The founders of analytics firm Glassnode are predicting that Bitcoin (BTC) will soon print fresh all-time highs for one key reason.

Jan Happel and Yann Allemann, who go by the handle Negentropic, tell their 63,200 followers on the social media platform X that Bitcoin may surge if the US Dollar Index (DXY) starts to decline due to the Fed’s rate-cutting cycle and quantitative easing (QE).

The DXY is a measure of the value of the US dollar against a basket of six major currencies. Traders keep a close watch on the DXY as a weak index suggests that investors are favoring risk assets like stocks and crypto over the dollar.

“Bitcoin and DXY: a tight dance. Bitcoin has closely tracked the DXY for weeks, especially post-US elections, as the dollar hit new yearly highs. But with easing policies in play, what happens when the DXY weakens and decoupling starts? Signs point to Bitcoin smashing new all-time highs with ease.”

Bitcoin is trading for $89,200 at time of writing, down nearly 5% from its all-time high of about $93,500.

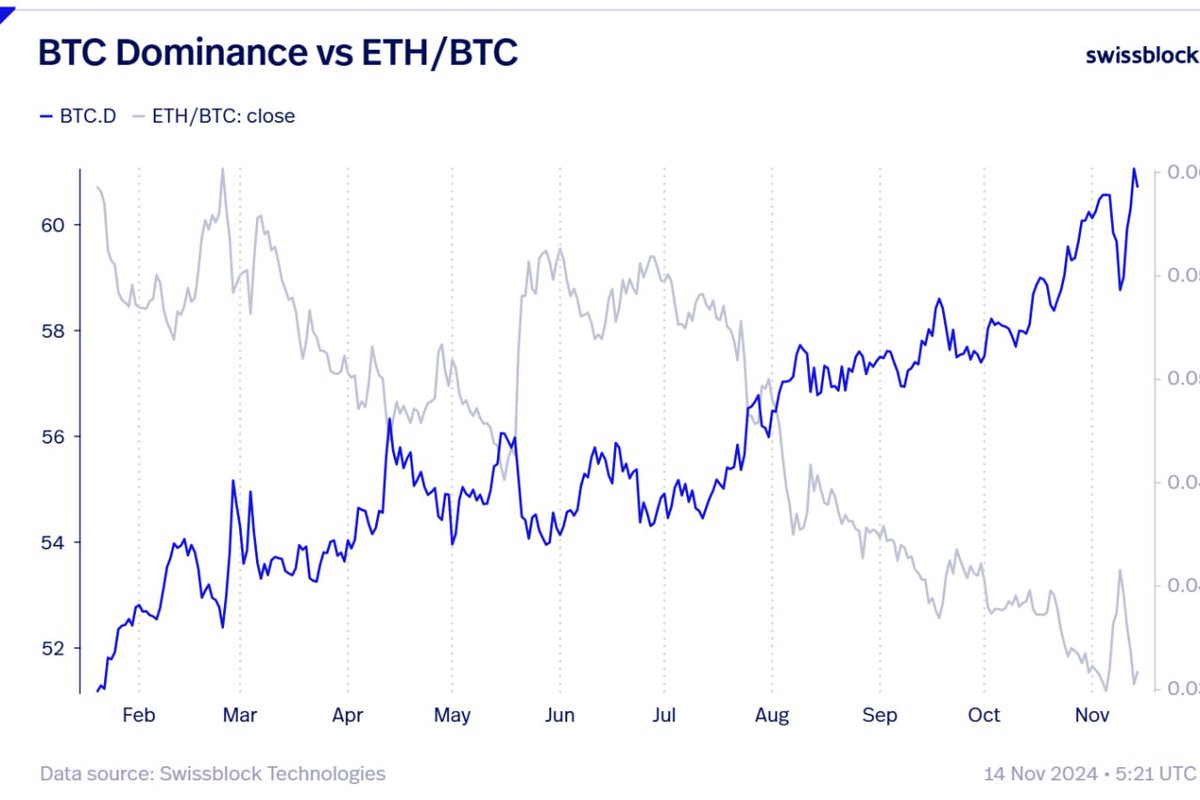

Next up, the analysts say Ethereum (ETH) is showing market strength despite declining against Bitcoin (ETH/BTC).

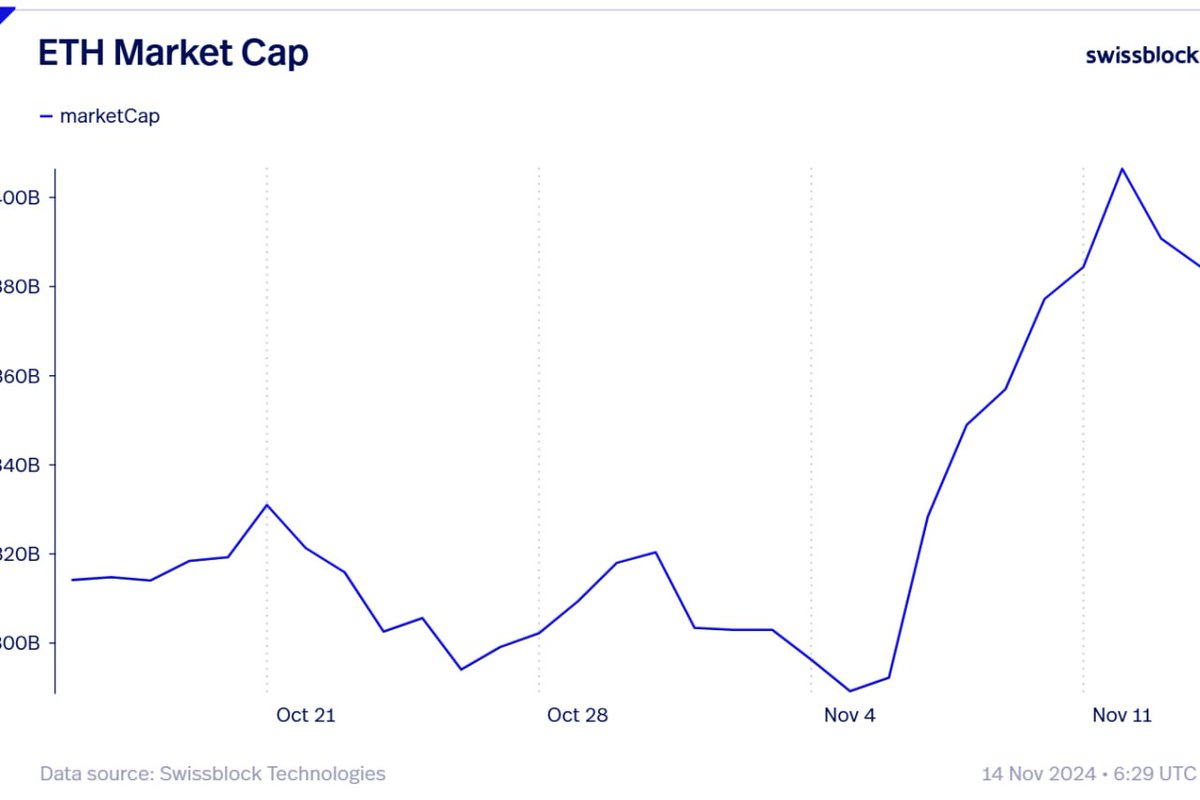

“During this Bitcoin rally, Ethereum took off, and as BTC hit $74,000 with a drop in dominance, the ETH/BTC pair eased its pressure. But after Bitcoin’s weekend pump, pushing it to $93,000, BTC dominance has surged, while the ETH/BTC pair slumped – without Ethereum’s price dropping significantly. What does this signal? A Bitcoin dominance rebound or ETH holders dumping on the pump? Taking a look at Ethereum’s market cap: after ‘Super Tuesday,’ it rose from $290 billion to just over $400 billion, During this ETH/BTC pullback and BTC dominance surge, ETH’s market cap only dipped to $380 billion. This suggests no dumping, just Bitcoin’s strength outshining other market forces.”

Bitcoin’s dominance level (BTC.D) is the ratio between the market cap of BTC versus the market cap of all crypto assets combined. At time of writing, BTC.D is at 61%.

ETH/BTC is trading for 0.03398 BTC ($3,035) at time of writing, down 4.39% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sol Invictus/IvaFoto

Source link

Daily Hodl Staff

https://dailyhodl.com/2024/11/15/bitcoin-to-hit-new-all-time-high-with-ease-predicts-glassnode-co-founders-heres-why/

2024-11-15 19:05:10