By Omkar Godbole (All times ET unless indicated otherwise)

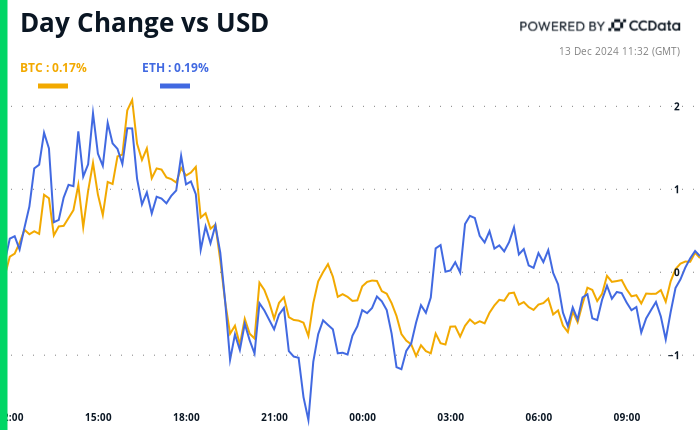

Bitcoin and ether’s bull momentum has hit a roadblock. The U.S. Producer Price Index (PPI) came in hotter than expected Thursday, prompting investors to tighten their stances and keep a bid for the dollar, as we anticipated. There’s also the Truflation index stirring up concern. Seen by some as more reliable than government numbers, it rose above 3% for the first time in over two years.

But guess what? Fed fund futures remain confident the central bank will cut rates by 25 basis points next week, and traders on decentralized exchanges, who have a knack for catching big trends, remain as bullish as ever.

The sentiment is reflected in the impressive $64.8 million open interest for active BTC call options on Derive, the leading on-chain options protocol. That’s a staggering six times larger than the open interest in put options. Ether traders are also leaning heavily toward calls, figures from Amberdata show.

On top of that, funding rates for BTC, ETH, and SOL on HyperLiquid, a prominent on-chain perpetuals trading protocol, are also positive, albeit with reservations. They’re hovering well under an annualized 50%, showing that while the sentiment is bullish, the leverage level is measured and not overly aggressive.

In the broader market, AVAX, the native token of the Avalanche network of blockchains, struggled to chew through selling pressure near $55, teasing a “double top” pattern on the charts. The lackluster price action comes on the heels of Thursday’s $250 million fundraise led by Galaxy Digital, Dragonfly and ParaFi Capital. Keep an eye out for a pick-up in volatility as the highly anticipated Avalanche9000 upgrade, aimed at making the platform more affordable and flexible for creating layer-1 chains, is set to go live on Dec. 16.

LQTY, the native token of censorship-resistant decentralized stablecoin lender Liquity, took a breather near $2.45, having more than doubled in value in the past four weeks because of the V2 launch and overall bullish market sentiment.

The Polygon ecosystem token, POL, wasn’t stirred by a proposal suggesting deploying DAI, USDC and USDT reserves locked in the PoS bridge — the equivalent of cash under a mattress — into yield-generating strategies.

Lastly, a survey by Vietnam’s leading digital assets exchange, Coin68, showed over half of respondents reporting profits from their investments last year and 93.5% anticipating an altcoin season in 2025. Emerging countries, in general, could see more pivot toward alternative investment vehicles as President-elect Donald Trump’s tariffs cause fiat volatility, although that could also motivate local governments to implement capital controls. So stay alert out there.

What to Watch

- Crypto:

- Dec. 13: Nasdaq announces its annual changes to the Nasdaq-100 index. MicroStrategy (MSTR), the world’s largest corporate holder of bitcoin, is widely expected to be added.

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

Token Events

- Governance votes & calls

- Arbitrum DAO has an active vote to allocate 22 million ARB ($22.8 million) to cover operating costs for OpCo, an entity it can use to create a more structured approach to governance. The vote closes Dec. 19.

- The Polygon community is evaluating a governance proposal that would see the deployment of $1 billion of its stablecoin reserve to generate a yield.

- Unlocks

- Axie Infinity (AXS) will unlock $6.4 million worth of tokens on Dec. 13, representing 0.52% of circulating supply.

- Starknet (STRK) will unlock $41.5 million worth of tokens on Dec. 14, representing 2.83% of circulating supply.

- Sei (SEI) will unlock $49 million worth of tokens on Dec. 15, representing 2.07% of circulating supply.

- Token Launches

- Binance announced that data sovereignty platform Vana (VANA) will release a token on the launchpool. Trading will start Dec. 16.

Conferences:

Token Talk

By Shaurya Malwa

This digital fart is worth nearly $700 million.

The scatologically named AI agent token fartcoin (FART) has zoomed to over $670 million in market cap, lifted by gains in the general AI agent sector we discussed on Thursday.

The coin allows users to engage with the token by submitting fart-related memes or jokes to claim tokens. It boasts a “Gas Fee” system — a parody of gas fees on serious projects such as Ethereum — with certain transactions producing a name-appropriate digital sound, adding a unique layer of what some might call fun.

Some community members see the token as more than just a meme; they view it as a cultural phenomenon within the crypto space — one that gets funnier as prices rise.

Fartcoin was conceived within the digital conversation space known as “Infinite Backrooms,” the chatroom that directly led to the creation of the first AI agent, Gospel of Goatse (GOAT).

The idea was initially discussed by an AI agent known as “Terminal of Truths” (@truth_terminal on X) in conversation with another AI bot. It was explored, among other token launch concepts, as part of a broader discussion on how to raise funds for various projects, including making a film and supporting environmental initiatives.

Derivatives Positioning

- BTC and ETH calls continue to be pricier than puts.

- Still, flows have been mixed in BTC, with uptake for $70K puts expiring in February and March.

- Speculative excesses remain at bay, keeping perpetual funding rates positive but low.

Market Movements:

- BTC is up 0.69 % from 4 p.m. ET Thursday to $100,468.14 (24hrs: -0.14%)

- ETH is up 0.83% at $3,899.63 (24hrs: -0.15%)

- CoinDesk 20 is up 0.36% to 3,830.21 (24hrs: -1.1%)

- Ether staking yield is up 7 bps to 3.24%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is unchanged at 106.99

- Gold is unchanged at $2,689.5/oz

- Silver is up 0.38% to $31.35/oz

- Nikkei 225 closed -0.95% at 39,470.44

- Hang Seng closed -2.09% at 19,971.24

- FTSE is up 0.11% at 8,321.32

- Euro Stoxx 50 is up 0.44% at 4,987.3

- DJIA closed on Thursday -0.53% to 43,914.12

- S&P 500 closed -0.54% at 6,051.25

- Nasdaq closed -0.66% at 19,902.84

- S&P/TSX Composite Index closed -0.96% at 25,410.7

- S&P 40 Latin America closed -2.02% at 2,349.72

- U.S. 10-year Treasury is up 7 bps at 4.34%

- E-mini S&P 500 futures are up 0.34% to 6,081.25

- E-mini Nasdaq-100 futures are up 0.68% to 21,798.0

- E-mini Dow Jones Industrial Average Index futures are up 0.24% at 44,083.00

Bitcoin Stats:

- BTC Dominance: 56.47% (24hrs: +0.11%)

- Ethereum to bitcoin ratio: 0.03888 (24hrs: +0.18%)

- Hashrate (seven-day moving average): 763 EH/s

- Hashprice (spot): $64.3

- Total Fees: 19.68 BTC/ $1.9 million

- CME Futures Open Interest: 196,355 BTC

- BTC priced in gold: 10.64%

- BTC vs gold market cap: 37.4 oz

- Bitcoin sitting in over-the-counter desk balances: 422.9k

Basket Performance

Technical Analysis

- The chart shows the upside in Avalanche’s AVAX being capped at around $55, the resistance level seen earlier this month.

- A renewed decline from here would translate into a double-top bearish reversal pattern. Keep an eye on this.

Crypto Equities

- MicroStrategy (MSTR): closed on Thursday at $392.19 (-4.67%), up 1.87% at $399.52 in pre-market.

- Coinbase Global (COIN): closed at $312.96 (-0.27%), up 0.9% at $315.83 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.45 (+0.59%)

- MARA Holdings (MARA): closed at $22.58 (-2.97%), up 1.42% at $22.90 in pre-market.

- Riot Platforms (RIOT): closed at $12.33 (+4.76%), up 1.46% at $12.51 in pre-market.

- Core Scientific (CORZ): closed at $15.54 (-2.02%), down 0.26% at $15.50 in pre-market.

- CleanSpark (CLSK): closed at $12.33 (-3.9%), down 2.6% at $12.01 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.86 (-0.11%).

- Semler Scientific (SMLR): closed at $71.84 (+11.33%), down 1.17% at $71.00 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $597.5 million

- Cumulative net inflows: $35.14 billion

- Total BTC holdings ~ 1.121 million.

Spot ETH ETFs

- Daily net inflow: $273.7 million

- Cumulative net inflows: $2.24 billion

- Total ETH holdings ~ 3.440 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- Solana leads all blockchains with the highest number of new developers actively exploring its ecosystem.

While You Were Sleeping

- Trump Advisers Seek to Shrink or Eliminate Bank Regulators (The Wall Street Journal): Advisers to President-elect Donald Trump are said to be exploring eliminating or consolidating major U.S. bank regulators such as the FDIC and CFPB, raising concerns about deposit insurance stability and financial industry oversight.

- LINK Surges to 2021 Levels as Trump’s World Liberty Buys More Chainlink Tokens (CoinDesk): Donald Trump-backed DeFi project World Liberty Financial bought $1 million in Chainlink’s LINK token for a second straight day, making the token its fourth-largest holding and helping drive the price up 22% in the past seven days.

- Solana Was the Biggest Draw for New Crypto Developers in 2024: Electric Capital (CoinDesk): Cryptocurrency developer numbers held steady in 2024, according to Electric Capital, with Solana outpacing Ethereum in new talent while Ethereum retained dominance across all continents with the largest number of developers.

- Ether Volume Overshadows Bitcoin on HyperLiquid as Platform Activity Hits $500B (CoinDesk): HyperLiquid’s ether perpetuals outpaced bitcoin this week, driving the platform’s total trading volume past $500 billion. Its HYPE token has surged over 300% in the past two weeks.

- UK Economy Unexpectedly Contracts in New Blow for Rachel Reeves (Reuters): The UK economy shrank 0.1% in October, missing forecasts, as services stagnated and manufacturing declined, highlighting ongoing challenges amid slow post-pandemic growth.

- Europe Has Choice of Doing Hard Work or Facing Next to No Growth (Bloomberg): Europe risks prolonged economic stagnation, The Conference Board warns, urging reforms to boost private investment, accelerate green transitions, and address labor shortages amid aging populations and geopolitical challenges.

In the Ether

Source link

Omkar Godbole, Shaurya Malwa

https://www.coindesk.com/daybook-us/2024/12/13/crypto-daybook-americas-bull-momentum-stalls-ahead-of-fed-rate-cut

2024-12-13 12:00:00