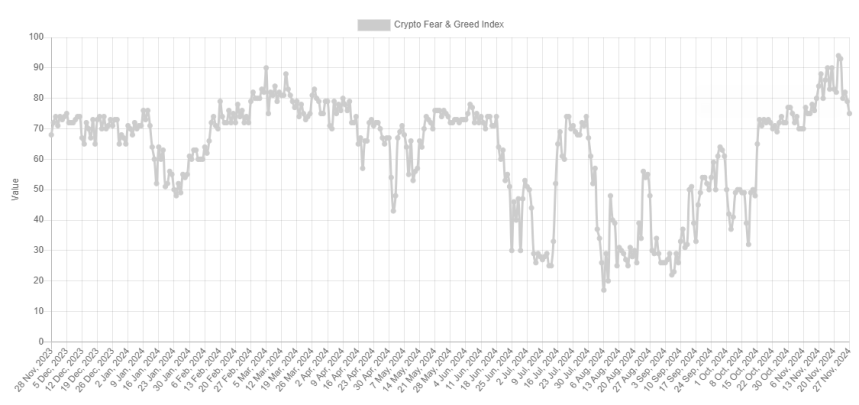

Historically, the extreme mentalities have proven to be quite significant for Bitcoin and other digital assets, as it’s when the index is in these zones, the prices tend to hit major points of reversal.

However, the relationship between the two is inverse, meaning bottoms are likely to happen when the market is the most fearful, while tops occur in times of immense greed.

Followers of a trading technique called contrarian investing leverage this fact to make their trades; they buy in extreme fear and sell during extreme greed. Warren Buffet’s famous quote also sums up this idea, “be fearful when others are greedy, and greedy when others are fearful.”

While the current value of the index is high, it was much higher during the last few days, as the below chart shows.

The Bitcoin Fear & Greed Index was firmly inside the extreme greed territory as the rally in the asset took place, with a peak of 94 occurring alongside the cryptocurrency’s top above the $99,000 level.

Thus, it appears Bitcoin has once again moved contrary to the crowd’s expectations, as its price has registered a notable drawdown since this extreme greed high.

Ideally, the sentiment would cool off into the fear region for a reversal in the asset. Still, during bull runs, where demand is extraordinarily high, a refresh into the neutral or normal greed zone is often enough for the rally to regain steam.

Related Reading

With the Fear & Greed Index inside the greed region again, it remains to be seen whether Bitcoin will be able to find a rebound.

BTC Price

When writing, Bitcoin is trading at around $93,800, up over 1% in the last 24 hours.

Featured image from Dall-E, Alternative.me, chart from TradingView.com

Source link

Keshav Verma

https://www.newsbtc.com/bitcoin-news/bitcoin-sentiment-cools-down-extreme-greed-rally/

2024-11-28 02:30:57