On-chain data shows the Bitcoin supply in loss has shot up close to the 20% mark after the recent bearish action in the coin’s price.

Bitcoin UTXO Supply In Loss Has Seen A Sharp Increase Recently

In a new post on X, CryptoQuant author Axel Adler Jr talked about the recent trend in the Bitcoin Unspent Transaction Output (UTXO) Supply in Loss indicator. The “UTXO Supply in Loss” measures, as its name suggests, the total percentage of UTXOs in existence (or more simply, just the tokens) that are being held at some net unrealized loss.

The indicator works by going through the on-chain history of each UTXO in circulation to see what price it was last moved at. Generally, the last transfer of any token represents the last point that it changed hands, so the price at its time can be assumed to be its cost basis.

When this cost basis for any UTXO is greater than the current spot price of the cryptocurrency, then that particular UTXO can be assumed to be underwater right now. The UTXO Supply in Loss adds up all UTXOs satisfying this condition to find what percentage of the total supply that they make up for. Like this metric, there also exists the UTXO Supply in Profit, which naturally keeps track of the UTXOs of the opposite type.

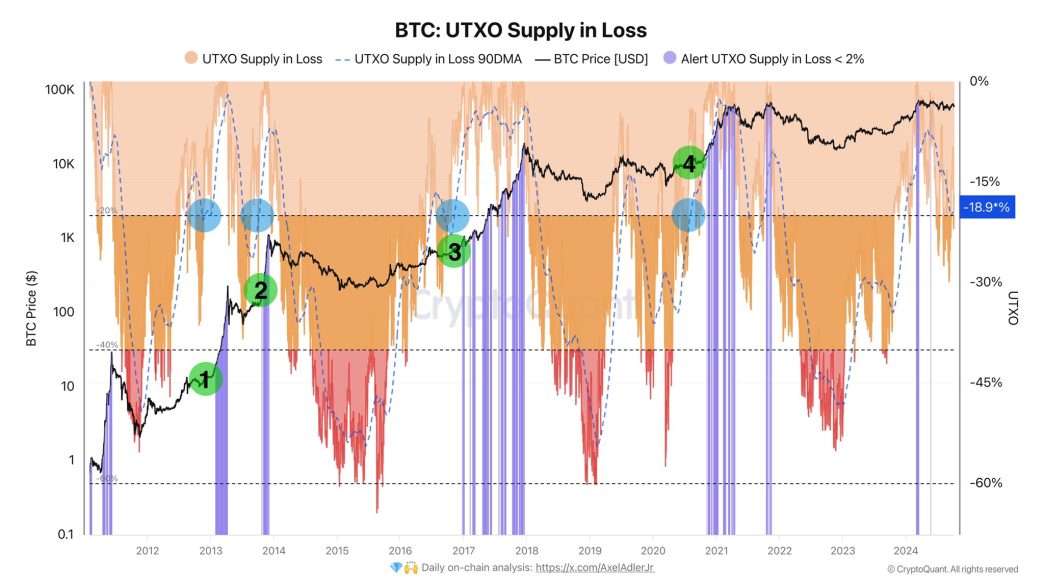

Now, here is the chart shared by the analyst that shows the trend in the Bitcoin UTXO Supply in Loss over the history of the asset:

As displayed in the above graph, the Bitcoin UTXO Supply in Loss registered a sharp plunge to the zero mark (note that the chart is reversed as it uses a negative scale) when the cryptocurrency’s price set its all-time high (ATH) back in March of this year. Whenever BTC sets a new record, 100% of the investors get into profits, so the UTXO Supply in Loss shrinking down to zero is only natural. As the coin has witnessed bearish momentum in the last few months, though, the metric’s value has gone through an increase again.

The 90-day moving average (MA) of the indicator, which is also listed in the chart, has now come close to the 20% mark. The CryptoQuant author has marked in the graph the previous instances of the metric making a similar retest of this level.

“In previous cycles, similar conditions were sometimes followed by a price rally,” notes Axel. Thus, it’s possible that a price surge may follow for Bitcoin this time as well.

As for why the UTXO Supply in Loss going up can be bullish for Bitcoin, the reason is that the investors in profit are the ones more likely to participate in selling, so whenever their number reduces, the chances of a selloff also go down.

BTC Price

Bitcoin had shown some recovery beyond the $64,000 level yesterday, but it would appear that the asset couldn’t maintain as it’s back at $62,500 now.

Source link

Keshav Verma

https://www.newsbtc.com/bitcoin-news/bitcoin-supply-loss-20-trigger-a-fresh-surge/

2024-10-09 05:00:14