Bitwise CIO Matt Hougan says three conditions could pave the way for Bitcoin (BTC) to rip to the $80,000 level before the end of the year.

In a new note to investors, Hougan references a prediction that Bitwise made at the end of 2023 forecasting that BTC would trade above the $80,000 level in 2024.

With Q4 underway, the investor now says that for the price target to be hit, Bitcoin needs three conditions to unfold.

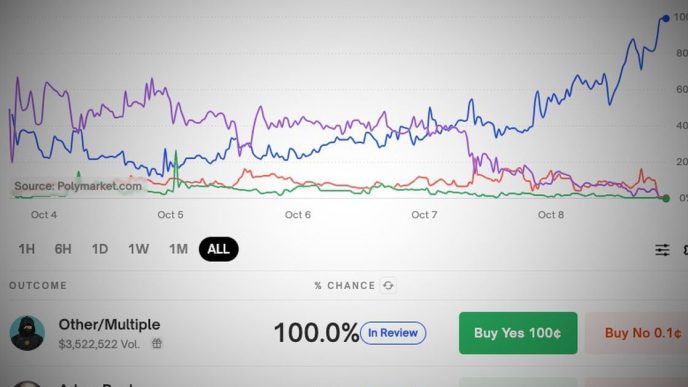

Hougan’s first condition is an election that results in “anything but a Democratic sweep.” While a Republican victory would portend well for crypto, the CIO says things are more nuanced on the Democratic side.

“To thrive, bitcoin doesn’t need politicians. It just needs them to get out of the way. And barring a Democratic sweep of both houses of Congress and the White House, I suspect they will, with the Democrats taking a more neutral approach to the industry.”

The second condition for Q4 Bitcoin rallies, according to Hougan, is two more rate cuts from the Federal Reserve.

After the Fed’s rate cut in September, Hougan says that markets are “hungry for more” and could be disappointed without them.

“The market is hungry for more. It currently expects an additional 50 bps in easing from the Federal Reserve by year’s end, and additional fiscal stimulus from China as well.

If it gets both, I suspect we will get our Q4 rally. If we don’t, I think the disappointment could weigh on the market.”

Hougan’s last condition for a Q4 melt-up is simply that “no major negative surprises” catch the markets off guard, like big hacks, lawsuits, or locked coins unexpectedly coming to market.

“Crypto’s history is unfortunately beset by countless such surprises. Over the past few quarters, the release of previously locked-up bitcoin from the failed exchange Mt. Gox and from government coffers has contributed to keeping us range-bound.

If we can make it through the end of the year without similar shocks, I’d expect new all-time highs and beyond.”

Hougan also notes that a broader crypto market rally that boosts altcoins could spread over to Bitcoin and “help seal the deal” that much more.

At time of writing, Bitcoin is trading at $61,457.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Alex Richardson

https://dailyhodl.com/2024/10/09/bitwise-cio-matt-hougan-says-bitcoin-q4-melt-up-likely-under-these-three-conditions/

2024-10-09 18:05:30