According to Glassnode, Bitcoin (BTC) is experiencing a prolonged distribution phase. Furthermore, both market momentum and capital flows have shifted into negative territory, suggesting a decrease in demand.

This shift, coupled with rising investor uncertainty, is contributing to a broader decline in overall market sentiment and confidence.

Bitcoin Enters Prolonged Distribution Phase

In its latest weekly newsletter, Glassnode pointed out that Bitcoin’s market structure has entered a post-all-time-high (ATH) distribution phase. This phase marks a natural progression of Bitcoin’s cyclical behavior.

The cycle is driven by alternating periods of accumulation and distribution, with capital shifting between different investor groups over time.

“The latest distribution phase commenced in January 2025, aligning with Bitcoin’s sharp correction from $108,000 to $93,000,” the newsletter read.

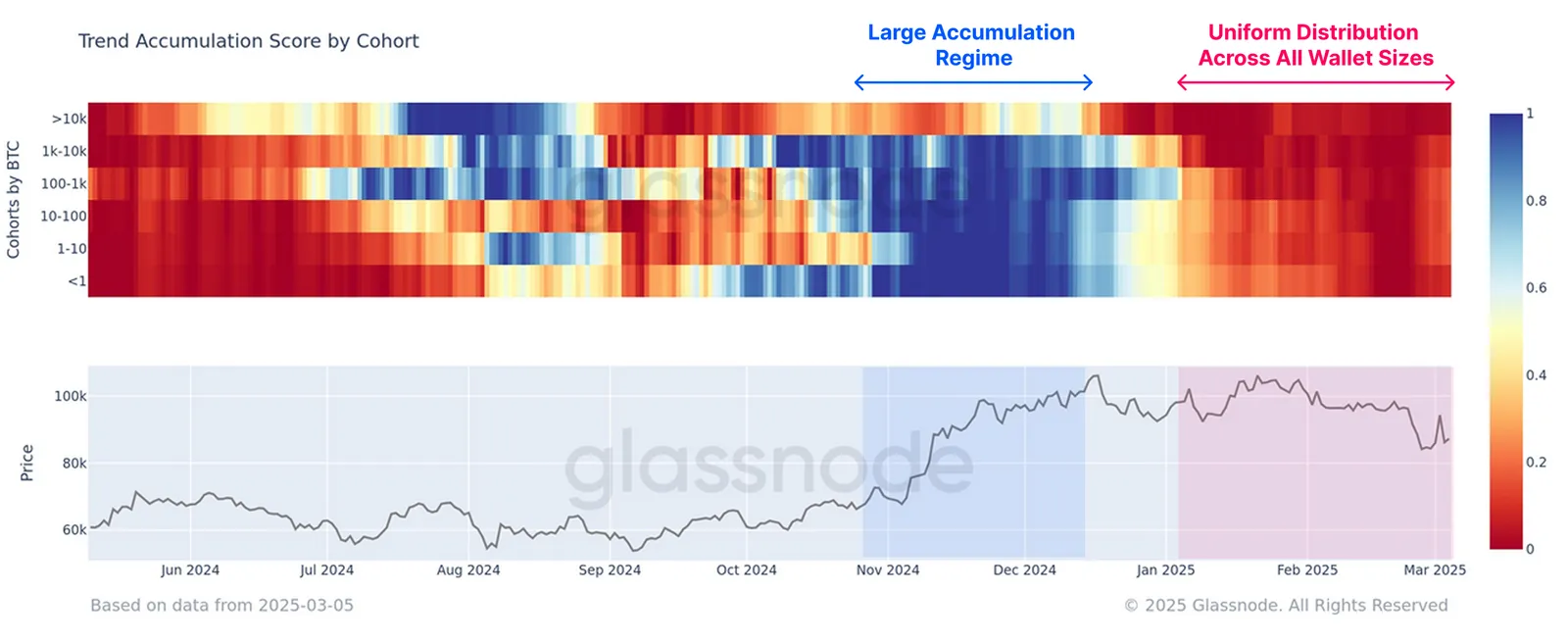

In addition, Glassnode highlighted that The Accumulation Trend Score remains below 0.1.

This suggests that market participants are more focused on liquidating their holdings rather than adding to their positions. Thus, until the trend reverses, the market may face continued downward pressure.

Meanwhile, the distribution isn’t specific to any single investor group. As per Glassnode, over the past two months, all wallet size categories have been actively distributing.

This has significantly intensified the sell-side pressure on the market. Moreover, the newsletter added that the selling activity has become more pronounced since mid-January.

A substantial portion of the sell-side pressure has come from coins being sold at a loss. This has further weighed on the market’s overall strength.

“This showcases that the current market downturn has been a challenging environment for investors, with many exiting the market below their cost basis under the pressure of the drawdown,” Glassnode explained.

In addition to distribution, market sentiment has also shifted. Investor sentiment has leaned more cautious. Glassnode revealed that accumulation decreased as macroeconomic uncertainty grew, especially after events like the Bybit hack and rising US tariff tensions.

The analytics firm noted that during price pullbacks between mid-December and February, investors were buying Bitcoin, especially in the $95,000–$98,000 range. They believed the bull trend would continue.

However, by late February, liquidity tightened, and external risks grew. Therefore, confidence in further accumulation began to fade.

“The lack of dip-buying at lower levels suggests that capital rotation is underway, potentially leading to a more prolonged consolidation or corrective phase before the market finds a firm support base,” Glassnode added.

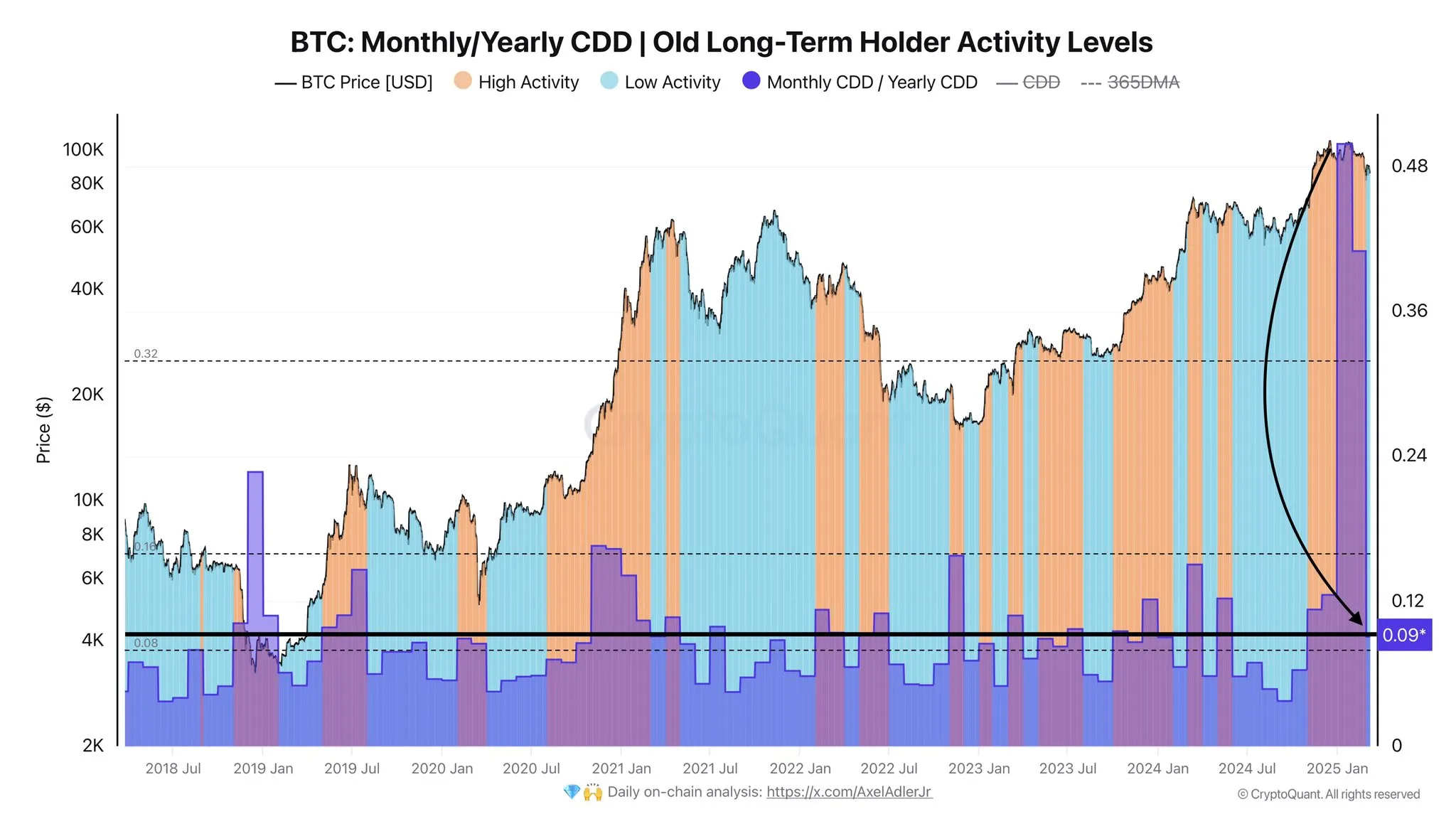

However, not all are pessimistic. An on-chain analyst – Axel Adler, observed that the largest distribution of Bitcoin by long-term holders in recent years appears to have ended.

As per his analysis, activity metrics have shifted from high-selling activity to lower levels of accumulation. This shift suggests that long-term holders may be regaining confidence, potentially signaling a stabilization or future upward movement in the market.

“This reduction in supply typically precedes stabilization and a new market cycle, representing a potentially positive market signal,” he posted on X.

As Bitcoin continues to navigate this phase, its price has shown significant volatility. BeInCrypto reported that BTC fell below $80,000 amid recession fears. Nonetheless, it managed a slight recovery as tariff and geopolitical tensions eased.

At press time, BTC was trading at $83,424. As per BeInCrypto data, this marked modest gains of 2.0% over the last day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Kamina Bashir

https://beincrypto.com/bitcoin-enters-distribution-phase/

2025-03-13 05:21:17