The race to launch the first Solana-focused exchange-traded fund (ETF) is heating up, with four major issuers filing applications with the Chicago Board Options Exchange (CBOE).

This development seems to have triggered a charge leading to the price of Solana’s native SOL token to a new all-time high (ATH), pushing it almost past $263 only hours before this writing.

SEC Filings and Optimism

The applications are from Bitwise, Canary Capital, VanEck, and 21Shares and have been filed as Form S-1s and 19b-4s with the U.S. Securities and Exchange Commission (SEC). Notably, Bitwise’s S-1 submission, dated November 21, indicates its intention to create a commodity-based trust.

The regulator now has up to 15 days to acknowledge the filings and publish them in the Federal Register. It would mark the next phase in the regulatory process, kickstarting a 240-day review window.

While previous filings for Solana ETFs were withdrawn earlier this year, industry watchers are much more optimistic about the new submissions’ success, given the shifting regulatory mood following Donald Trump’s victory in the recently concluded U.S. presidential election.

The President-elect’s pro-crypto stance and Gary Gensler’s impending departure from the SEC helm have given observers a sense of positivity, even though some challenges remain, including pending lawsuits referencing SOL as a security.

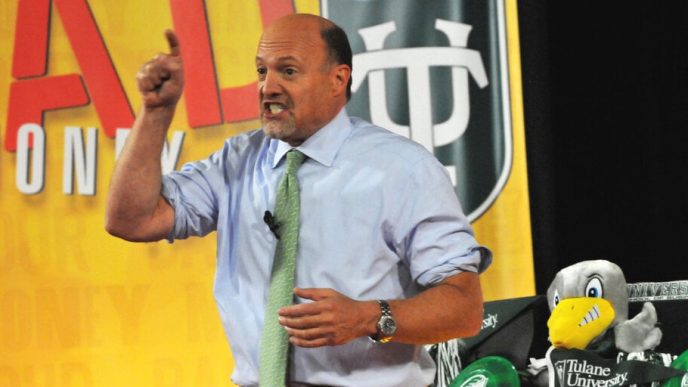

Bloomberg’s senior ETF analyst, Eric Balchunas, warned that the lawsuits and regulatory hurdles must be resolved before approval can be expected.

Fellow expert Nate Geraci had earlier predicted that several ETFs would be filed after Trump’s victory. For now, the optimism seems rooted in speculation rather than concrete signals from the SEC.

Solana’s Price Soars Amid ETF Buzz

If approved, the ETFs could broaden access to Solana for traditional investors, solidifying its standing alongside Bitcoin and Ethereum as a top blockchain ecosystem.

SOL’s market cap now stands at over $125 billion, with a fully diluted valuation of $153.25 billion. A 24-hour trading volume of $14.8 billion per CoinGecko is a testament to the market’s excitement and growing investor interest.

The token, ranked #4 on the list of largest cryptocurrencies by market cap, surged to an all-time high of $262.93 on the back of the filings. Although the price had retracted to just above $259 at the time of writing, it still represents a nearly 9% improvement over the last 24 hours.

The surge is a much more impressive 24.7% across seven days, outpacing the broader crypto market’s 9.3% growth in the same period. Additionally, its performance has been among the most dominant in the layer 1 space, where most coins averaged 13.4% gains.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Wayne Jones

https://cryptopotato.com/bitwise-canary-capital-vaneck-and-21shares-submit-solana-etf-applications-amid-price-surge/

2024-11-22 18:18:42