BONK price has recently seen a significant breakout from a five-month-old descending wedge pattern. Typically considered bullish, this pattern signals a potential surge in the cryptocurrency’s price.

The meme coin market has been flourishing lately, and this could be BONK’s opportunity to push towards its previous all-time high.

BONK Traders Are Bullish

The market sentiment around BONK has recently shifted positively, as evidenced by a notable increase in Open Interest (OI). OI saw a 24% jump in the last 24 hours, climbing from $8 million to $10.19 million. This increase reflects renewed interest from traders who are returning to the market, potentially preparing for a significant rally.

Despite some previous bearish sentiment in the market, BONK’s recent rise in OI shows that traders are once again optimistic about the meme coin’s potential.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

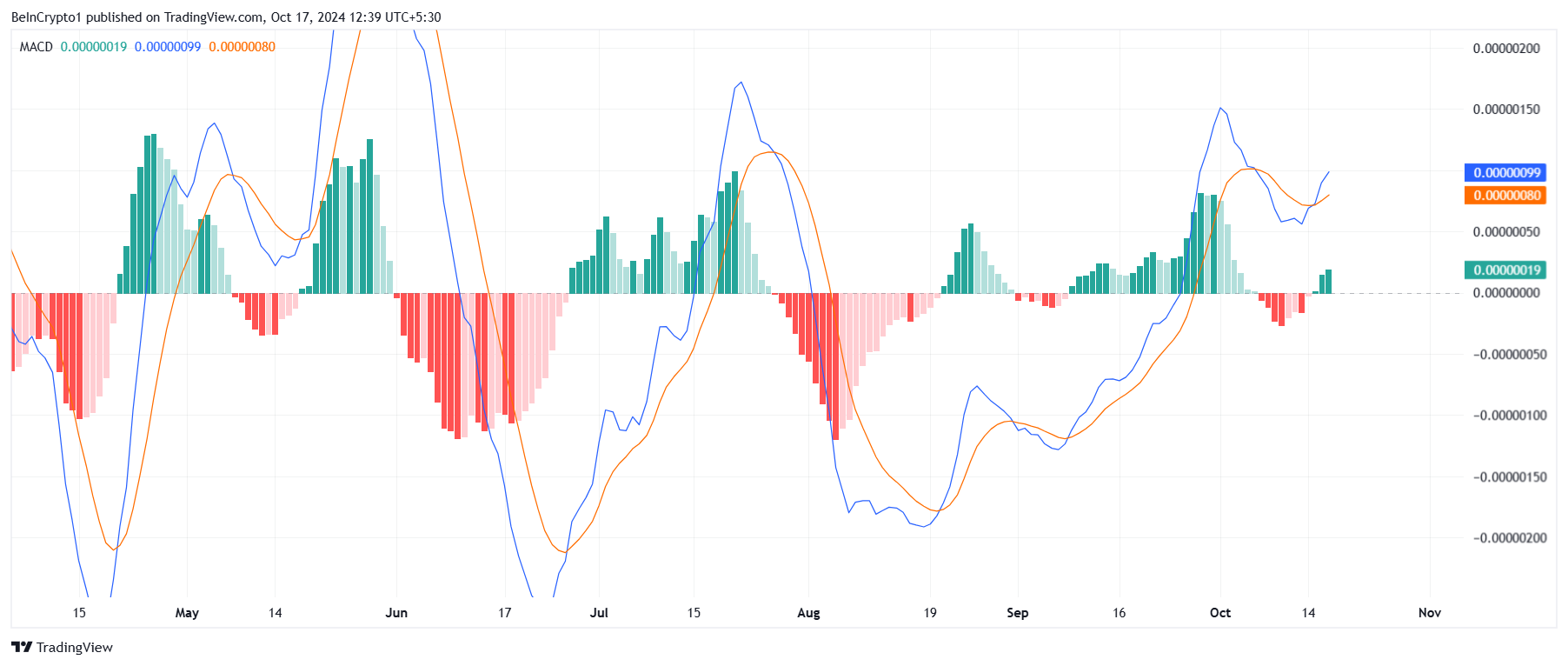

The overall macro momentum for BONK is also leaning bullish, supported by key technical indicators. Indicator Moving Average Convergence Divergence (MACD) has returned to bullish territory after a brief period of bearishness. This shift in momentum is critical for BONK, as it aligns with the broader bullish trend seen across meme coins in the cryptocurrency market.

Additionally, the broader market’s bullishness has provided a tailwind for BONK, enabling it to regain lost ground. As long as these macro trends persist, BONK has a strong chance of continuing its upward trajectory, although traders must remain cautious of potential volatility.

BONK Price Prediction: Finding Support

BONK is currently experiencing a breakout from its descending wedge pattern, which signals a potential 92% rally. The meme coin has its sights set on $0.00004352, just shy of its all-time high of $0.00004800.

However, for BONK to reach this level, it must first break through the crucial resistance at $0.00002748 and turn it into support. Achieving this would mark a multi-month high and potentially pave the way for further gains.

Read more: 11 Top Solana Meme Coins to Watch in June 2024

At the same time, it is important to note that BONK has struggled to break past $0.00002748 in previous attempts. If it fails again, consolidation under this level is likely, with $0.00002153 serving as the next significant support. This could invalidate the bullish outlook and keep the meme coin in a sideways trading range.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bonk-price-signals-bullish-breakout/

2024-10-17 09:30:00