A wallet associated with Mt. Gox transferred 27,871 Bitcoin worth $2.8 billion amid Bitcoin’s breakthrough above $100,000, late Wednesday evening. It was a show of unprecedented resilience for traders in the face of large-scale transfers, which have historically triggered volatility.

The transfer, tracked by blockchain analytics firm Arkham Intelligence, directed 27,871 Bitcoin to an unmarked address.

Analysts note that although large-scale movements from wallets associated with Mt. Gox typically have a negative impact on the Bitcoin price, today’s movement is different.

“Typically, announcements from Mt. Gox have a negative impact on the market, often causing Bitcoin’s price to decline,” notes Min Jung, an analyst and researcher from Presto Labs.

Bitcoin pushes past $100K unfazed

What happened “has been met with relative silence,” Jung told Decrypt, adding that the market showed “little reaction” to the transfer.

This muted response suggests that bullish sentiment among Bitcoin investors remains strong, the analyst claims.

However, given that U.S. trading hours were not yet open when this transfer was made and news broke, Jung says that there remains a need to observe how the U.S. market reacts.

The timing and scale of the transfer also present a striking contrast: While the exchange demonstrates a capacity to move billions in digital assets efficiently, it simultaneously extends basic administrative processes for creditor repayments.

The transfer follows Mt. Gox’s decision in November to extend its repayment deadline by one year to October 2025, citing ongoing verification requirements for creditors.

“Mt. Gox-related headlines could still influence the market if the bullish sentiment cools,” Jung notes.

Resilience and maturity

Market observers note that while some creditors have received fiat currency payments, many await full compensation in Bitcoin or Bitcoin Cash. The extended timeline affects thousands of creditors who lost assets during one of the industry’s most significant setbacks.

This latest move indicates that Bitcoin’s price is “reflecting a pattern of consolidation,” Kronos Research Chief Investment Officer Vincent Liu told Decrypt.

Liu adds that this recent wallet activity, which did little to pause Bitcoin’s push past $100,000, supports the idea that the market is testing and displaying “resilience and maturity.”

The exchange retains approximately 39,878 Bitcoin, valued at $4.1 billion at current prices. The latest transfer follows a previous movement of 2,500 Bitcoin worth $222 million to another address in November.

These wallet activities continue as the exchange works to resolve outstanding compensation claims from former users who lost assets during its 2014 security breach.

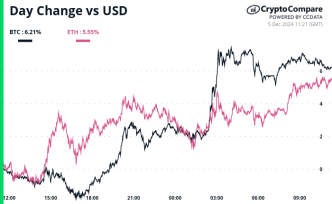

At press time, Bitcoin is trading just above $102,400, a 5.9% increase over the past 24 hours, according to data from CoinGecko.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Vince Dioquino

https://decrypt.co/294985/bitcoin-mt-gox-transfer

2024-12-05 11:42:04