Starting next Monday, First Mover Americas will become Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. Publishing at 7 a.m. ET, it will kickstart your morning with comprehensive insights. You won’t want to start your day without it.

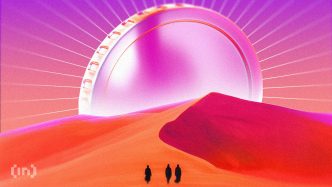

CoinDesk 20 Index: 3,108.77 -9.55%

Bitcoin (BTC): $92,029.63 -6.72%

Ether (ETH): $3,319.02 -4.95%

S&P 500: 5,987.37 +0.3%

Gold: $2,632.36 +0.57%

Nikkei 225: 38,442.00 -0.87%

Top Stories

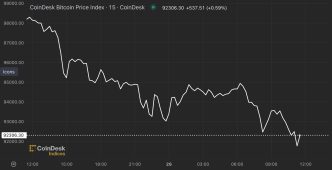

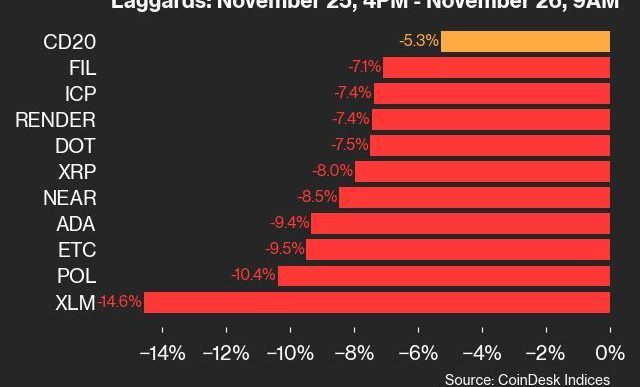

A bitcoin-led crypto market correction entered a third day as the asset lost a further 6% in the past 24 hours, falling below $93,000. BTC has pared weekly gains from over 10% to just less than 1% amid profit-taking on the expected pullback. Major tokens have followed the tumble, with Solana’s SOL, BNB, Cardano’s ADA and DOGE falling as much as 7% in the past 24 hours. The broad-based CoinDesk 20 (CD20), a liquid index tracking the biggest tokens by market capitalization, minus stablecoins, is down nearly 3%. Analysts view a correction of as much as 10% from the peak as perfectly natural while maintaining a short-term target of $100,000 per BTC.

Some indicators point to an ongoing correction in BTC’s price, sending it as low as $90,000. Among them is the 25-delta risk reversal. This measures the volatility premium of out-of-the-money (OTM) calls, used to bet on price rallies, relative to OTM put options, which offer downside protection. On Deribit, calls expiring this Friday now trade at a cheaper valuation to puts, resulting in a negative risk reversal, according to data source Amberdata. The first negative reading in at least a month indicates a bias for protective puts. Perhaps sophisticated traders are prepping for an extension of Monday’s price slide. On Monday, traders sold call spreads and bought put options tied to BTC on the over-the-counter liquidity network Paradigm.

After a prolonged downtrend relative to bitcoin, ether is showing signs of a resurgence. ETH climbed to over $3,500 for the first time since June on Monday, while BTC was falling from its recent highs. Ether has since been caught by the wider market correction, trading 5% lower in the last 24 hours while still outperforming the broader market, which has lost over 8%, as measured by the CoinDesk 20 Index (CD20). Investors have started to rotate capital to smaller, riskier cryptocurrencies over the weekend following the stall of bitcoin’s near-vertical surge since Donald Trump’s election victory. The ETH/BTC ratio, which measures ether’s strength vs. bitcoin, plummeted to as low as 0.0318 on Thursday, its weakest reading since March 2021, but the gauge has gained 15% since to 0.3660 at press time.

Chart of the Day

- Leverage is a double-edged sword, magnifying both profits and losses … and how.

- The Defiance Daily Target 2x Long MSTR ETF, trading under the ticker MSTX on Nasdaq, has crashed 41% from $220 to $112 in three days.

- The ETF seeks to deliver twice the daily performance of shares in bitcoin-holder MicroStrategy. MSTR has dropped 20% to $403.

- Source: TradingView

– Omkar Godbole

Trending Posts

Source link

Jamie Crawley, Omkar Godbole

https://www.coindesk.com/markets/2024/11/26/first-mover-americas-bitcoins-correction-takes-price-below-93-k

2024-11-26 13:03:02