Bitwise chief investment officer Matt Hougan is pointing out metrics for one Solana (SOL) competitor that he says are impressive.

Hougan tells his followers on the social media platform X that out of all the charts he’s looked at recently, the on-chain metrics of Aptos (APT) are standing out the most.

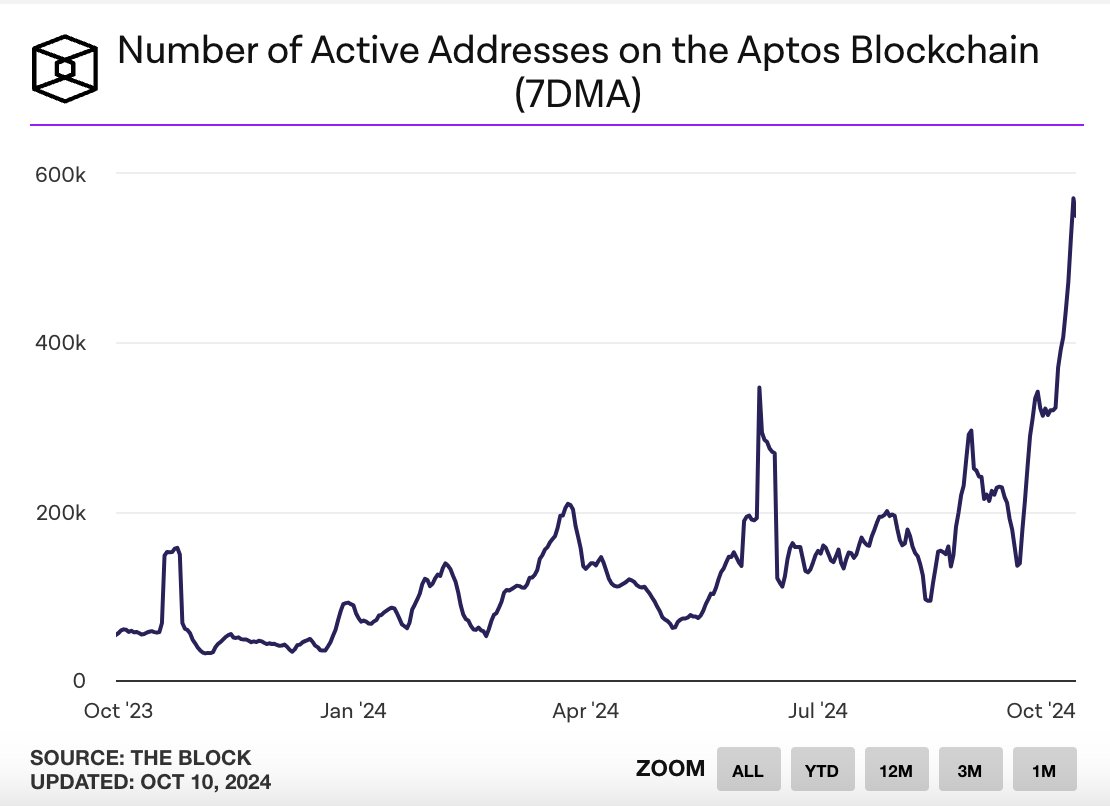

He shares charts showing rises in daily transactions and active addresses on Aptos, which have started picking up in the last several months.

“Every week I start my Friday by looking at ~150 charts. Sometimes, one or two stand out. This week, I was struck by these two from

Aptos.”

In another chart, Hougan shows the number of active addresses on Aptos soaring to new all-time high (ATH) levels.

Aptos, which uses the AptosBFT consensus mechanism with the Move programming language, was launched on October 18th, 2022 and is down about 50% from its all-time high of $19.92. However, APT is up over 130% from its August 2024 low of $4.303.

At time of writing, APT is trading for $10.11, an almost 20% surge in the past day.

Hougan also gave Base, the Ethereum (ETH) layer-2 launched by Coinbase, an honorable mention in terms of blockchains with impressive metrics.

“I was keeping it super simple today. What struck me is not that Base is dominating, but rather, that Base keeps setting new ATHs.”

The Bitwise executive recently unveiled his three conditions for Q4 crypto fireworks, which included more Fed rate cuts, a favorable outcome to the November election, and “no major negative surprises” catching the markets off guard, like big hacks, lawsuits or locked coins unexpectedly coming to market.

“Crypto’s history is unfortunately beset by countless such surprises. Over the past few quarters, the release of previously locked-up Bitcoin from the failed exchange Mt. Gox and from government coffers has contributed to keeping us range-bound.

If we can make it through the end of the year without similar shocks, I’d expect new all-time highs and beyond.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Alex Richardson

https://dailyhodl.com/2024/10/13/bitwise-cio-matt-hougan-says-hes-struck-by-two-charts-from-one-solana-sol-rival/

2024-10-14 00:00:06