Ethereum (ETH) price has been on a remarkable rally, gaining 20% over the past week. This rally has been fueled in part by a significant outflow of ETH from exchanges, suggesting growing confidence among holders. Whale accumulation has also picked up, hinting at increasing bullish sentiment.

However, with recent minor corrections, ETH is now at a pivotal point, testing its support and resistance levels to determine its next move.

ETH Net Transfer Volume Reached 128,000 On November 10

ETH has been on a strong rally, climbing 20.10% in the past 7 days. More than 361,000 ETH left exchanges on October 25 – a substantial outflow that pointed towards growing confidence among holders before the current rally.

Such a large movement typically suggests that investors are moving their assets to personal wallets, hinting that they may be planning to hold rather than sell.

When a lot of coins leave exchanges, it’s generally bullish because it indicates users are less likely to sell. Conversely, when large volumes of coins flow into exchanges, it can be bearish, as holders might be preparing to sell.

Since October 25, the net transfer volume to and from exchanges has been fluctuating between positive and negative, reaching 128,000 on November 10. This indicates uncertainty, as the market is experiencing a mix of buying and selling pressure.

Ethereum Whales Are Accumulating Again

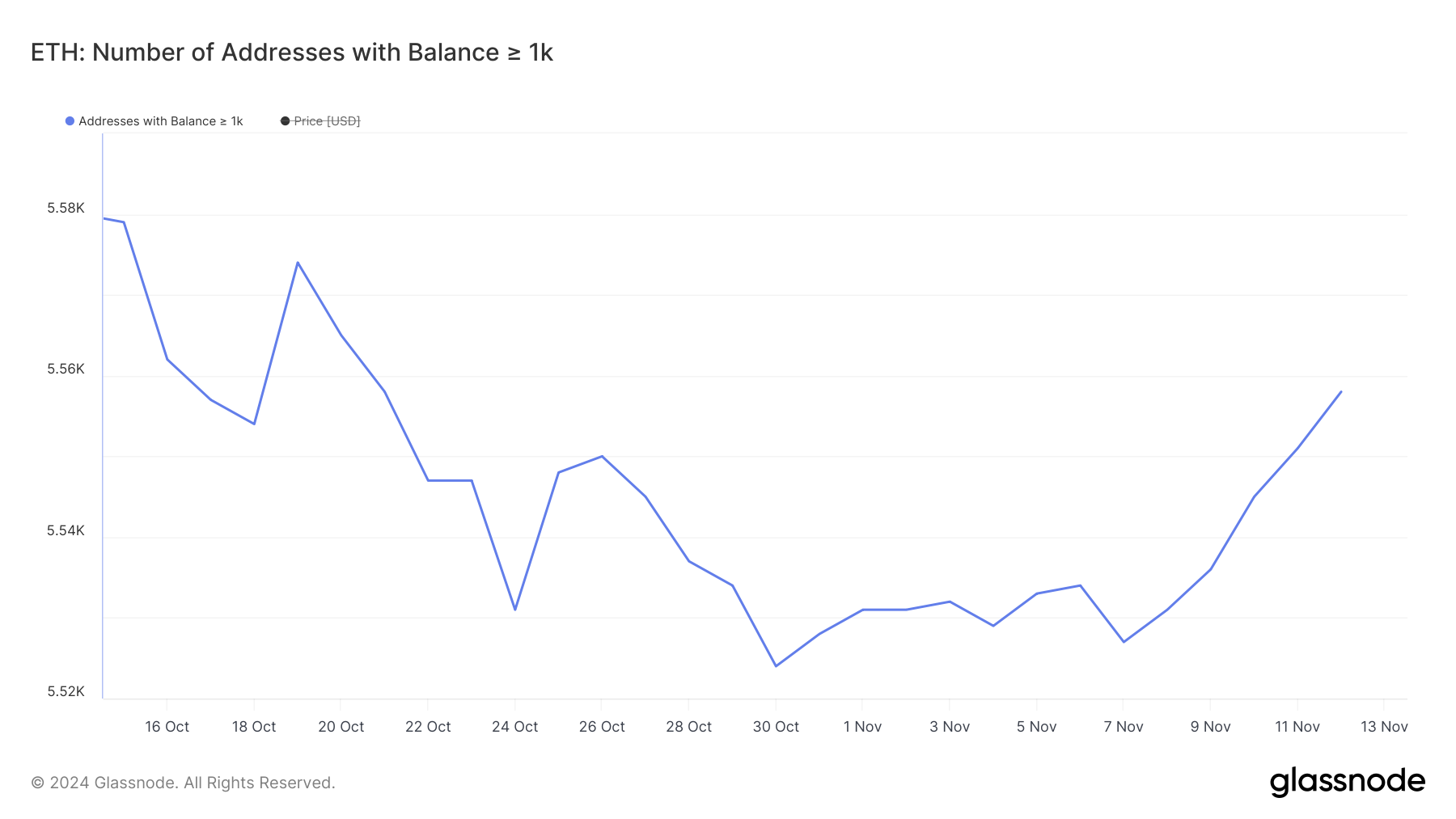

After weeks of decline, the number of whales holding at least 1,000 ETH has finally started to rise again. This trend reversal began on November 7, and the number has been climbing consistently day after day—from 5,527 on November 7 to 5,558 on November 12.

The renewed accumulation among whales suggests a shift in sentiment, with large holders showing increasing confidence in ETH price.

Tracking these whale wallets is crucial because their activity can significantly influence market trends. When whales start accumulating, it often signals a potential price increase, as these holders typically move markets.

Their buying can also reduce the available supply on exchanges, creating more upward pressure on the price of Ethereum.

ETH Price Prediction: Is a Rally To $4,000 Possible?

After a strong rally, ETH price has faced a minor correction over the last few days. The EMA lines remain bullish, with short-term lines still above the long-term ones, indicating an overall upward trend.

However, the price has dropped below the shortest EMA line, which suggests that the current uptrend might be losing some momentum.

ETH’s closest resistance level is now around $3,500. If this resistance is broken, ETH price could potentially surge to $3,700—a possible 17.9% rise and its highest level since June.

On the flip side, if the uptrend reverses, ETH price may retest support at $3,000. If that fails, the next level of support would be around $2,800.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/ethereum-eth-price-whale-buying/

2024-11-14 00:00:00