The past few days have seen bitcoin (BTC) briefly trade below the $90,000 range, and analysts say the cryptocurrency faces the risk of more volatility in the short term. Although the narrative paints BTC as resilient, macroeconomic pressures could drag the digital asset to levels not seen in months.

A Bitfinex Alpha report has cited tightening financial conditions, the U.S. Federal Reserve signaling fewer rate cuts, and news of the Justice Department’s authorization to liquidate $6.5 billion worth of BTC as factors driving the dump. However, rising U.S. Treasury yields are another important factor.

Macroeconomic Pressures

The 10-year U.S. Treasury yields have recently climbed to 4.79%, a level not seen in 14 months. The last time yields surged above this 4.6% was in April 2024, when BTC traded close to $73,000. Interestingly, BTC did not touch $73,000 again for seven months.

Analysts at Bitfinex noted that the rise in Treasury yields has significant implications for both traditional markets and risk assets. Higher yields lead to an uptick in returns from low-risk government bonds, making them more attractive to institutional and conservative investors.

“As yields increase, the opportunity cost of holding Bitcoin rises, prompting some institutional investors to rebalance their portfolios away from cryptocurrencies and into safer, yield-generating assets,” analysts stated.

Additionally, higher yields signal tightening financial conditions, which affects overall liquidity in financial markets. Borrowing becomes more expensive, and capital flowing into speculative assets like cryptocurrencies declines significantly. Diversified institutional investors also rotate their capital out of crypto into bonds to take advantage of safer returns.

A More Volatile Environment for BTC

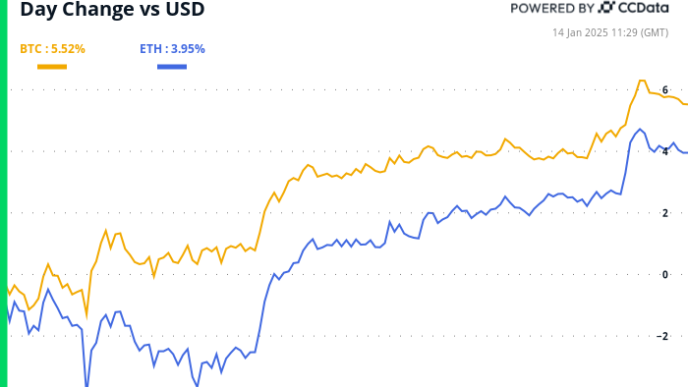

Although Treasury yield moves often impact risk assets with a delayed effect, BTC tends to react more quickly compared to equities due to its higher volatility and greater sensitivity to liquidity changes. The S&P 500 reacts within one to three months, while it takes BTC one to two weeks or less in highly speculative market conditions.

Bitcoin’s reaction to the recent rise in Treasury yields can be seen in net outflows across U.S. spot Bitcoin exchange-traded funds (ETFs). These funds have recorded negative flows in seven out of the last 12 trading days.

While the market’s condition suggests a more volatile environment in the coming weeks, Bitfinex thinks the incoming U.S. administration could limit deeper losses and keep BTC in a strong long-term position.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Mandy Williams

https://cryptopotato.com/bitcoin-to-face-more-volatility-in-the-short-term-as-us-treasury-yields-surge-bitfinex-alpha/

2025-01-14 11:36:14