Bitcoin is on the verge of reaching a historic milestone, with its price inching closer to the coveted $100,000 mark. This remarkable rally has fueled optimism among investors, signaling Bitcoin’s continued dominance in the cryptocurrency market.

However, despite the bullish outlook, Bitcoin is not entirely immune to potential bearish pressure. The backbone of Bitcoin’s price stability — long-term holders (LTHs) — appears to be wavering, raising concerns over possible downward movements in the near term.

Bitcoin’s Support Is Wavering

Long-term holders of Bitcoin have recently shown signs of bearish sentiment. The HODLer net position change indicator, which tracks the behavior of LTHs, has turned negative.

This shift indicates that a significant number of long-term investors are taking profits by selling their holdings. Negative values on this metric often signal a reduction in confidence, which could put pressure on Bitcoin’s price.

Since LTHs are considered the backbone of Bitcoin’s price, their selling activity has the potential to disrupt market momentum. These investors typically hold assets through market fluctuations, contributing to price stability.

When they begin to sell, it can lead to increased volatility, and if the trend continues, it could trigger a price correction. This potential selling pressure is something that Bitcoin investors are closely monitoring, especially with the $100,000 threshold so near.

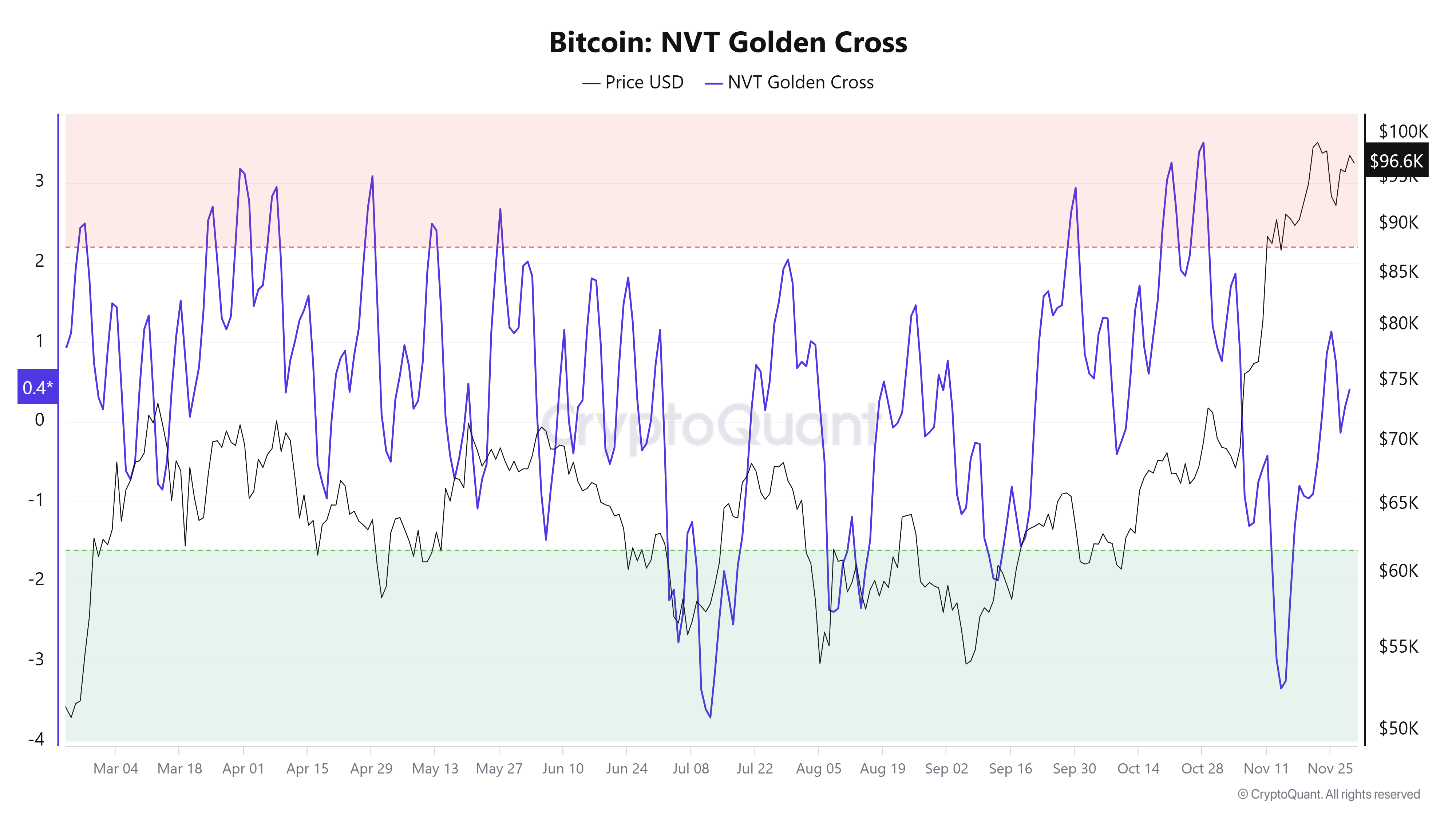

The broader macro momentum for Bitcoin remains strong despite the short-term bearish sentiment among LTHs. A key indicator to watch is the Bitcoin Network Value to Transactions (NVT) Golden Cross, which is currently sitting in the neutral zone.

While it’s not yet in the bullish territory (under -1.6), the NVT Golden Cross is an important signal for Bitcoin’s future price movements. Historically, when the NVT indicator enters the bearish zone (above 2.2), it has often been considered a short signal for the market.

However, Bitcoin has not yet reached this bearish zone, giving it room for further growth. The NVT Golden Cross is still a positive sign, indicating that Bitcoin has enough momentum to rise further before any potential downturn.

As long as the indicator remains in the neutral zone, Bitcoin has the opportunity to push towards $100,000 without facing immediate significant bearish pressure.

BTC Price Prediction: Making History

Bitcoin’s price is moving at $96,572, inching closer to the historic $100,000 mark. The cryptocurrency has seen significant upward movement in recent weeks, spurred by institutional interest and increased adoption. If the current trend continues, Bitcoin is poised to break through this psychological barrier, reaching a new all-time high of $99,595.

Should Bitcoin break the $100,000 mark, the next target could be $120,000. A successful push above $100,000 would likely trigger additional buying pressure from both retail and institutional investors. However, the potential for profit-taking from LTHs remains a concern, as any significant selling could cause a temporary pullback.

Despite the short-term concerns, Bitcoin’s overall trend remains positive, and the recent NVT Golden Cross suggests that the path to $100,000 is still achievable. As long as Bitcoin maintains its position above key support levels, the long-term outlook remains bullish.

While LTH selling could create some volatility, Bitcoin is likely to continue its upward trajectory in the coming months, barring any major market disruptions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-selling-holds-no-threat-to-rally/

2024-11-30 20:30:00