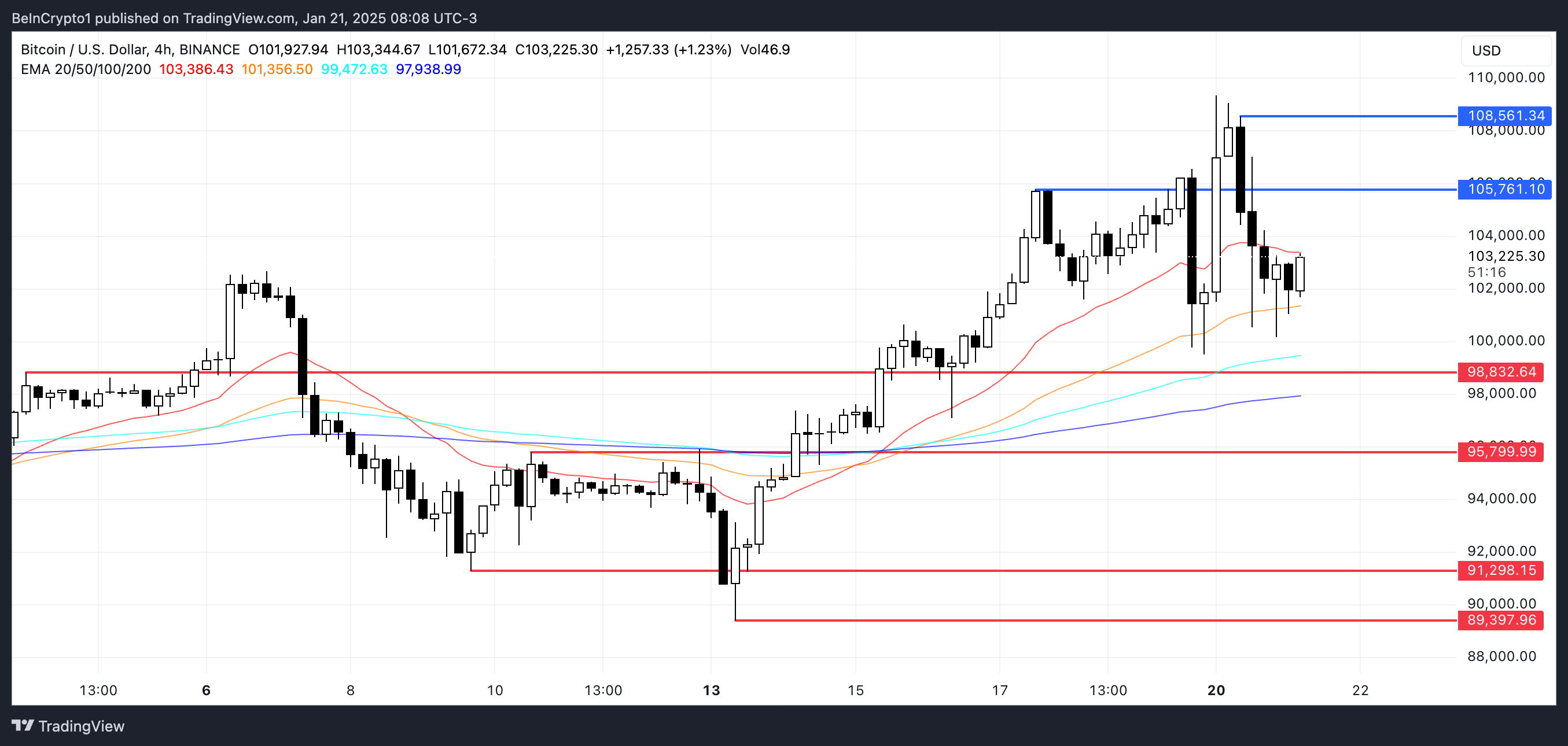

Bitcoin (BTC) price is up over 8% in the last seven days, with a new all-time high on January 20, when it surpassed $108,000 for the first time. This remarkable surge has fueled speculation about whether BTC’s uptrend will continue to test new resistance levels or face a potential pullback.

Despite the bullish momentum, technical indicators like the DMI and RSI suggest that the strength of the trend may be weakening, with sellers beginning to exert more influence.

BTC DMI Shows Sellers Could Be Taking Control

The Bitcoin DMI chart reveals that the ADX has fallen to 23.2 from 30.7 over the past two days, highlighting a weakening trend. The ADX measures trend strength, with values above 25 signaling a strong trend and those below 20 suggesting a lack of direction.

The current reading below 25 indicates that BTC bullish momentum is losing strength, potentially hinting at a slowdown in market activity or a pause in the uptrend.

Meanwhile, the +DI has sharply declined from 34.8 to 19.7 in a day, reflecting waning buying pressure, while the -DI has increased from 17.8 to 26.6, showing rising selling pressure.

This shift suggests that although BTC is technically still in an uptrend, the weakening +DI and strengthening -DI point to a market losing steam. If this trend continues, Bitcoin price may enter a consolidation phase or risk a reversal, particularly if -DI overtakes +DI, signaling bearish dominance.

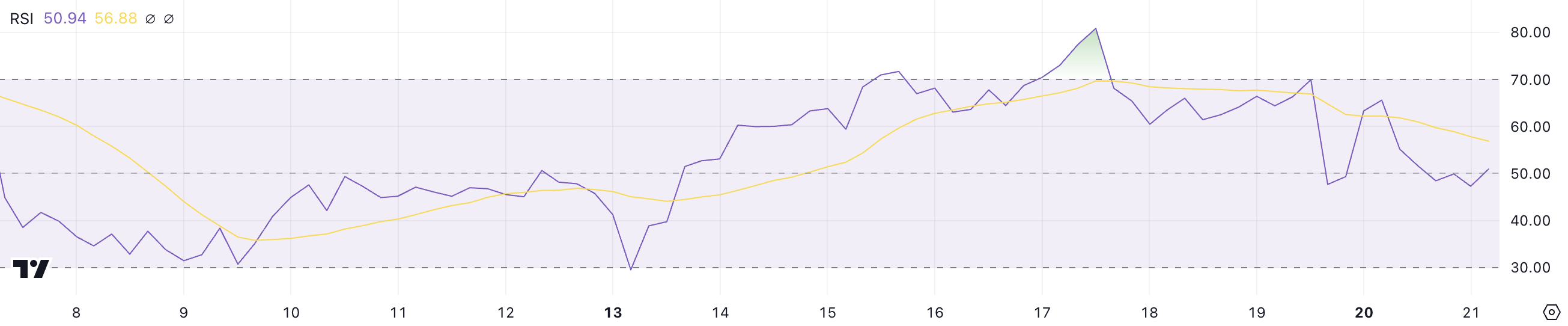

Bitcoin RSI Indicates Cooling Momentum

The BTC RSI is currently at 50.9, down from 65.5 just one day ago, indicating a shift in momentum. The Relative Strength Index measures the speed and magnitude of price movements on a scale of 0 to 100, with values above 70 suggesting overbought conditions and potential price corrections.

In contrast, values below 30 indicate oversold levels and possible rebounds. A reading around 50 signals neutral momentum, suggesting neither buyers nor sellers are in clear control.

With BTC’s RSI now at 50.9, it reflects a balance between buying and selling pressure, but the recent decline from 65.5 shows a weakening bullish momentum.

This could indicate that BTC recent upward movement is losing steam, with price potentially entering a consolidation phase. If the RSI continues to drop closer to 40, it could suggest increasing bearish momentum, while a rebound above 60 might reignite bullish sentiment.

BTC Price Prediction: Can Bitcoin Reach $110,000?

BTC EMA lines indicate it is currently in an uptrend, with short-term lines positioned above long-term lines. However, the narrowing distance between these lines suggests that bullish momentum might be weakening, signaling a potential slowdown in the trend’s strength.

If the uptrend regains strength, BTC price could test the resistance at $105,700, and a breakout could push the price to $108,500. Further bullish momentum might even drive BTC to $110,000 for the first time.

On the downside, if momentum cools off, BTC price could test the support at $98,800, with potential declines to $97,800 and $91,200 if that level is lost. A further breakdown could see BTC price dropping below $90,000 to test the key support at $89,400.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/bitcoin-price-momentum-weakens/

2025-01-21 15:00:00