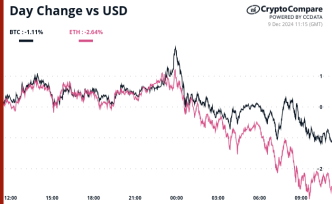

Crypto markets started the week in the red as bitcoin (BTC) slumped during the European morning hours after having briefly crossed the $100,000 level.

BTC fell 2% from its six-figure landmark causing a dive across majors. XRP, dogecoin (DOGE) and Solana’s SOL fell as much as 5.5%, with BNB Chain’s BNB and ether (ETH) down 2.5%. Cardano’s ADA fared the worst with a 7% drop, which came on the back of the Cardano Foundation’s X account getting temporarily compromised on Sunday.

The market slide led to over $300 million in bullish bets liquidated.

The CoinDesk 20 (CD20), a liquid index tracking the largest tokens by market cap, fell 3.6%. Weakness in majors saw midcaps fall as much as 10%, per Coingecko data.

That slide led to $300 million in longs, or bets on higher prices, to be liquidated, with futures tracking smaller altcoins and meme tokens recording higher losses than BTC or ETH futures in an unusual move, data shows.

The largest single liquidation order happened on Binance — a DOGE futures trade valued at $5.53 million.

Meanwhile, Singapore-based QCP Capital expects the market to be rangebound until 2025.

“Although we’re still structurally bullish, spot is likely to range here for the remainder of the holiday season,” QCP said in a Telegram broadcast on Monday. “Historically, ETH does not usually put in a new all-time high until January of the post-halving year. This sentiment is also reflected in the options market, where ETH risk reversals are skewed toward calls only from January onwards.”

BTC’s failure to remain above the $100,000 market is another concerning sign for a continued rally, some say.

“Bitcoin is failing to consolidate above $100K, likely suppressing buying in the overall market, “ FxPro chief market analyst Alex Kuptsikevich said in a Monday email to CoinDesk. “Bitcoin is trading just below $99K with minimal overnight movement. Its inability to grow has negatively impacted altcoins.

“We view Bitcoin’s lull as an important position correction that will help the market shake off short-term overbought conditions and move more reliably higher. However, the next upside momentum could take the price to the $120K area, working off the Fibonacci extension,” Kuptsikevich added.

Source link

Shaurya Malwa

https://www.coindesk.com/markets/2024/12/09/cardano-xrp-lead-losses-among-majors-as-market-slide-liquidates-300-m-bullish-bets

2024-12-09 11:50:43