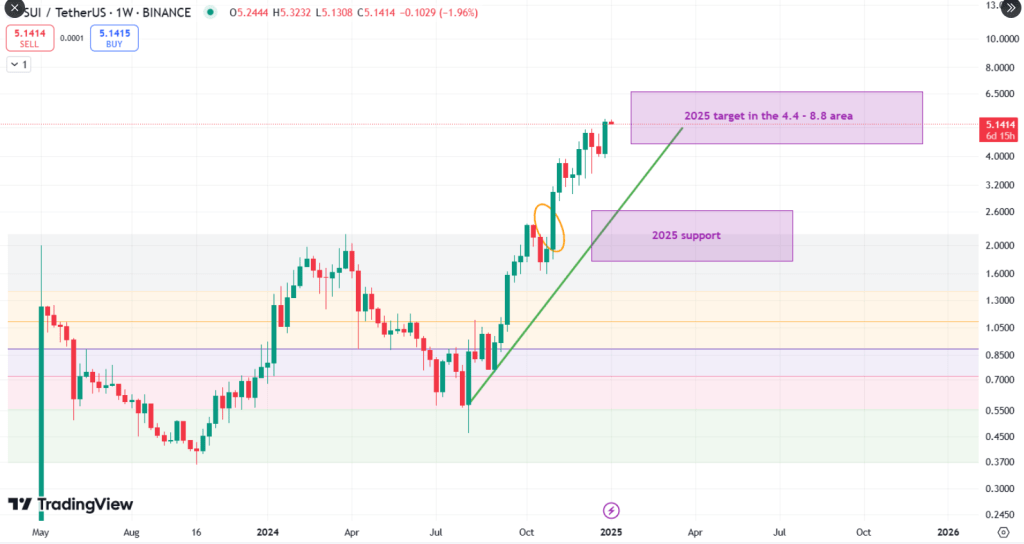

SUI has been going through a remarkable surge recently and has just touched a new all-time high at $5.36. Traders and investors are all attracted to this sudden breakthrough from the resistance level of $4.80.

Related Reading

Whether SUI will continue the trend and hit $6 remains the question in the minds of most traders and investors. The next resistance is set at $5.67, and a breakout past that level may give a way to higher prices. The overall market sentiment is good, and it seems the uptrend can sustain itself for much longer.

Path To $6

SUI has been strong enough to break above the psychological mark of $4.80, and thus, the same has helped establish a solid support level that the investors are waiting for to increase the momentum to the upside.

If SUI can break above the $5.67 resistance, it could just keep on climbing to $6. As for 2025 projections, they vary from $4.4 to $8.8, based on how the market behaves and where investors’ heads are at. That said, the unpredictable nature of the crypto market means a correction could hit at any moment, so caution wouldn’t hurt.

Market Sentiment And Expert Insights

The strength of SUI’s technical indicators and favorable market view have driven its increase. The general professional study on the token shows quite positive future prospects. Crypto analyst Investing Heaven has noted that more development is yet possible.

Will $SUI Continue Its Climb?

After a stunning 10x rally, SUI’s long-term chart suggests further upside potential in 2025.

The rising trendline is key, acting as a foundation for continued growth.

Holding this trendline could guide SUI to its 2025 price target. pic.twitter.com/EJBK4XCGZ6

— InvestingHaven (@InvestingHaven) January 6, 2025

The token’s strong fundamentals and bullish momentum may lead to a breakout toward the $6 level. According to Investing Heaven, technical patterns are in favor, with key moving averages and RSI levels indicating that SUI may continue its upward trend.

There is no question that the news on SUI has positive sentiments, though one should recall the crypto market volatility. Corrections due to abrupt shifts in conditions or sentiment might appear at any moment. In general, analysts still believe SUI has solid reasons to navigate these potential blows and continue with a long-term trajectory upward.

Related Reading

Volatility & Investor Caution

Even though buyers are very excited, they should be careful because the market can change quickly. Because cryptocurrencies are fragile, corrections are possible. As RSI and moving averages rise, they must be watched to see how healthy SUI is.

Strong technicals point to a likely upward direction for SUI. If it breaks through $5.67, the altcoin could hit $6. When the market shifts, it’s important to stay alert and careful with all cryptocurrency.

At the time of writing, SUI was trading at $5.12, up 0.8% and 23.1% in the daily and weekly timeframes.

Featured image from Revolutionized, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/altcoin/sui-skyrockets-bullish-momentum-drives-push-toward-6/

2025-01-07 18:00:57