Chainlink (LINK) price has been gaining attention as it approaches key resistance levels, with several technical signals suggesting potential moves ahead.

Following a recent surge, LINK’s momentum could lead to further growth, but traders are keeping a close eye on critical thresholds.

LINK Directional Movement Index Looks Bullish

The Directional Movement Index (DMI) for LINK currently shows strong bullish momentum. The Positive Directional Index (+DI) is at 29.2, significantly outpacing the Negative Directional Index (-DI) at 13.3, indicating that buyers have a clear advantage over sellers. The Average Directional Index (ADX), which measures trend strength, is at 28.2, suggesting that the current trend is sustainable.

The DMI is composed of three key indicators: +DI, -DI, and ADX. While +DI and -DI track the strength of upward and downward price movements, the ADX measures overall trend strength. Typically, an ADX above 25 signals a strong trend, while lower values suggest weaker trends or consolidation. When the +DI surpasses the -DI, it indicates bullish momentum, and the reverse suggests bearish sentiment.

Read more: How to Buy Chainlink (LINK) With a Credit Card: A Step-By-Step Guide

With the +DI far higher than the -DI and the ADX above 25, LINK is in a strong upward trend. This suggests that its price could continue to climb in the short term as buying pressure dominates. However, traders should keep an eye on the ADX for any shifts in trend strength, as well as the interaction between the +DI and -DI lines, which could signal potential reversals.

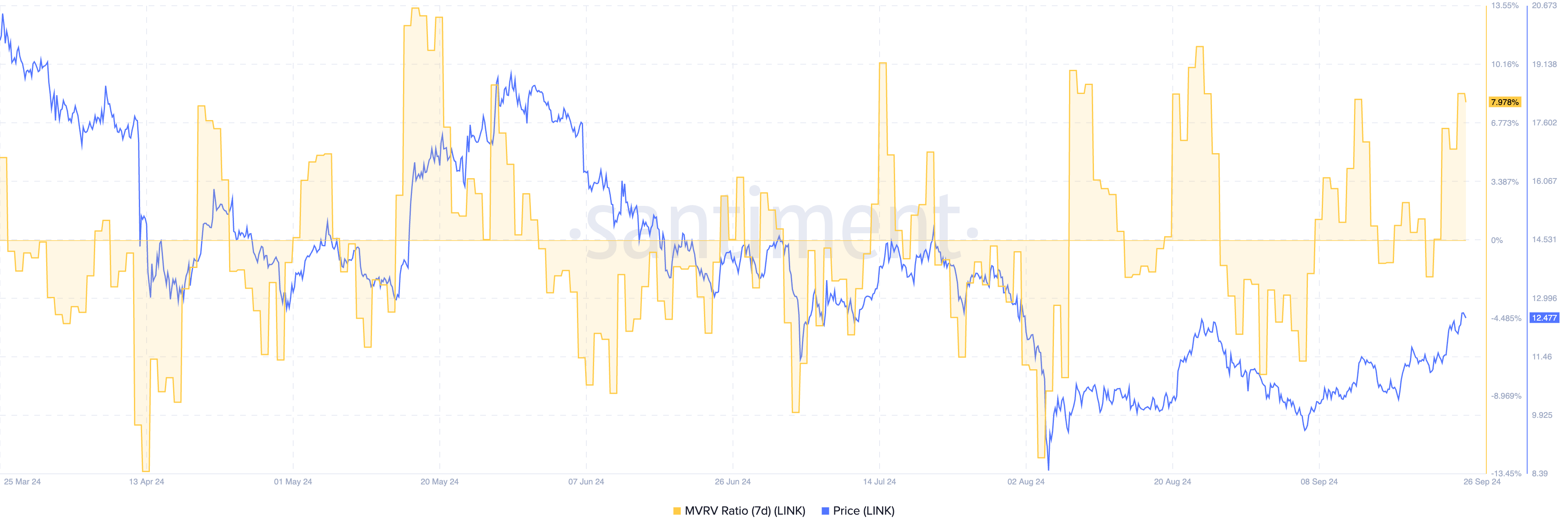

Chainlink 7D MVRV Shows Potential, But Caution Is Needed

LINK 7-day MVRV Ratio is currently at 7.9%, suggesting that the asset might still have room for price growth. The MVRV (Market Value to Realized Value) ratio is a metric used to assess holders’ potential profitability by comparing the current market value to the average price at which coins were acquired.

Generally, a high MVRV ratio indicates that holders have a higher level of unrealized profit, which can lead to increased selling pressure and potential price corrections. Conversely, a low MVRV ratio suggests that fewer holders are in profit, reducing the likelihood of a major sell-off.

Historically, MVRV thresholds vary, but a value around 10% has often been a signal of overvaluation, leading to potential corrections. For LINK, specifically, over the last six months, the price has held steady as the MVRV approached 10%. However, once this threshold was reached, LINK price experienced corrections, as traders likely took profits at elevated levels.

At the current MVRV of 7.9%, LINK appears to have some room for further price growth. However, with the ratio nearing the 10% threshold, it is important to monitor this metric closely. A rise beyond that point could indicate an increased risk of a pullback as more holders enter profitable territory and may consider selling.

LINK Price Prediction: 50% Surge Likely

On September 17, LINK EMA (Exponential Moving Average) lines formed a golden cross, triggering a notable price surge of 20% in the following days. A golden cross occurs when a short-term EMA crosses above a long-term EMA, typically signaling a bullish shift in momentum. Traders often watch for this pattern as an indication of upward price movement.

The EMAs smooth out price data to help identify trends, with a golden cross commonly viewed as a bullish sign, especially when the shorter EMA crosses above the longer one.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

Though the EMA lines are currently in a bullish formation, they are not yet significantly separated, which may lead to some caution among traders. The closer proximity of the lines can suggest that while the trend is bullish, it might not be fully established or could revert with volatility.

Chainlink is now facing strong resistance at key levels of $13.9 and $15. If LINK manages to break through these resistances, it could test the $19.1 level. That would represent a 50% growth from its current price.

However, if the trend reverses and the EMAs cross again, LINK could experience a pullback. It could potentially drop back to $9.9, a key support level. Traders should closely monitor these levels as they will play a crucial role in determining LINK’s next move.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/link-eyes-surge-bullish-momentum/

2024-09-27 17:00:00